Analysis

2017, June, 21, 11:25:00

BP ENERGY REVIEW

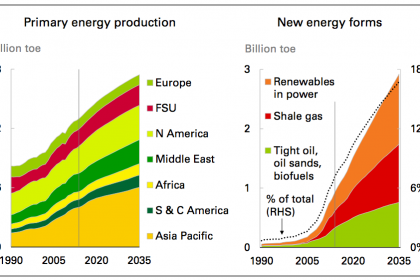

Bob Dudley, BP group chief executive, said: “Global energy markets are in transition. The longer-term trends we can see in this data are changing the patterns of demand and the mix of supply as the world works to meet the challenge of supplying the energy it needs while also reducing carbon emissions. At the same time markets are responding to shorter-run run factors, most notably the oversupply that has weighed on oil prices for the past three years."

2017, June, 21, 11:15:00

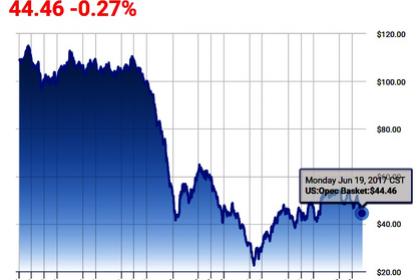

OIL PRICES DOWN 20%

Prices have fallen more than 20 per cent from their levels in early January, which they last touched in the summer of 2015. A decline of more than 20 per cent from a most recent high is typically considered a bear market.

2017, June, 21, 11:10:00

OIL PRICES MINIMUM

U.S. crude for July delivery lost 97 cents, or 2.2%, to $43.23 a barrel on the New York Mercantile Exchange, trading at prices it hasn't settled below since Aug. 10. A settlement at $43.56 a barrel or lower put oil into a bear market, which means it has lost 20% or more since the recent high, a nearly one-year high on Feb. 23.

2017, June, 21, 11:05:00

SAUDIS OIL RESOURCES UP

Saudi Arabia effectively grew its recoverable oil resources by 73 billion barrels this year after lower tax rates for state producer Saudi Aramco boosted the country's estimated prospective resources.

2017, June, 20, 14:40:00

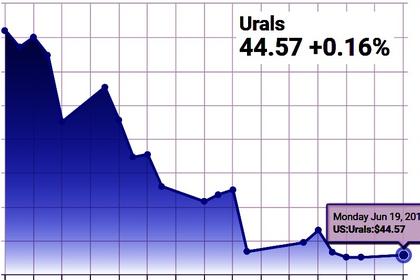

OIL PRICE: STILL ABOVE $47

Brent futures were up 4 cents at $46.95 at 0214 GMT. On Monday, they fell 46 cents, or 1 percent, to settle at $46.91 a barrel.

That was their lowest since Nov. 29, the day before the Organization of the Petroleum Exporting Countries (OPEC) and other producers agreed to cut output for six months from January.

U.S. West Texas Intermediate crude futures were down 1 cent at $44.19 a barrel. They declined 54 cents, or 1.2 percent in the previous session, to settle at $44.20 per barrel, the lowest close since Nov. 14. The July contract will expire on Tuesday and August will become the front-month.

2017, June, 20, 14:30:00

OIL MARKET MOVEMENT

"In my opinion, market fundamentals are going in the right direction, but in light of the large surplus in stockpiles over the past years, the cut needs time to take effect," he told the newspaper, referring to a global deal to curb oil production.

2017, June, 20, 14:10:00

HUGE NORWEGIAN OIL & GAS

“We have been producing oil and gas in Norway for nearly 50 years and we are still not halfway done. Vast volumes of oil and gas have been discovered on the Norwegian shelf that are still waiting to be produced. We want companies with the ability and willingness to utilise new knowledge and advanced technology. This will yield profitable production for many decades in the future,” says Ingrid Sølvberg, Director of development and operations in the Norwegian Petroleum Directorate.

2017, June, 20, 14:05:00

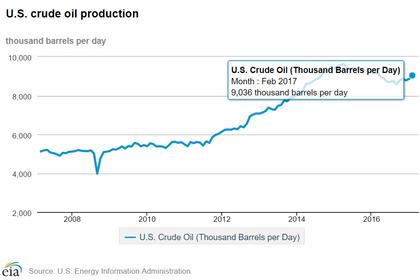

U.S. OIL GAS PRODUCTION WILL UP ANEW

Crude oil production from the seven major US onshore producing regions is forecast to rise 127,000 b/d month-over-month in June to average 5.475 million b/d. Gas production from the seven regions is forecast to gain 684 MMcfd month-over-month in June to 51.685 bcfd.

2017, June, 20, 14:00:00

U.S. RIGS UP 6 TO 933

U.S. Rig Count is up 509 rigs from last year's count of 424, with oil rigs up 410, gas rigs up 100, and miscellaneous rigs down 1.

Canadian Rig Count is up 90 rigs from last year's count of 69, with oil rigs up 63, gas rigs up 28, and miscellaneous rigs down 1 to 0.

2017, June, 10, 18:30:00

U.S. RIGS UP 11 TO 927

U.S. Rig Count is up 513 rigs from last year's count of 414, with oil rigs up 413, gas rigs up 100, and miscellaneous rigs unchanged.

Canadian Rig Count is up 67 rigs from last year's count of 65, with oil rigs up 45 and gas rigs up 22.

2017, June, 9, 21:15:00

OIL PRICE: ABOVE $48

Brent crude oil LCOc1 was up 48 cents at $48.34 a barrel by 12:17 p.m. EDT. U.S. crude CLc1 was 39 cents higher at $46.04 a barrel. U.S. crude and Brent benchmarks remained on track for weekly declines of more than 3 percent, pressured by big U.S. inventories and heavy worldwide flows.

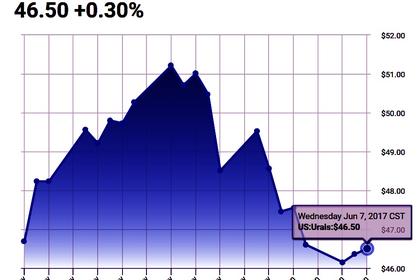

2017, June, 9, 21:10:00

GAS PRICE: $3.020

At the New York Mercantile Exchange (Nymex), the July 2017 contract price fell 5¢ from $3.071/MMBtu last Wednesday to $3.020/MMBtu yesterday.

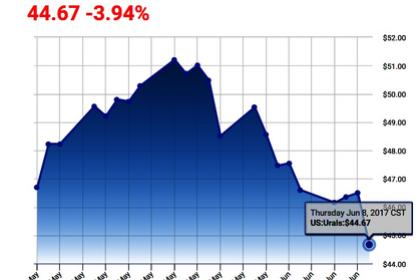

2017, June, 8, 18:05:00

OIL PRICE: ABOVE $47

Brent crude LCOc1 was up 43 cents by 0900 GMT at $48.49 a barrel, having fallen 4 percent the day before, while U.S. crude futures CLc1 rose 38 cents to $46.10 a barrel.

2017, June, 8, 17:55:00

U.S.: THE TOP PRODUCER

The United States remained the world's top producer of petroleum and natural gas hydrocarbons in 2016 for the fifth straight year despite production declines for both petroleum and natural gas relative to their 2015 levels. The United States has been the world's top producer of natural gas since 2009, when U.S. natural gas production surpassed that of Russia, and it has been the world's top producer of petroleum hydrocarbons since 2013, when its production exceeded Saudi Arabia’s.

2017, June, 8, 17:40:00

OPEC OIL PRODUCTION UP: 32.12 MBD

OPEC’s crude oil production increased by 270,000 bpd in May over April, to stand at 32.12mn bpd – the highest level since January this year