Analysis

2017, June, 2, 16:35:00

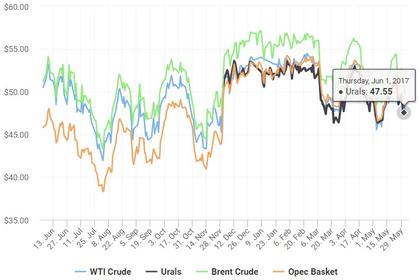

OIL PRICE: ABOVE $49

Benchmark Brent crude futures LCOc1 were off by nearly 3 percent at $49.14 per barrel at 1034 GMT (6:34 a.m. ET), down $1.49 from the previous close.

U.S. West Texas Intermediate crude CLc1 futures fell $1.45 cents to $46.91 per barrel.

2017, June, 2, 16:20:00

НИЗКИЕ ЦЕНЫ НАДОЛГО

В своем докладе Глава «Роснефти» заявил, что период низких нефтяных цен надолго, в настоящее время цены зафиксировались в диапазоне от 45 до 50 долларов за баррель Брент, а волатильность рынков и неопределенность значительно выросли. «Нынешняя «передышка» не должна нас успокаивать, - заявил Игорь Сечин, – условий для стабильной работы рынка пока не создано. Ряд крупных производителей, которые не участвуют в договоренностях, активно используют конъюнктуру для усиления собственной рыночной позиции, что, скорее, создает предпосылки для новой нестабильности, нежели для выхода на траекторию устойчивого роста».

2017, June, 1, 19:20:00

MARGINAL OIL: NOT ENOUGH

"When these factors are taken together I can only conclude that the supplies coming from marginal barrels including shale production will not be sufficient to meet the future need for incremental capacity the mid-term," Falih said. "The market balance is already pointing in that direction," he added.

2017, June, 1, 19:15:00

OIL COULD BE $50

Pumping crude from seabeds thousands of feet below water is turning cheaper as producers streamline operations and prioritize drilling in core wells, according to Wood Mackenzie Ltd. That means oil at $50 a barrel could sustain some of these projects by next year, down from an average break-even price of about $62 in the first quarter and $75 in 2014, the energy consultancy estimates.

2017, June, 1, 19:10:00

US OIL PRODUCTION UP

The historic record of 10 million barrels per day was reached during November, 1970, when US oil prices were still below 3 USD. The record was close to being surpassed in 2015 when US production peaked in April at 9.6 million barrels. Production then dropped 1 million barrels per day over 18 months as oil prices fell from above 100 to below 40 USD.

2017, May, 31, 17:50:00

OIL PRICE: ABOVE $50

Benchmark Brent oil LCOc1 was down $1.45, or 2.8 percent, at $50.39 a barrel by 1157 GMT (7.57 a.m. ET), after earlier touching $50.13 a barrel, the weakest since May 10. U.S. light crude CLc1 traded at $48.43, down $1.23 cents, or 2.5 percent.

2017, May, 30, 20:45:00

OIL PRICES ANALYSIS

West Texas Intermediate futures were down 0.8 percent from Friday’s closing price following the U.S. Memorial Day holiday on Monday. OPEC and Russia’s deal to extend output limits through March was initially met with a sell-off as deeper cuts or a plan for the rest of 2018 weren’t proposed. Saudi Arabia’s Energy Minister Khalid Al-Falih said the strategy is working and stockpiles will drop faster in the third quarter.

2017, May, 30, 20:30:00

LUKOIL PROFIT UP 33.7%

In the first quarter of 2017, profit attributable to PJSC LUKOIL shareholders was 62.3 bln RUB, up 33.7% and 45.5% quarter-on-quarter and year-on-year, respectively. Profit was significantly impacted by non-cash foreign exchange loss. Excluding this item, profit attributable to PJSC LUKOIL shareholders amounted to 97.1 bln RUB, a 22.7% increase year-on-year.

2017, May, 29, 13:50:00

OIL PRICE: ABOVE $51 ANEW

Brent crude futures were trading down 19 cents at $51.96 per barrel at 0857 GMT. The contract ended the previous week down nearly 3 percent.

U.S. West Texas Intermediate (WTI) crude futures were also down 19 cents at $49.61 per barrel.

2017, May, 29, 13:35:00

HARD OIL DEMAND

While most big oil companies foresee a day when the world will need less crude, timing when that peak in oil demand will materialize is one of the hottest flashpoints for controversy within the industry. It’s tough to predict because changes to oil demand will hinge on future disruptive technologies, such as batteries in electric cars that will allow drivers to travel for hundreds of miles on a single charge.

2017, May, 29, 13:20:00

U.S. RIGS UP 7 TO 908

U.S. Rig Count is up 504 rigs from last year's count of 404, with oil rigs up 406, gas rigs up 98, and miscellaneous rigs unchanged.

Canadian Rig Count is up 50 rigs from last year's count of 43, with oil rigs up 26, gas rigs up 25, and miscellaneous rigs down 1 to 0.

2017, May, 26, 14:05:00

OIL PRODUCTION & PRICES

Ministers from the Organization of Petroleum Exporting Countries and its allies meet in Vienna to decide whether to prolong their agreement. Major producers including Saudi Arabia, Russia and Iraq favor an extension for nine months and, while other options will be discussed, consensus is building around an agreement that runs through next March.

2017, May, 26, 14:00:00

WORSE FOR LNG

A balanced global crude oil market likely will remain elusive into 2018 because so many underlying dynamics have changed in the last 10 years. The outlook is worse for LNG because markets are saturated, prices are depressed, and economics are unfavorable.

2017, May, 24, 19:45:00

OIL PRICE: ABOVE $54 ANEW

The July light, sweet crude contract on NYMEX climbed 34¢ on May 23 to close at $51.47/bbl. The August contract rose 32¢ to settle at $51.72/bbl.

The natural gas price for June fell 11¢ to a rounded $3.22/MMbtu. The Henry Hub cash gas price was $3.20/MMbtu, down 1¢.

The Brent crude contract for July on London’s ICE gained 28¢ to $54.15/bbl. The August contract was up 30¢ to $54.41/bbl. The June gas oil contract held unchanged at $479/tonne.

OPEC’s basket of crudes on May 23 settled at $51.34/bbl, down 20¢.

2017, May, 23, 15:15:00

OIL PRICE: ABOVE $53 ANEW

Brent crude LCOc1 ended a run of four days of consecutive gains to trade 36 cents lower at $53.51 per barrel at 0831 GMT.

U.S. light crude CLc1 was down 33 cents at $50.80.