Analysis

2016, November, 24, 18:45:00

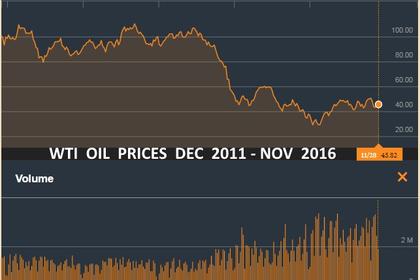

OIL PRICES: ABOUT $49 ANEW

At 1040 GMT (5:40 a.m. ET), Brent crude futures LCOc1 were trading at $48.89, down 6 cents from their close. U.S. West Texas Intermediate (WTI) crude CLc1 was down 2 cents at $47.94 per barrel.

2016, November, 24, 18:40:00

ГЛОБАЛЬНОЕ ОБОСТРЕНИЕ КОНКУРЕНЦИИ

В качестве главных вызовов для энергетики Министр назвал глобальное снижение цен на углеводороды, технологические прорывы, глобализацию рынков и обострение конкуренции, рост вмешательства в рыночный механизм со стороны государства, замедление темпов роста потребления топливно-энергетических ресурсов.

2016, November, 22, 19:00:00

OIL PRICES: ABOVE $49 AGAIN

Brent crude oil futures LCOc1 were up 85 cents a barrel at $49.75 by 1000 GMT (5:00 a.m. ET), having earlier risen $1 in a push against the $50 mark for the first time since the end of October.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 68 cents, or 1.4 percent, at $48.92 a barrel.

2016, November, 22, 18:50:00

НОВАТЭК СПГ: БОЛЬШЕ $10 МЛРД.

«Новатэк» ожидает, что капитальные затраты на проект «Арктик СПГ – 2» на Гыданском полуострове превысят $10 млрд. Компания ведет предварительные работы по проектированию, мощность предприятия будет аналогична «Ямал СПГ» (16,5 млн т в год), запасы газа территории могут обеспечить поставки СПГ до 70 млн т в год, ресурсная база проекта – 1,2 трлн куб. м газа и 56,5 млн т жидких углеводородов по категории С1 + С2.

2016, November, 22, 18:35:00

SEADRILL NET LOSS $656 MLN

Highlights:

- Revenue of $743 million

- Operating income of $247 million

- EBITDA of $441 million

- 95% economic utilization

- Reported Net Loss of $656 million and diluted loss per share of $1.29, reflecting an $882 million non-cash impairment to investments primarily relating to Seadrill Partners.

- Underlying Net Income , excluding non-recurring items and non-cash mark to market movements on derivatives,was $135 million and earnings per share was $0.28.

- Cash and cash equivalents of $1.3 billion

- Seadrill Limited orderbacklog of approximately $3.0 billion

2016, November, 22, 18:30:00

TESCO NET LOSS $97.8 MLN

Tesco reported a U.S. GAAP net loss of $22.1 million, or $(0.48) per share, for the third quarter ended September 30, 2016. Our adjusted net loss for the quarter was $17.3 million, or $(0.37) per share, excluding special items, consisting primarily of several charges related to inventory and restructuring costs. This compares to a U.S. GAAP net loss of $18.9 million, or $(0.47) per diluted share, in the second quarter of 2016, and a U.S. GAAP net loss of $19.9 million, or $(0.51) per diluted share, for the third quarter of 2015. Adjusted net loss in the second quarter of 2016 was $15.8 million, or $(0.39) per diluted share, and in the third quarter of 2015 was $12.5 million, or $(0.32) per diluted share.

2016, November, 21, 19:10:00

OIL PRICES: ABOVE $47 ANEW

Brent crude oil LCOc1 was up 60 cents a barrel at $47.23 by 1120 GMT (6:20 a.m. ET). U.S. light crude CLc1 was up 50 cents at $46.07.

2016, November, 21, 18:45:00

NORWAY'S OIL PRODUCTION UP TO 30%

Preliminary production figures for October 2016 show an average daily production of 2 099 000 barrels of oil, NGL and condensate, which is an increase of 486 000 barrels per day (approx. 30 percent) compared to September.

2016, November, 21, 18:40:00

U.S. OIL DEMAND UP

Domestic crude oil production in October was higher compared to the prior month, but was lower than the prior year, and the prior year to date. At an average of 8.6 million barrels per day, U.S. crude oil production in October decreased 8.0 percent from October 2015, but increased from September by 0.2 percent. October’s crude oil production was the third highest since 1985 and the second highest year to date in 31 years, since 1985.

2016, November, 21, 18:30:00

U.S. RIGS UP 20

U.S. Rig Count is down 169 rigs from last year's count of 757, with oil rigs down 93, gas rigs down 77, and miscellaneous rigs up 1.

Canadian Rig Count is up 18 rigs from last year's count of 166, with oil rigs up 33 and gas rigs down 15.

2016, November, 18, 18:50:00

OIL DEMAND 2040

Global oil demand won’t stop growing before 2040 despite pledges made at the Paris climate change summit last year to cap greenhouse-gas emissions.

2016, November, 18, 18:45:00

RUSSIAN DECISION: $6 BLN

Russia’s decision earlier this year to engage in talks with OPEC about limiting oil output has added more than 400 billion rubles ($6 billion) to the nation’s budget, according to two officials familiar with government calculations.

2016, November, 17, 18:50:00

OIL PRICES: EVEN ABOVE $47

Brent crude oil LCOc1 was up 60 cents a barrel at $47.23 by 1120 GMT (6:20 a.m. ET). U.S. light crude CLc1 was up 50 cents at $46.07.

2016, November, 16, 18:50:00

OIL PRICES: ABOVE $46 STILL

Global benchmark Brent crude LCOc1 was down 39 cents at $46.56 a barrel at 0917 GMT. It closed Tuesday 5.7 percent higher on news that members of the Organization of the Petroleum Exporting Countries would renew efforts to limit production.

U.S. crude CLc1 was 47 cents lower at $45.34 a barrel.

2016, November, 15, 18:55:00

OIL PRICES: ABOVE $45 YET

Light, sweet crude for December delivery settled down 9 cents, or 0.2%, at $43.32 a barrel on the New York Mercantile Exchange, the lowest settlement since Sept. 19. U.S. oil fell as low as $42.20 a barrel, the lowest intraday price since mid-August, before a rebound throughout the afternoon. Brent, the global benchmark, fell 32 cents, or 0.7%, to $44.43 a barrel, its lowest settlement since Aug. 10.