Analysis

2016, December, 2, 19:05:00

OIL PRICES: ABOVE $53

Front-month Brent crude futures LCOc1 were down 45 cents, or 0.8 percent by 0951 GMT (4:51 a.m. ET) from their last settlement at $53.49 per barrel. The contract was up more than 13 percent this week, its biggest gain since March 2009.

U.S. West Texas Intermediate (WTI) futures CLc1 were at $50.68, down 38 cents.

2016, December, 2, 19:00:00

CHINA'S OIL BENEFITS

For China’s beleaguered oil sector, a deal by the Organization of the Petroleum Exporting Countries to cut output could offer a lifeline to an industry that has been hammered by low prices—and may also hasten its shift away from a heavy reliance on Saudi crude.

2016, December, 2, 18:55:00

U.S. OIL BENEFITS

Shares in US oil companies soared on Wednesday as Opec ministers meeting in Vienna agreed a plan to cut output by 1.2m barrels per day.

“The biggest beneficiaries from this Opec move are the US shale players,” said Mike Kelly, head of exploration and production company research at Seaport Global Securities.

2016, December, 2, 18:40:00

OPEC - RUSSIA DEAL

Oil prices slipped on Friday as some investors opted to cash out after Brent touched 16-month a high on Thursday, with optimism over this week's OPEC-Russia accord on cutting output giving way to questions on the "sticking point" of implementing the deal.

2016, December, 1, 18:45:00

OIL PRICES: ABOVE $52 AGAIN

U.S. crude oil CLc1 added to overnight gains of 9 percent to reach $50.00 a barrel for the first time since October. Brent crude LCOc1, which soared $4 overnight, touched a six-week peak of $52.73 a barrel.

2016, November, 30, 18:55:00

OIL PRICES: ABOVE $49 ANEW

Brent crude, the international oil marker, rose more than $3.00, or 7.2 per cent, to $49.73 in the late morning in London.

2016, November, 30, 18:45:00

OIL INVESTMENT: -$1.99 TLN + $630 BLN

Oil companies around the world have together added $630 billion to their market value this year, the biggest gain in six years following a 30 percent rise in benchmark Brent crude. This follows a $1.2 trillion loss in value last year and $790 billion in 2014 as crude prices plunged.

2016, November, 30, 18:40:00

UKRAINE'S LAST OPTIONS

Gazprom has started to vary its marketing strategy by using a variety of methodologies, including selling gas via the traditional long term contracts, via auctions, via Gazprom Marketing & Trading and via Wingas (its 100% owned European utility). As a result it has gained flexibility (that was formerly in the hands of the European utilities) and can adapt much faster to market changes.

2016, November, 30, 18:35:00

LUKOIL NET INCOME DOWN 55%

EBITDA decreased by 12.5% quarter-on-quarter mainly because of negative crude oil export duty time lag effect, which was partially offset by higher refining margins in Russia. Profit attributable to shareholders was 54.8 bln RUB, down 12.4% from the second quarter of 2016.

2016, November, 28, 19:05:00

OIL PRICES: ABOUT $46 ANEW

Brent crude futures LCOc1 fell as far as 2 percent before clawing back to trade up 29 cents at $47.44 per barrel at 1008 GMT.

U.S. West Texas Intermediate (WTI) crude futures CLc1 also recouped early losses and were trading up 15 cents at $46.21 per barrel.

2016, November, 28, 19:00:00

2017: DEMAND RECOVERY

“We expect demand to recover in 2017, then prices will stabilize, and this will happen without an intervention from OPEC,” Al-Falih said in Dhahran, eastern Saudi Arabia, on Sunday, according to the Saudi newspaper Asharq al-Awsat. “We don’t have a single path which is to cut production at the OPEC meeting, we can also depend on recovery in consumption, especially from the U.S.”

2016, November, 24, 18:45:00

OIL PRICES: ABOUT $49 ANEW

At 1040 GMT (5:40 a.m. ET), Brent crude futures LCOc1 were trading at $48.89, down 6 cents from their close. U.S. West Texas Intermediate (WTI) crude CLc1 was down 2 cents at $47.94 per barrel.

2016, November, 24, 18:40:00

ГЛОБАЛЬНОЕ ОБОСТРЕНИЕ КОНКУРЕНЦИИ

В качестве главных вызовов для энергетики Министр назвал глобальное снижение цен на углеводороды, технологические прорывы, глобализацию рынков и обострение конкуренции, рост вмешательства в рыночный механизм со стороны государства, замедление темпов роста потребления топливно-энергетических ресурсов.

2016, November, 22, 19:00:00

OIL PRICES: ABOVE $49 AGAIN

Brent crude oil futures LCOc1 were up 85 cents a barrel at $49.75 by 1000 GMT (5:00 a.m. ET), having earlier risen $1 in a push against the $50 mark for the first time since the end of October.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 68 cents, or 1.4 percent, at $48.92 a barrel.

2016, November, 22, 18:50:00

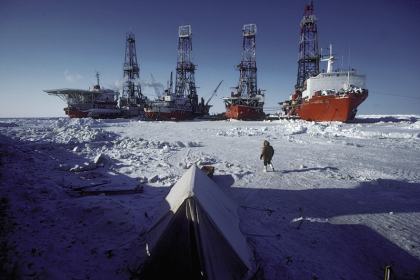

НОВАТЭК СПГ: БОЛЬШЕ $10 МЛРД.

«Новатэк» ожидает, что капитальные затраты на проект «Арктик СПГ – 2» на Гыданском полуострове превысят $10 млрд. Компания ведет предварительные работы по проектированию, мощность предприятия будет аналогична «Ямал СПГ» (16,5 млн т в год), запасы газа территории могут обеспечить поставки СПГ до 70 млн т в год, ресурсная база проекта – 1,2 трлн куб. м газа и 56,5 млн т жидких углеводородов по категории С1 + С2.