Analysis

2016, November, 9, 19:15:00

OIL PRICES: ABOVE $45

At 3:30 pm Singapore time (0739 GMT), January ICE Brent crude futures were down 64 cents/b (1.39%) from Tuesday's settle at $45.40/b, while the NYMEX December light sweet crude contract fell 59 cents/b (1.31%) to $44.39/b.

2016, November, 9, 19:10:00

OIL PRICES: $43 - $51

EIA expects Brent crude oil prices will average close to $48/ barrel (b) in the fourth quarter of 2016 and in the first quarter of 2017. Forecast Brent prices average $43/b in 2016 and $51/b in 2017. West Texas Intermediate (WTI) crude oil prices are forecast to average about $1/b less than Brent prices in 2017. The values of futures and options contracts indicate significant uncertainty in the price outlook, with NYMEX contract values for February 2017 delivery traded during the five-day period ending November 3 suggesting that a range from $35/b to $66/b encompasses the market expectation of WTI prices in February 2017 at the 95% confidence level.

2016, November, 9, 19:05:00

URALS: $40,72

Средняя цена нефти марки Urals по итогам января-октября 2016 года составила $ 40,72 за баррель.

2016, November, 8, 18:35:00

DEMAND WILL UP AGAIN

OPEC raised its outlook for oil use in 2018, 2019 and 2020, when it sees demand reaching 98.3 million barrels a day, or 900,000 more than the group projected in its previous annual outlook.

2016, November, 8, 18:30:00

BOTTOM IS GOING

Oil producers would love to see higher prices, but OPEC so far has been unable to cut output.

In September, OPEC agreed to have a committee look at potentially cutting production to 32.5 million to 33 million barrels a day, shaving off 700,000 barrels a day — some 2 percent of overall production.

2016, November, 7, 19:00:00

OIL PRICE: ABOVE $46

Brent crude futures LCOc1 were trading at $46.29 per barrel at 0705 GMT, up 71 cents, or 1.56 percent, from their previous close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 730 cents, or 1.66 percent, at $44.80 a barrel.

2016, November, 7, 18:50:00

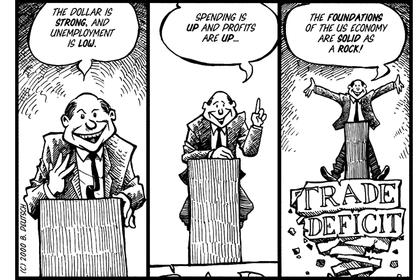

U.S. DEFICIT $36.4 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $36.4 billion in September, down $4.0 billion from $40.5 billion in August, revised. September exports were $189.2 billion, $1.0 billion more than August exports. September imports were $225.6 billion, $3.0 billion less than August imports.

2016, November, 7, 18:45:00

CHINA'S SHALE GAS UP

Sinopec Ltd. reported that Fuling shale gas field in southwestern China produced a cumulative 3.76 billion cu m of gas from January to September. The 107% increase in production was accompanied by additional processing capacity of 5.5-6.5 bcm, the company said. In 2014, Sinopec announced plans to bring production capacity to 10 bcm/year by 2017.

2016, November, 7, 18:35:00

WORLDWIDE RIG COUNT DOWN 466

The worldwide rig count for October 2016 was 1,620, up 36 from the 1,584 counted in September 2016, and down 466 from the 2,086 counted in October 2015.

2016, November, 7, 18:30:00

U.S. RIGS UP 12

U.S. Rig Count is down 202 rigs from last year's count of 771, with oil rigs down 122, gas rigs down 82, and miscellaneous rigs up 2.

Canadian Rig Count is down 31 rigs from last year's count of 185, with oil rigs down 3, gas rigs down 29, and miscellaneous rigs up 1.

2016, November, 2, 18:50:00

OIL PRICE: ABOVE $47 AGAIN

U.S. West Texas Intermediate crude CLc1 fell by 70 cents to $45.97 by 0611 ET and Brent crude LCOc1 was down 69 cents at $47.45. Both contracts were at their lowest since Sept. 28.

2016, November, 2, 18:40:00

U.S. OIL WILL DOWN 800 TBD

Output in the U.S. will fall 800,000 barrels a day this year, Adam Sieminski, administrator for the EIA, said in an interview in Riyadh. That would be the first drop since 2008, data compiled by Bloomberg show. OPEC’s attempts to carry out an agreement on limiting production are still “very much up in the air,” he said.

2016, November, 2, 18:30:00

TRANSCANADA NET INCOME DOWN 48%

TransCanada Corporation (TSX:TRP) (NYSE:TRP) (TransCanada) announced a net loss attributable to common shares for third quarter 2016 of $135 million or $0.17 per share compared to net income of $402 million or $0.57 per share for the same period in 2015. Third quarter 2016 results included a $656 million after-tax goodwill impairment charge related to our U.S. Northeast Power business. Excluding the net loss on the goodwill impairment and certain other specific items, comparable earnings for third quarter 2016 were $622 million or $0.78 per share compared to $440 million or $0.62 per share for the same period in 2015. TransCanada's Board of Directors also declared a quarterly dividend of $0.565 per common share for the quarter ending December 31, 2016, equivalent to $2.26 per common share on an annualized basis.

2016, November, 1, 19:00:00

CHINA'S GASOIL RECORD

September gasoil exports surged to a record high of 1.6 million mt, or 398,197 b/d, surpassing the previous high of 1.53 million mt, or 368,840 b/d, in July, according to data from the General Administration of Customs.

On a daily average basis in barrels, exports in September were 44.4% higher year on year and up 55.4% month on month.

2016, November, 1, 18:45:00

EXXON NET INCOME $6.16 BLN

Exxon Mobil Corporation today announced estimated third quarter 2016 earnings of $2.7 billion, or $0.63 per diluted share, compared with $4.2 billion a year earlier. Results reflect lower refining margins and commodity prices.