Analysis

2021, November, 1, 13:55:00

ЦЕНА URALS: $67,51

Средняя цена на нефть марки Urals в январе-октябре 2021 года сложилась в размере $67,51 за баррель

2021, November, 1, 13:25:00

SAUDI ARAMCO NET INCOME $30.4 BLN

The Saudi Arabian Oil Company (“Aramco” or “the Company”) announced its third quarter financial results, recording a 158% year-on-year (YoY) increase in net income to $30.4 billion and declaring a dividend of $18.8 billion to be paid in the fourth quarter.

2021, November, 1, 13:20:00

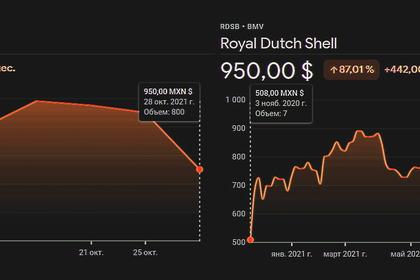

SHELL LOSS $400 MLN

Third quarter 2021 income attributable to Royal Dutch Shell plc shareholders was a loss of $0.4 billion, which included non-cash charges of $5.2 billion due to the fair value accounting of commodity derivatives and post-tax impairment charges of $0.3 billion, partly offset by net gains on sale of assets of $0.3 billion.

2021, November, 1, 13:15:00

U.S. RIGS UP 2 TO 544

U.S. Rig Count is up 2 from last week to 544, Canada Rig Count is up 2 from last week to 166.

2021, October, 29, 14:30:00

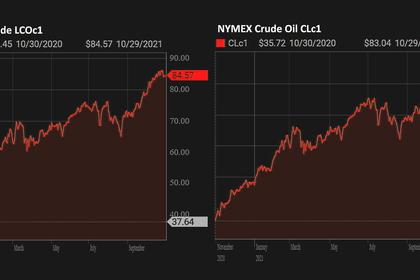

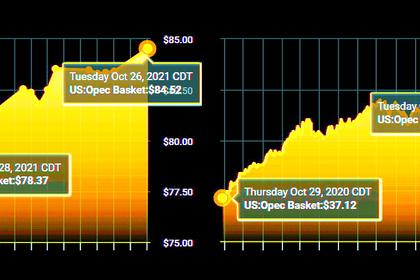

OIL PRICE: NOT BELOW $84

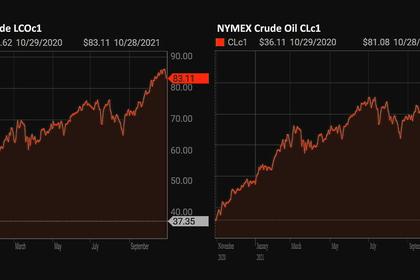

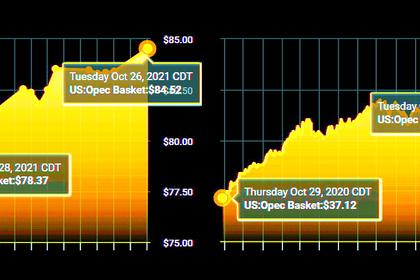

Brent rose 21 cents, or 0.3%, to $84.53 a barrel, WTI added 10 cents, or 0.1%, to $82.91.

2021, October, 29, 14:25:00

OPEC+ 400 TBD AGAIN

Ministers from the Organization of the Petroleum Exporting Countries (OPEC), Russia and their allies - colectively known as OPEC+ - meet on Nov. 4 to decide output policy.

2021, October, 29, 13:45:00

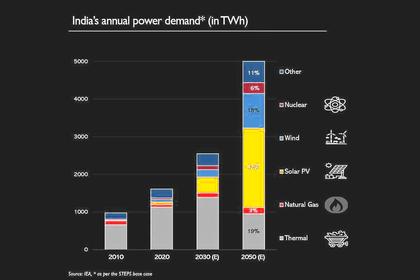

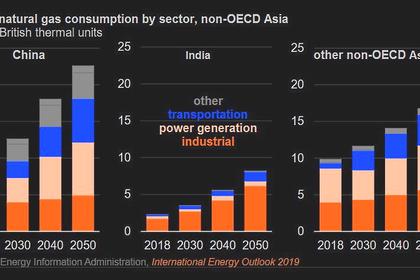

INDIA'S POWER DEMAND GROWTH

As per the recently released, World Energy Outlook 2021, IEA forecasts that’s India's power demand is slated to nearly treble to 5000 TWh by 2050, let primarily by renewable sources of energy.

2021, October, 29, 13:30:00

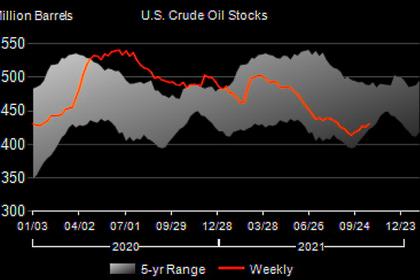

U.S. OIL INVENTORIES UP BY 4.3 MB TO 430.8 MB

U.S. commercial crude oil inventories increased by 4.3 million barrels from the previous week to 430.8 million barrels.

2021, October, 28, 14:10:00

OIL PRICE: NOT BELOW $83

Brent dropped $1.07, or 1.3%, to $83.51 a barrel, WTI was down $1.20, or 1.5%, at $81.46.

2021, October, 28, 14:00:00

OPEC+ OIL DELIVERIES +400 TBD

OPEC+ has been sticking to its script of bringing on 400,000 b/d of crude to the market each month, with the Saudi energy minister suggesting panic buying is causing much of the market tightness.

2021, October, 28, 13:55:00

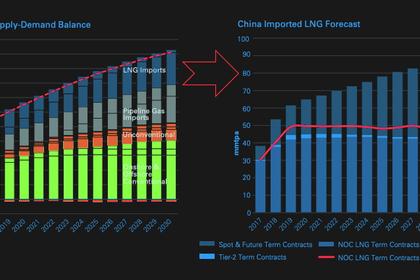

CHINA GAS DEMAND WILL UP 10%

Chinese energy firms and government researchers expect a significant increase in gas demand for power generation and industrial sectors this winter as a nationwide coal supply crunch and power outtages drive up demand for alternative fuels.

2021, October, 28, 13:50:00

GAS FOR CHINA WILL UP

The increase in supply should help alleviate some of the price pressure in the domestic gas market as trucked LNG prices have soared to more than Yuan 7,000/mt ($1,093.82/mt), imported LNG remains over $30/MMBtu in the spot market and wider energy shortages persist amid cold weather.

2021, October, 27, 13:10:00

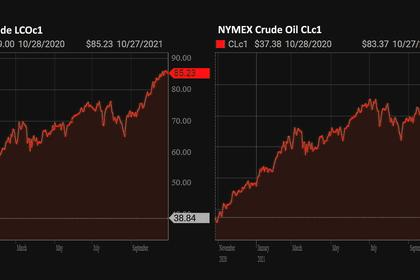

OIL PRICE: NOT ABOVE $86 ANEW

Brent fell $1.13 cents, or 1.3%, to $85.27 a barrel, WTI were down $1.44, or 1.7%, to $83.21 per barrel.

2021, October, 27, 13:05:00

NUCLEAR ACHIEVE SDG GOALS

Nuclear’s contribution to achieving the UN Sustainable Development Goals

2021, October, 26, 13:30:00

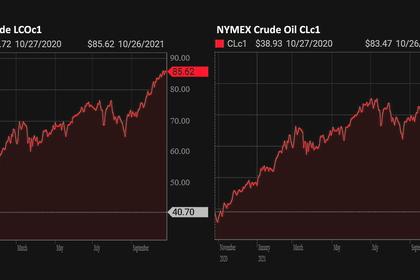

OIL PRICE: NOT ABOVE $86

Brent was down 55 cents, or 0.6%, at $85.44 a barrel, WTI dropped 56 cents, or 0.7%, to $83.20.