Companies

2021, November, 18, 12:55:00

MOZAMBIQUE LNG START

Area 4 is operated by Mozambique Rovuma Venture (MRV), an incorporated joint venture owned by Eni, ExxonMobil and CNPC, which holds a 70% interest in the Area 4 exploration and production concession contract.

2021, November, 17, 13:30:00

RUSSIAN GAS FOR FRANCE

It was noted that Russia has been a reliable supplier of gas to France for as many as 45 years, with exports over this period surpassing 427 billion cubic meters in total.

2021, November, 17, 13:20:00

NORD STREAM 2 CERTIFICATION SUSPENDED

The regulator said a new subsidiary of Nord Stream 2 AG announced by the operator would need to submit a new application for certification.

2021, November, 16, 14:45:00

NORD STREAM 2 CERTIFICATION ANEW

Russia has said that Nord Stream 2 is ready to begin commercial operations pending regulatory approval and that gas flows through the pipeline would help ease the current high European gas prices, which remain at sustained highs on winter supply concerns.

2021, November, 16, 14:35:00

RUSSIAN NUCLEAR FOR STEELMAKER

Rosenergoatom (part of the electric power division of Rosatom State Corporation) and the international metallurgical company NLMK Group concluded an agreement on cooperation in the supply of low-carbon electricity.

2021, November, 12, 12:25:00

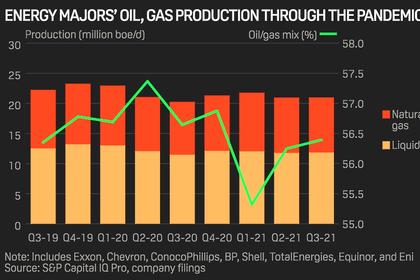

LIMITED OIL GAS PRODUCTION

At the end of 2019, combined oil output from ExxonMobil, BP, Shell, Chevron, TotalEnergues, Equinor, ConocoPhillips, and Eni stood at 13.3 million b/d, or about 13% of total global supplies,

2021, November, 11, 14:40:00

MAERSK, NOBLE COMBINATION

Noble and Maersk shareholders will each hold 50% in the combined entity, which will be named Noble Corp. with headquarters in Houston.

2021, November, 10, 12:00:00

BRITAIN'S NUCLEAR SMR

In May, the UK's Department for Business, Energy and Industrial Strategy opened the GDA process to advanced nuclear technologies, including SMRs.

2021, November, 9, 17:00:00

RUSSIA'S NUCLEAR SAFETY

The five-day follow-up Corporate OSART mission, completed on 29 October, was carried out at the request of the Russian Government. Rosenergoatom is a subsidiary of the Russian state corporation Rosatom and currently owns and operates all 38 nuclear reactors across the Russian Federation.

2021, November, 3, 12:10:00

RUSSIAN NUCLEAR WILL UP

Today Russia’s 11 nuclear plants operate 38 units with a total installed capacity of over 30.5GW. The share of nuclear generation in the total electricity generation in Russia is 20.6% as of mid-2021. In the European part of the country this rises to 30%, and in the North-West to 37%.

2021, November, 2, 13:50:00

GAZPROM PRODUCTION, SUPPLIES UP

According to preliminary data, Gazprom produced 422.6 billion cubic meters of gas in January–October of 2021, which is 15.8 per cent (or 57.7 billion cubic meters) more than in the same period of last year.

2021, November, 2, 13:45:00

RUSSIAN GAS FOR MOLDOVA

Gazprom and Moldovagaz extended the contract for Russian gas supplies to consumers in the Republic of Moldova from November 1, 2021, for a period of five years on mutually beneficial terms.

2021, November, 2, 13:20:00

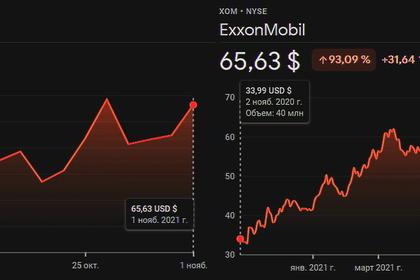

EXXON EARNINGS $6.8 BLN

Exxon Mobil Corporation announced estimated third-quarter 2021 earnings of $6.8 billion, or $1.57 per share assuming dilution.

2021, November, 1, 13:25:00

SAUDI ARAMCO NET INCOME $30.4 BLN

The Saudi Arabian Oil Company (“Aramco” or “the Company”) announced its third quarter financial results, recording a 158% year-on-year (YoY) increase in net income to $30.4 billion and declaring a dividend of $18.8 billion to be paid in the fourth quarter.

2021, November, 1, 13:20:00

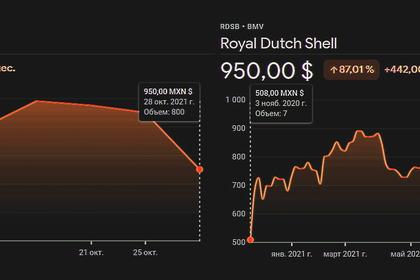

SHELL LOSS $400 MLN

Third quarter 2021 income attributable to Royal Dutch Shell plc shareholders was a loss of $0.4 billion, which included non-cash charges of $5.2 billion due to the fair value accounting of commodity derivatives and post-tax impairment charges of $0.3 billion, partly offset by net gains on sale of assets of $0.3 billion.