Companies

2019, August, 5, 13:10:00

PETROBRAS NET INCOME $1.3 BLN

Accounting net income excluding non-recurring factors was US$ 1.3 billion and operating cash flow reached US$ 5.2 billion. Advances in pre-salt exploration, with lower lifting cost (US$ 6/boe) and better quality of oil, allowed adjusted EBITDA per barrel of oil equivalent (boe) in the exploration & production (E&P) business to reach US$ 33.50 in 2Q19 against US$ 29.50 last year, despite the drop in average Brent oil prices from US$ 71.0 to US$ 68.8.

2019, August, 5, 13:05:00

ADNOC NET PROFIT AED1.173 BLN

ADNOC Distribution today reported that its first-half 2019 net profit increased by 4.3 percent, to AED1.173 billion, compared with the same period last year.

2019, August, 2, 11:15:00

TC ENERGY NET INCOME $1.1 BLN

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) announced net income attributable to common shares for second quarter 2019 of $1.1 billion or $1.21 per share compared to net income of $785 million or $0.88 per share for the same period in 2018.

2019, August, 1, 12:10:00

RUSSIAN STREAMS: NEW SANCTIONS

The bill would sanction vessels that lay Russian energy export pipelines at least 100 feet below sea level.

2019, August, 1, 12:05:00

ADNOC, ENI DEAL $3.24 BLN

Eni and ADNOC announced that they have closed their strategic partnership, announced in January, through which Eni acquired a 20% equity interest in ADNOC refining. The final cash price is approximately $3.24bn. The partners, which include Austria’s OMV, also set up a new trading joint venture.

2019, August, 1, 12:00:00

SHELL INCOME $3 BLN

“We have delivered good cash flow performance, despite earnings volatility, in a quarter that has seen challenging macroeconomic conditions in refining and chemicals as well as lower gas prices. This quarter we achieved some key milestones, such as the start-up of Appomattox and the first LNG cargo from Prelude. These add to our competitive portfolio, which is expected to generate additional cash in the coming quarters.

The resilience of our Upstream and customer-facing businesses and their ability to generate cash support the delivery of our 2020 outlook, which remains unchanged.”

2019, August, 1, 11:55:00

SHELL BUYBACK PROGRAMME $2.75 BLN

Royal Dutch Shell plc (the ‘company’) today announces the commencement of trading in the next tranche of its share buyback programme previously announced on July 26, 2018. In the next tranche, the company has entered into an irrevocable, non-discretionary arrangement with a broker to enable the purchase of A ordinary shares and/or B ordinary shares for a period up to and including October 28, 2019. The aggregate maximum consideration for the purchase of A ordinary shares and/or B ordinary shares under the next tranche is $2.75 billion. The company’s intention is to buy back at least $25 billion of its shares by the end of 2020, subject to further progress with debt reduction and oil price conditions.

2019, August, 1, 11:50:00

SHELL SELLS $1.9 BLN

Royal Dutch Shell plc (Shell), through its affiliate Shell Overseas Holdings Limited, has completed the sale of its shares in Shell Olie-og Gasudvinding Danmark B.V. (SOGU), holding a 36.8% non-operating interest in the Danish Underground Consortium (DUC), to Norwegian Energy Company ASA (Noreco) for a consideration amount of $1.9 billion.

2019, August, 1, 11:45:00

SHELL SELLS $0.965 BLN

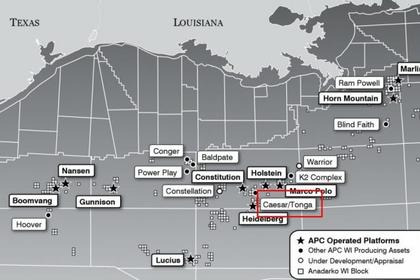

Shell Offshore Inc. (Shell), a subsidiary of Royal Dutch Shell plc, has completed the sale of 22.45% non-operated interest in the Caesar-Tonga asset in the US Gulf of Mexico to Equinor Gulf of Mexico LLC (Equinor), a subsidiary of Equinor ASA, subject to approval of the lease assignments by the regulator. The total cash consideration was $965 million.

2019, August, 1, 11:40:00

BAKER HUGHES A GE NET LOSS $9 MLN

BAKER HUGHES, A GE COMPANY ANNOUNCES SECOND QUARTER 2019 RESULTS

2019, August, 1, 11:35:00

TANAP IS READY

The Trans Anatolian Natural Gas Pipeline (TANAP), the major segment of the Southern Gas Corridor is ready to supply Azerbaijani gas directly to Europe.

2019, July, 31, 13:30:00

MUBADALA ASSETS $229 BLN

Abu Dhabi sovereign wealth fund Mubadala saw a jump in its assets under management in 2018, reaching $229bn, up from $127.7bn the previous year.

2019, July, 31, 13:25:00

TC ENERGY SELLS $2.87 BLN

TC Energy Corporation (TSX:TRP) (NYSE:TRP) (TC Energy) announced that it has entered into an agreement through its wholly-owned subsidiary, TransCanada Energy Ltd., to sell interests in three Ontario natural gas-fired power plants to a subsidiary of Ontario Power Generation Inc., for approximately $2.87 billion.

2019, July, 31, 13:20:00

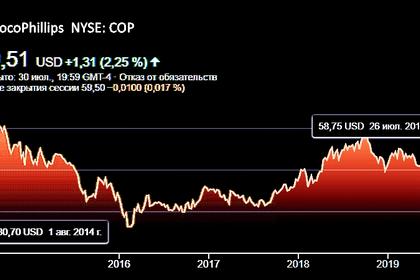

CONOCO EARNINGS $1.6 BLN

ConocoPhillips (NYSE: COP) reported second-quarter 2019 earnings of $1.6 billion, or $1.40 per share, compared with second-quarter 2018 earnings of $1.6 billion, or $1.39 per share.

2019, July, 30, 12:20:00

АККУЮ В ГРАФИКЕ

“Очередное заседание Рабочей группы по энергетике, которое состоялось накануне, позволило подвести итоги реализации проектов в этой области, а также наметить новые направления совместной работы. На особом контроле держим реализацию наших ключевых проектов - “Турецкого потока” и АЭС “Аккую”. Мы рассчитываем на своевременный запуск проектов в конце 2019 года и к 2023 году соответственно”, - сказал Александр Новак.