Finance

2017, November, 30, 12:10:00

KOCH BROTHERS INDUSTRIES

INVESTOPEDIA - The Koch brothers have become well-known for their libertarian and conservative politics, and are often portrayed as significant personalities that impact elections and government decisions.

2017, November, 20, 09:15:00

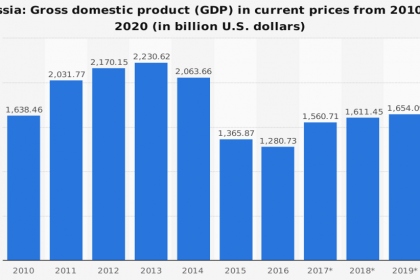

IMF: RUSSIA'S RECOVERY

IMF - A cyclical recovery in Russia is gaining pace after a two-year recession, with growth expected to reach around 2 percent this year, supported by higher oil prices and easier domestic financial conditions. Nevertheless, growth is likely to remain low in the medium-term, due to demographics, unaddressed structural bottlenecks as well as enduring sanctions.

2017, November, 7, 12:20:00

U.S. DEFICIT $43.5 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.5 billion in September, up $0.7 billion from $42.8 billion in August, revised. September exports were $196.8 billion, $2.1 billion more than August exports. September imports were $240.3 billion, $2.8 billion more than August imports.

2017, November, 3, 12:10:00

U.S. FEDERAL FUNDS RATE 1 - 1.25%

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

2017, November, 3, 12:05:00

SHELL INCOME $9.2 BLN

Compared with the third quarter 2016, CCS earnings attributable to shareholders excluding identified items increased to $4.1 billion, reflecting higher contributions from Downstream, Upstream and Integrated Gas. Earnings benefited mainly from stronger refining and chemicals industry conditions, increased realised oil and gas prices and higher production from new fields, offsetting the impact of field declines and divestments.

2017, November, 2, 09:41:00

WEATHERFORD NET LOSS $256 MLN

Weatherford International plc (NYSE: WFT) reported a net loss of $256 million, or a loss of $0.26 per share, and a non-GAAP net loss of $221 million before charges and credits ($0.22 non-GAAP loss per share) on revenues of $1.46 billion for the third quarter of 2017.

2017, November, 1, 13:00:00

ANADARKO NET LOSS $699 MLN

Anadarko Petroleum Corporation (NYSE: APC) announced its third-quarter 2017 results, reporting a net loss attributable to common stockholders of $699 million, or $1.27 per share (diluted). These results include certain items typically excluded by the investment community in published estimates. In total, these items increased the net loss by $272 million, or $0.50 per share (diluted), on an after-tax basis.(1) Net cash provided by operating activities in the third quarter of 2017 was $639 million.

2017, October, 30, 11:40:00

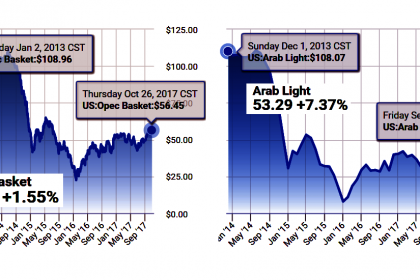

SAUDIS PROGRESS

IMF - Saudi Arabia had made good progress in initiating its ambitious reform agenda. Fiscal consolidation efforts are beginning to bear fruit. Progress with reforms to improve the business environment are gaining momentum, and a framework to increase the transparency and accountability of government is in place. Effective prioritization, sequencing, and coordination of the reforms is essential, and they need to be well-communicated and equitable to gain social buy-in to ensure their success.

2017, October, 30, 11:30:00

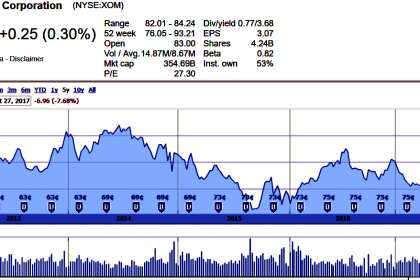

EXXON EARNINGS $11.3 BLN

Exxon Mobil Corporation announced estimated third quarter 2017 earnings of $4 billion, or $0.93 per diluted share, compared with $2.7 billion a year earlier as commodity prices improved and performance in the Upstream and Downstream strengthened. Impacts related to Hurricane Harvey reduced earnings by an estimated 4 cents per share.

2017, October, 30, 11:25:00

TOTAL NET INCOME $7.6 BLN

"Total reported adjusted net income of $2.7 billion this quarter, a 29% increase compared to a year ago while the Brent price increased by 14%. This solid performance was also reflected in a return on equity of close to 10% and strong cash flow generation: excluding acquisitions-divestments, the Group generated $2.1 billion of cash flow after investments in the third quarter 2017 and $5.2 billion in the first nine months. The Group took full advantage of the favorable environment thanks to the performance of its integrated model and its strategy to reduce its breakeven point.

2017, October, 30, 11:20:00

CHEVRON NET INCOME $6 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $2.0 billion ($1.03 per share – diluted) for third quarter 2017, compared with $1.3 billion ($0.68 per share – diluted) in the third quarter of 2016. Included in the quarter was a gain on an asset sale of $675 million and an asset write-off of $220 million. Foreign currency effects decreased earnings in the 2017 third quarter by $112 million, compared with an increase of $72 million a year earlier.

Sales and other operating revenues in third quarter 2017 were $34 billion, compared to $29 billion in the year-ago period.

2017, October, 27, 19:15:00

CONOCO LOSS $2.4 BLN

ConocoPhillips’ nine-month 2017 earnings were a loss of $2.4 billion, or ($1.98) per share, compared with a nine-month 2016 loss of $3.6 billion, or ($2.88) per share. Nine-month 2017 adjusted earnings were $0.2 billion, or $0.16 per share, compared with a nine-month 2016 adjusted loss of $3.0 billion, or ($2.40) per share.

2017, October, 27, 19:10:00

NOV VARCO NET LOSS $221 MLN

National Oilwell Varco, Inc. (NYSE: NOV) reported a third quarter 2017 net loss of $26 million, or $0.07 per share. Revenues for the third quarter of 2017 were $1.84 billion, an increase of four percent compared to the second quarter of 2017 and an increase of eleven percent from the third quarter of 2016. Operating loss for the third quarter was $7 million, or 0.4 percent of sales. Adjusted EBITDA (operating profit excluding other items before depreciation and amortization) for the third quarter was $167 million, or 9.1 percent of sales, an increase of $25 million from the second quarter of 2017. Cash flow from operations for the third quarter was $232 million.

2017, October, 27, 19:05:00

NOVATEK'S PROFIT ₽112 BLN

In the third quarter of 2017, our total revenues amounted to RR 130.7 billion and Normalized EBITDA, including our share in EBITDA of joint ventures, totalled RR 59.3 billion, representing increases of 3.3% and 2.7%, respectively, as compared to the corresponding period in 2016.

2017, October, 16, 11:45:00

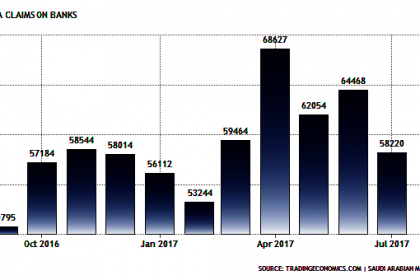

SAUDI'S BANKS ARE BETTER

But we expect a rise in the sector's NPL ratio and muted credit demand in the second half of 2017 and 2018, reflecting the slowing economy. GDP growth slowed to 1.4% in 2016 from 3.4% in 2015 and we expect it to be below 1% in 2017 and 2018.