Finance

2017, August, 3, 12:40:00

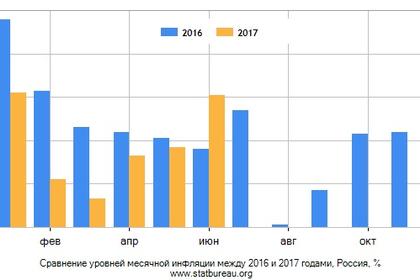

БАНК РОССИИ: СТАВКА 9%

Банк России принял решение сохранить ключевую ставку на уровне 9,00% годовых.

2017, August, 3, 12:30:00

WORLD BANK BUYS COUNTRIES

World Bank Group commitments to help developing countries take on poverty and boost opportunity reached nearly $59 billion in loans, grants, equity investments and guarantees in fiscal year 2017.

2017, August, 3, 12:25:00

IMF BUYS IRAQ

The completion of the second review allows the authorities to draw the equivalent of SDR 584.2 million (about US$ 824.8 million), bringing total disbursements to SDR 1494.2 million about US$ 2109.7 million. The SDR 3.831 billion arrangement (about US$5.34 billion at the time of approval of the arrangement) was approved in July, 2016 and the first review was completed on December 5, 2016.

2017, August, 3, 12:05:00

BP PROFIT $553 MLN

“We continue to position BP for the new oil price environment, with a continued tight focus on costs, efficiency and discipline in capital spending. We delivered strong operational performance in the first half of 2017 and have considerable strategic momentum coming into the rest of the year and 2018, with rising production from our new Upstream projects and marketing growth in the Downstream.”

2017, July, 31, 14:30:00

ВВП РОССИИ: БОЛЬШЕ НА 2,7%

Минэкономразвития России скорректировало оценку темпа роста ВВП за май до 3,5% г/г. В июне 2017 года рост ВВП, по оценке, составил 2,9% г/г, темп роста ВВП во 2 кв. 2017 г. оценивается в 2,7% г/г.

2017, July, 31, 14:25:00

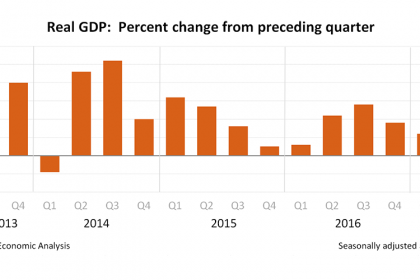

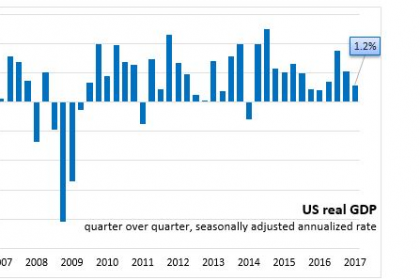

U.S. GDP UP 2.6%

Real gross domestic product increased at an annual rate of 2.6 percent in the second quarter of 2017 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 1.2 percent (revised).

2017, July, 31, 14:15:00

EXXON EARNINGS $3.35 BLN

Exxon Mobil Corporation announced estimated second quarter 2017 earnings of $3.4 billion, or $0.78 per diluted share, compared with $1.7 billion a year earlier, as oil and gas realizations increased and refining margins improved.

2017, July, 31, 14:10:00

CHEVRON EARNINGS $1.45 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $1.5 billion ($0.77 per share – diluted) for second quarter 2017, compared with a loss of $1.5 billion ($0.78 per share – diluted) in the second quarter of 2016. Included in the quarter were impairments and other non-cash charges totaling $430 million, partially offset by gains on asset sales of $160 million. Foreign currency effects increased earnings in the 2017 second quarter by $3 million, compared with an increase of $279 million a year earlier.

2017, July, 31, 14:05:00

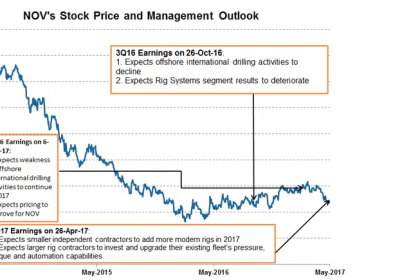

NOV VARCO NET LOSS $75 MLN

National Oilwell Varco, Inc. (NYSE: NOV) reported a second quarter 2017 net loss of $75 million, or $0.20 per share. Excluding other items, net loss for the quarter was $54 million, or $0.14 per share. Other items totaled $30 million, pretax, and primarily consisted of charges related to severance and facility closures.

2017, July, 29, 09:31:00

WEATHERFORD NET LOSS $171 MLN

Weatherford International plc (NYSE: WFT) reported a net loss of $171 million, or a loss of $0.17 per share, and a non-GAAP net loss of $282 million before charges and credits ($0.28 non-GAAP loss per share) on revenues of $1.36 billion for the second quarter of 2017.

2017, July, 28, 09:45:00

SHELL INCOME $1.55 BLN

Royal Dutch Shell Chief Executive Officer Ben van Beurden commented: “Shell’s strong results this quarter show that we are reshaping the company following the integration of BG.

Cash generation has been resilient over four consecutive quarters, at an average oil price of just under $50 per barrel. This quarter, we generated robust earnings excluding identified items of $3.6 billion, while over the past 12 months cash flow from operations of $38 billion has covered our cash dividend and reduced gearing to 25%.

2017, July, 28, 09:40:00

STATOIL NET INCOME $1.4 BLN

“Our solid financial results and strong cash flow are driven by good operational performance with high production efficiency and continued cost improvements. At oil prices around 50 dollars per barrel, we have generated 4 billion dollars in free cash flow, and reduced our net debt ratio by 8.1 percentage points since the start of the year. We expect to deliver around 5% production growth this year, and at the same time realise an additional one billion dollars in efficiencies,” says Eldar Sætre, President and CEO of Statoil ASA.

2017, July, 28, 09:35:00

TOTAL NET INCOME $2.5 BLN

"In a price environment that remains volatile, Total again delivered an excellent set of quarterly results with adjusted net income of $2.5 billion, a 14% increase compared to a year ago, and operating cash flow before working capital changes of $5.3 billion, a 33% increase, while Brent only increased by 9%. In the first half of the year, the Group generated more than $3.1 billion of cash flow after investments, excluding acquisitions and divestments.

2017, July, 28, 09:30:00

U.S. FEDERAL FUNDS RATE 1.25%

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

2017, July, 17, 13:55:00

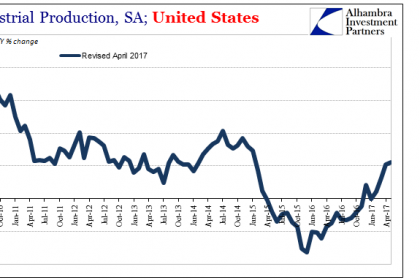

U.S. FRB: INDUSTRIAL PRODUCTION UP 0.4%

Industrial production rose 0.4 percent in June for its fifth consecutive monthly increase. Manufacturing output moved up 0.2 percent; although factory output has gone up and down in recent months, its level in June was little different from February. The index for mining posted a gain of 1.6 percent in June, just slightly below its pace in May. The index for utilities, however, remained unchanged. For the second quarter as a whole, industrial production advanced at an annual rate of 4.7 percent, primarily as a result of strong increases for mining and utilities. Manufacturing output rose at an annual rate of 1.4 percent, a slightly slower increase than in the first quarter. At 105.2 percent of its 2012 average, total industrial production in June was 2.0 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in June to 76.6 percent, a rate that is 3.3 percentage points below its long-run (1972–2016) average.