Finance

2021, February, 26, 11:10:00

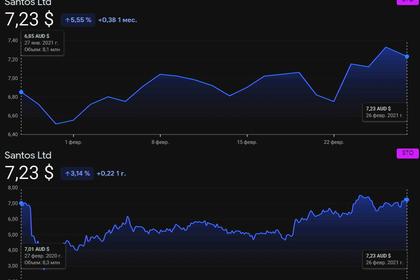

AUSTRALIA'S SANTOS RATING BBB-

Santos notes the announcement from S&P Global Ratings (S&P) reaffirming Santos’ BBB- credit rating with stable outlook.

2021, February, 25, 11:40:00

EUROPE'S CLEAN ENERGY PARTNERSHIP EUR 10 BLN

The EU will provide nearly Eur10 billion of funding that the partners will match with at least an equivalent amount of investment, the EC said in a statement.

2021, February, 24, 10:45:00

INDIA'S INDEXES UP

The NSE Nifty 50 index was up 0.77% at 14,820.45 by 0450 GMT, while the S&P BSE Sensex gained 0.63% to 50,061.21.

2021, February, 24, 10:40:00

ITER FUSION FUNDING EUR 5.61 BLN

The ITER agreement was signed in November 2006 by Euratom, the US, Russia, Japan, China, South Korea and India.

2021, February, 24, 10:25:00

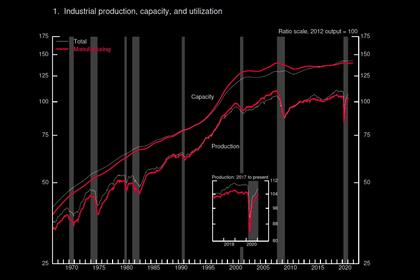

U.S. INDUSTRIAL PRODUCTION UP 0.9%

U.S. industrial production increased 0.9 percent in January.

2021, February, 19, 12:50:00

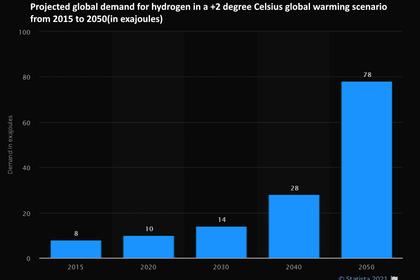

GLOBAL HYDROGEN INVESTMENT $300 BLN

There are now 228 large-scale projects for a combined $300 billion of proposed investment through to 2030

2021, February, 18, 12:15:00

NOVATEK PROFIT RUB 67.8 BLN

PAO NOVATEK released its audited consolidated financial statements for the year ended 31 December 2020 prepared in accordance with International Financial Reporting Standards (“IFRS”).

2021, February, 18, 12:10:00

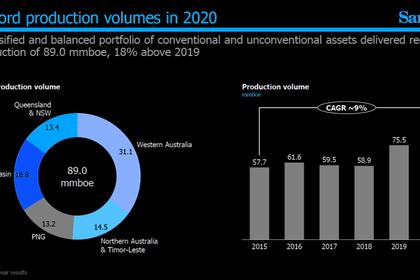

AUSTRALIA'S SANTOS LOSS $357 MLN

The reported net loss after tax of US$357 million includes the previously announced impairments, primarily due to lower oil price assumptions.

2021, February, 16, 12:15:00

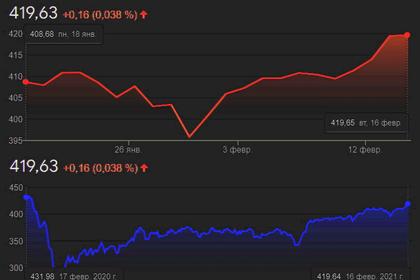

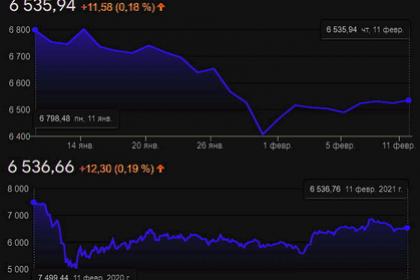

EUROPEAN INDEXES UP ANEW

The pan-European STOXX 600 was up 0.2% by 0802 GMT, after jumping 1.3% in the previous session to its highest level since February 2020.

2021, February, 16, 12:10:00

JAPAN INDEXES UP

The Nikkei 225 Index ended up 1.28% at 30,467.75, closing at its highest since August 1990.

2021, February, 15, 13:40:00

INDIA'S ENERGY TRANSITION BUDGET 2021-22

Budget 2021-22 is a mixed bag in terms of support for India’s transition to a sustainable, low carbon economy.

2021, February, 12, 12:15:00

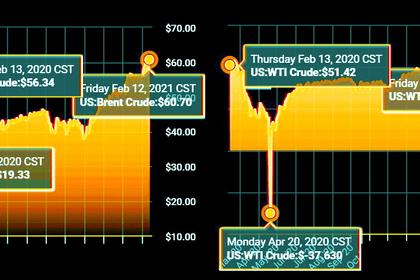

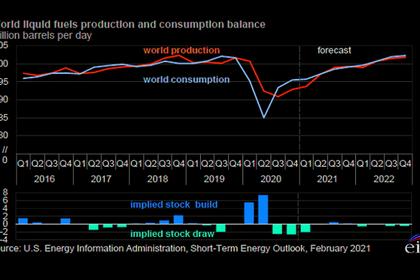

GLOBAL OIL DEMAND + 5.8 MBD

For 2021, oil demand is now anticipated to increase by 5.8 mb/d, revised down by around 0.1 mb/d from last month’s projection, to average 96.1 mb/d.

2021, February, 12, 12:05:00

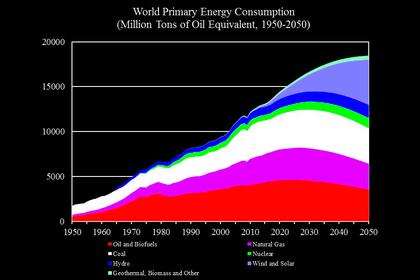

OIL REVENUES WILL DOWN $9 TLN

OPEC has long maintained that oil will remain a dominant energy source in the decades to come.

2021, February, 12, 11:55:00

OIL ISN'T ENOUGH FOR $3 TRLN

To meet the global cumulative demand over the next 30 years, undeveloped and undiscovered resources totaling 313 billion barrels of oil need to be added to currently producing assets.

2021, February, 11, 14:20:00

GLOBAL INDEXES UP AGAIN

European stocks opened higher, with the STOXX 600 and London’s FTSE 100 up 0.3%. That followed a subdued Asian session as markets in China, Japan, South Korea and Taiwan were closed for holidays.