Gas

2019, May, 6, 12:00:00

MOZAMBIQUE'S LNG PROJECTS

With estimated gas reserves of over 5,000 Bcm, Mozambique has attracted three LNG projects with total capacity of more than 30 million mt/year and $50 billion capex development, with commissioning expected between 2022 and 2025.

2019, May, 6, 11:55:00

SHELL SELLS INDONESIA'S LNG

Shell, the world’s largest buyer and seller of LNG, is raising cash to help pay for its $54 billion purchase of BG Group in 2015 and hopes to raise around $1 billion from the sale of its 35 percent stake in the project, the sources said.

2019, May, 6, 11:45:00

SHELL CCS EARNINGS $5.3 BLN

CCS earnings attributable to shareholders excluding identified items were $5.3 billion, reflecting lower realised chemicals and refining margins, decreased realised oil prices and lower tax credits, partly offset by stronger contributions from trading as well as increased realised LNG and gas prices compared with the first quarter 2018. In addition, there was a negative impact of $43 million related to the implementation of IFRS 16.

2019, May, 5, 10:55:00

TRANSCANADA CHANGED NAME TO TC ENERGY

We changed the name of our company from TransCanada to TC Energy, following the approval of our shareholders at our Annual and Special Meeting of Shareholders on May 3, 2019.

2019, May, 4, 11:20:00

TRANSCANADA'S NET INCOME $1 BLN

TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for first quarter 2019 of $1.004 billion or $1.09 per share compared to net income of $734 million or $0.83 per share for the same period in 2018.

2019, May, 2, 17:00:00

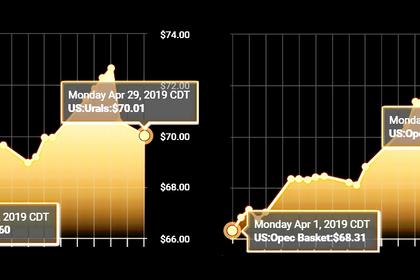

OPEC + RUSSIA OBLIGATIONS

Russia is meeting its obligations under the OPEC/non-OPEC crude production agreement, and participants remain committed to the arrangement, despite ongoing uncertainty over world energy market developments.

2019, May, 2, 16:35:00

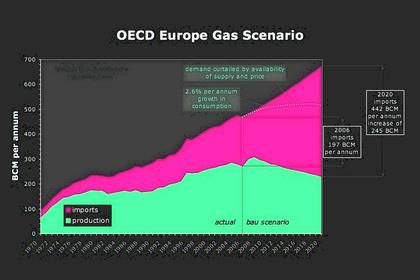

EUROPE'S GAS DIVERSIFICATION

The EU has long worked to diversify from relying on Russia for almost 40 percent of its gas needs by developing LNG infrastructure to access other suppliers. Qatar and Australia are other major LNG suppliers.

2019, May, 2, 16:30:00

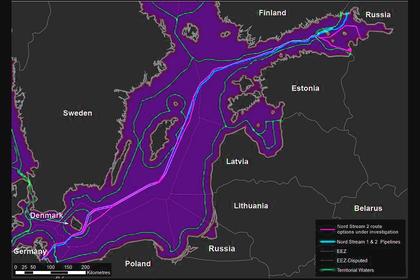

THE THIRD NORD STREAM 2 AGAIN

Nord Stream 2 is already waiting for the DEA to decide on permit applications for two different routes, and claims the request for a third route option is illegal.

2019, May, 2, 16:15:00

GAZPROM'S PROFIT: TWICE

Profit attributable to the owners of PJSC Gazprom for the year ended December 31, 2018 amounted to RUB 1,456,270 million which is by RUB 741,968 million, or 104 %, more than for the year ended December 31, 2017.

2019, May, 2, 16:00:00

SHELL BUYBACK PROGRAMME TRANCHE $6.75 BLN

Royal Dutch Shell plc (the ‘company’) today announces the commencement of trading in the next tranche of its share buyback programme previously announced on July 26, 2018.

2019, April, 29, 11:45:00

GAS PRICE FOR UKRAINE

Putin said Ukraine was overpaying for gas which it could get much cheaper if it signed a transit deal with Russia.

2019, April, 29, 11:00:00

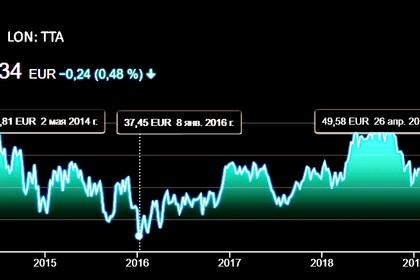

TOTAL NET INCOME $2.8 BLN

“Markets remained volatile with Brent averaging $63/b in the first quarter, down 6% from last year, while natural gas prices were down 11% in Europe and 30% in Asia. Adjusted net income was $2.8 billion this quarter, down 4%, and return on equity held steady at 12% this quarter.

2019, April, 29, 10:55:00

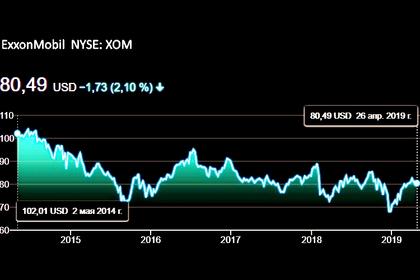

EXXON EARNING $2.4 BLN

Exxon Mobil Corporation today announced estimated first quarter 2019 earnings of $2.4 billion, or $0.55 per share assuming dilution, compared with $4.7 billion a year earlier.

2019, April, 26, 11:20:00

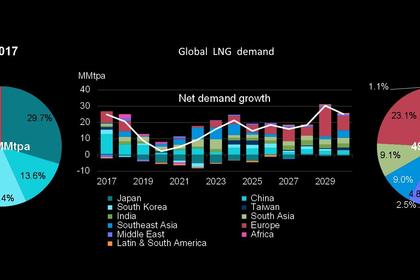

GLOBAL LNG TRADE UP 8%

In 2018, global trade in liquefied natural gas (LNG) increased by 3.2 billion cubic feet per day (Bcf/d) to 41.3 Bcf/d, an 8% increase from 2017

2019, April, 26, 11:15:00

FLEXIBLE LNG MARKET

Global oversupply that has pulled spot LNG prices down by more than 50 percent over the past half-year has producers succumbing to consumer demands for fuel on shorter notice and without sourcing or destination restrictions.