Investments

2016, February, 11, 18:45:00

MUST TO CUT $24 BLN

North American oil and natural gas drillers will need to cut an additional 30 percent from their capital budgets to balance their spending with the cash coming in their doors even if crude rises to $40 a barrel, according to an analysis by IHS Inc.A group of 44 North American exploration and production companies are planning to spend $78 billion on capital projects this year, down from $101 billion last year.

2016, February, 9, 18:25:00

JAPAN - IRAN INVESTMENT

Possible Japanese investment in Iran could include petroleum, natural gas resource developments, refinery upgrades, petrochemical plants and distribution systems, according to industry sources.

2016, February, 4, 19:15:00

CUTTING JOBS & INVESTMENTS

Oil companies are cutting investment, slashing jobs and selling off pipelines and other assets as crude prices plunge. “It’s going to be a very turbulent year for our industry,” says BP CEO Bob Dudley.

2016, January, 28, 19:25:00

U.S. CUTS OIL INVESTMENTS

Three leading US shale oil producers have announced steep cuts in their planned capital spending, as they set their budgets to respond to the collapse in crude prices.

2016, January, 28, 19:20:00

U.S. LOSERS: $14 BLN

During the next eight days, independent U.S. oil explorers are expected to report 2015 losses totaling almost $14 billion, the result of the steepest price collapse in a generation.

2016, January, 28, 18:40:00

THE GREATEST INVESTING OPPORTUNITIES

Last month, David Rubenstein, a founder of private-equity firm Carlyle Group, said he anticipates “maybe the greatest energy investing opportunities we’ve ever seen.” Marc Lasry, founder of hedge fund Avenue Capital, has described energy as a “once-in-a-lifetime opportunity.”

2016, January, 28, 18:35:00

ENI PROPOSES $4 BLN

Eni has already developed phases 4 and 5 of the South Pars gas field as well as two phases of Darkhovin oilfield. It has shown interest in developing Iran’s North Pars gas field and also the third phase of Darkhovin oilfield.

2016, January, 26, 19:00:00

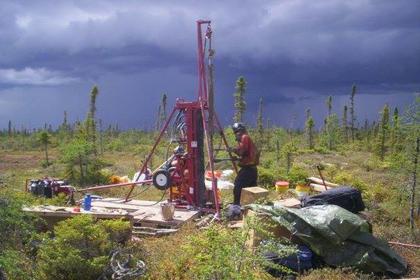

CANADIAN OIL INVESTMENTS DOWN

The Canadian Association of Petroleum Producers, which represents the industry, forecast that it would invest C$42bn (US$29.5bn) this year, 13 per cent less than last year and 48 per cent less than in 2014. That is a steeper decline than investment in oil and gas production worldwide, which is expected to drop by 40 per cent over 2014-16, according to Wood Mackenzie, the energy research company.

2016, January, 22, 18:45:00

INVESTORS SHUN U.S.

Investors have pulled billions from US stock funds for the third straight week amid sharp market gyrations, which have frayed investor nerves as global equity bourses slid deeper into correction territory.

2016, January, 15, 20:05:00

OIL COMPANIES ROUT

“Companies have to be prudent in the face of what’s happening,” says Daniel Yergin, vice-chairman of consultancy IHS. “It’s a wrenching period for the industry.”

2016, January, 15, 19:55:00

IRAN NEEDS $20 BLN

Iran needs $20bn to develop the remaining phases of the South Pars gas field, energy minister Bijan Namdar Zanganeh said

2016, January, 10, 18:05:00

SAUDI'S IPO PLAN

The IPO proposal is consistent with the broader direction of economic reform in the kingdom, including state asset sales and market deregulation, Aramco said. Bringing in investors would also strengthen the company’s focus on long-term growth and the prudent management of its reserves, according to the statement.

2016, January, 10, 17:55:00

OIL SERVICE'S CAP

Even if E&P clients are able to negotiate more favorable terms for their debt, the industry’s overextended balance sheets will put a cap on activity — even if oil prices rise. On the producer side, companies will most likely de-lever before they drill should some extra cash come in the door. For OFS, building all the new equipment such as walking rigs and big frac spreads to meet strong client demand has some players in this sector significantly over-levered.

2016, January, 5, 17:05:00

2016: THE NEXT GLOBAL RECESSION

West Texas Intermediate crude for February delivery declined to $36.58 a barrel on the New York Mercantile Exchange, after falling 0.8 percent Monday. U.S. crude inventories are forecast to keep supplies more than 130 million barrels above the five-year seasonal average, according to a Bloomberg survey before government data Wednesday.

2016, January, 5, 17:00:00

2016: OIL & GAS INVESTMENTS DOWN TO $522 BLN

While tens of thousands of jobs have already been cut in 2015, more redundancies are expected this year as companies narrow their focus.