News

2018, August, 17, 11:30:00

U.S. INDUSTRIAL PRODUCTION UP 0.1%

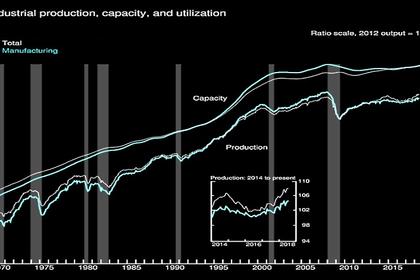

U.S. FRB - Industrial production edged up 0.1 percent in July after rising at an average pace of 0.5 percent over the previous five months. Manufacturing production increased 0.3 percent, the output of utilities moved down 0.5 percent, and, after posting five consecutive months of growth, the index for mining declined 0.3 percent. At 108.0 percent of its 2012 average, total industrial production was 4.2 percent higher in July than it was a year earlier. Capacity utilization for the industrial sector was unchanged in July at 78.1 percent, a rate that is 1.7 percentage points below its long-run (1972–2017) average.

2018, August, 17, 11:25:00

NORWAY'S PETROLEUM PRODUCTION: 1.911 MBD

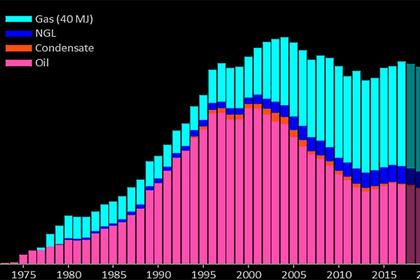

NPD - Preliminary production figures for July 2018 show an average daily production of 1 911 000 barrels of oil, NGL and condensate, which is an increase of 64 000 barrels per day compared to June.

2018, August, 17, 11:20:00

GAZPROM NEFT NET PROFIT UP TO 49.6%

GAZPROM NEFT - For the first six months of 2018 Gazprom Neft achieved revenue** growth of 24.4% year-on-year, at one trillion, 137.7 billion rubles (RUB1,137,700,000,000). The Company achieved a 49.8% year-on-year increase in adjusted EBITDA, to RUB368.2 billion. This performance reflected positive market conditions for oil and oil products, production growth at the Company’s new projects, and effective management initiatives. Net profit attributable to Gazprom Neft PJSC shareholders grew 49.6% year on year, to RUB166.4 billion. Growth in the Company’s operating cash flow, as well as the completion of key infrastructure investments at new upstream projects, delivered positive free cash flow of RUB47.5 billion for 1H 2018.

2018, August, 15, 11:10:00

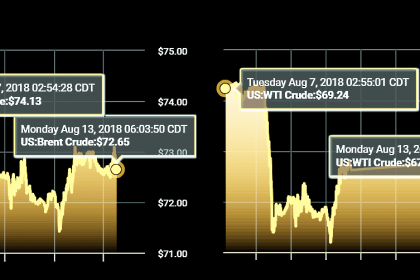

OIL PRICE: NEAR $72

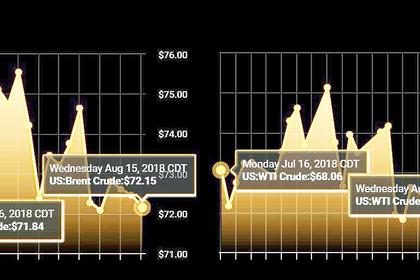

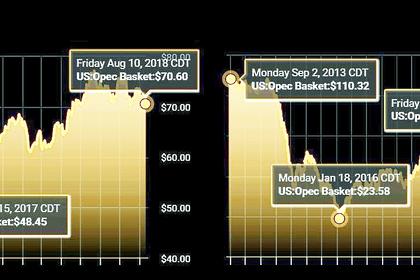

REUTERS - Front-month Brent crude oil futures LCOc1 were at $72.34 per barrel at 0648 GMT, down by 12 cents, or 0.2 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were down 23 cents, or 0.3 percent, at $66.81 per barrel.

2018, August, 15, 11:05:00

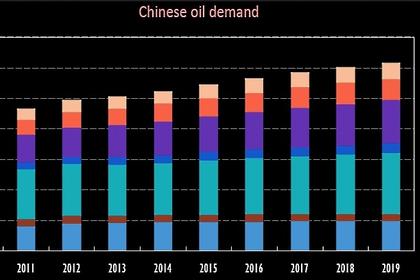

OIL DEMAND - 2019: 100 MBD

OPEC - In 2018, oil demand growth is anticipated to increase by 1.64 mb/d, 20 tb/d lower than last month’s projections, mainly due to weaker-than-expected oil demand data from Latin America and the Middle East in 2Q18. Total oil demand is anticipated to reach 98.83 mb/d. For 2019, world oil demand is forecast to grow by 1.43 mb/d, also some 20 tb/d lower than last month’s assessment. Total world consumption is anticipated to reach 100.26 mb/d. The OECD region will contribute positively to oil demand growth, rising by 0.27 mb/d y-oy, yet with growth of 1.16 mb/d, non-OECD nations will account for the majority of growth expected.

2018, August, 15, 11:00:00

U.S. OIL FOR CHINA

REUTERS - Chinese oil importers are shying away from buying U.S. crude as they fear Beijing’s decision to exclude the commodity from its tariff list in a trade dispute between the world’s biggest economies may only be temporary.

2018, August, 15, 10:55:00

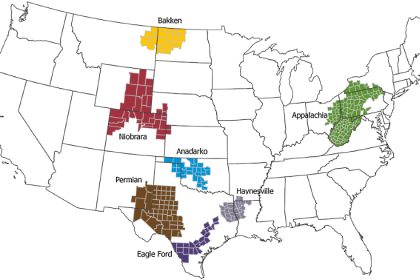

U.S. OIL PRODUCTION + 93 TBD, GAS PRODUCTION + 1,007 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 93,000 b/d month-over-month in August from 7,429 to 7,522 thousand barrels/day , gas production to increase 1,007 million cubic feet/day from 71,413 to 72,420 million cubic feet/day .

2018, August, 15, 10:50:00

RUSSIA'S NUCLEAR OFFENSIVE

ASIAN REVIEW - Russia accounts for 67% of the world's nuclear plant deals currently in development. By 2030, Rosatom aims to increase its overseas sales to two-thirds of total sales, from 50% at currently. Vladimir Putin's government is looking to expand Russian influence through nuclear diplomacy, vying with China -- which is promoting its own nuclear plants -- for the status of nuclear energy superpower.

2018, August, 15, 10:45:00

ROSATOM UP TO 10.2%

ROSATOM - As per IFRS, in 2017, revenues increased by 10.2% up to RUB 967.4 billion. International revenues reached US $6.1 billion (by 9.4% compared to2016).

2018, August, 15, 10:40:00

RUSSIAN NUCLEAR IN EURASIA

WNN - Rusatom International Network - a subsidiary of Russian state nuclear corporation Rosatom - has signed a memorandum of understanding and cooperation with the Eurasian Development Bank (EDB). The memorandum provides for establishing common principles of bilateral cooperation with Armenia, Belarus, Kazakhstan, Kyrgyzstan, Tajikistan and other countries.

2018, August, 15, 10:35:00

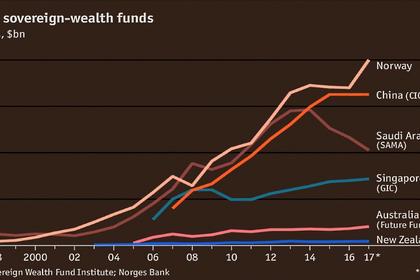

NORWAY'S KEY PRIORITY

BLOOMBERG - The Norwegian government in June made its first deposit into its wealth fund since the end of 2015. Now that the economy is in full recovery and the labor market is tightening, winding down fiscal stimulus is a key priority in next year’s budget, the prime minister said in an interview in Arendal, on Norway’s southern coast.

2018, August, 15, 10:30:00

ALASKA LNG: $43 BLN

PLATTS - A deal between Chinese companies and Alaska's state gas corporation to build the $43 billion Alaska LNG Project appears to be on scheduled despite the trade war brewing between the US and China.

2018, August, 13, 14:05:00

OIL PRICE: NEAR $73

REUTERS - Benchmark Brent crude oil LCOc1 was up 10 cents at $72.91 a barrel by 0930 GMT. U.S. light crude CLc1 was unchanged at $67.63 a barrel.

2018, August, 13, 14:00:00

RUSSIA SANCTIONS AGAIN

PLATTS - "This has been discussed for a while with Russia's largest trading partners such as India and China. Even Arab countries are starting to think about it... If they do create difficulties for our Russian banks, all we have to do is replace [dollars],"

2018, August, 13, 13:55:00

GERMANY VS U.S. SANCTIONS

REUTERS - “This trade war is slowing down and destroying economic growth - and it creates new uncertainties,” Altmaier told Bild am Sonntag newspaper, adding that consumers suffered the most because higher tariffs were driving up prices.