News

2017, September, 18, 12:30:00

RUSSIA - CHINA - VENEZUELA OIL

“The principal risk regarding Russian and Chinese activities in Venezuela in the near term is that they will exploit the unfolding crisis, including the effect of US sanctions, to deepen their control over Venezuela’s resources, and their [financial] leverage over the country as an anti-US political and military partner,” observed R. Evan Ellis, a senior associate in the Center for Strategic and International Studies’ Americas Program.

2017, September, 18, 12:25:00

RUSSIAN GAS FOR CROATIA

Gazprom Export LLC and the Croatian Prvo plinarsko društvo d.o.o. signed a long-term contract on natural gas supplies for the period from 1 October 2017 to 31 December 2027. The annual supply volume within the contract amounts to 1 billion cubic meters, and 0.25 bcm is to be delivered in the fourth quarter of 2017.

2017, September, 18, 12:20:00

U.S. - IRAN SANCTIONS

On Thursday, the administration extended certain sanctions on Iran's oil and banking sectors that have been suspended since the nuclear deal took place in January 2016.

2017, September, 18, 12:15:00

BP ARGENTINIAN TANGO

BP has agreed with Bridas Corporation to form a new integrated energy company by combining their interests in the oil and gas producer Pan American Energy and the refiner and marketer Axion Energy in a cash-free transaction. The new company, Pan American Energy Group, will be the largest privately-owned integrated energy company operating in Argentina.

2017, September, 18, 12:10:00

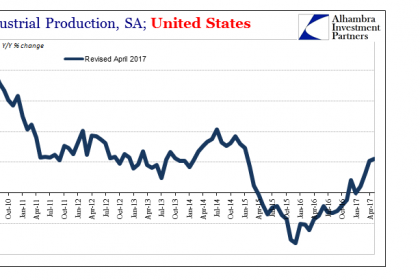

U.S. INDUSTRIAL PRODUCTION DOWN 0.9%

Industrial production declined 0.9 percent in August following six consecutive monthly gains. Hurricane Harvey, which hit the Gulf Coast of Texas in late August, is estimated to have reduced the rate of change in total output by roughly 3/4 percentage point. The index for manufacturing decreased 0.3 percent; storm-related effects appear to have reduced the rate of change in factory output in August about 3/4 percentage point. The manufacturing industries with the largest estimated storm-related effects were petroleum refining, organic chemicals, and plastics materials and resins.

2017, September, 18, 12:05:00

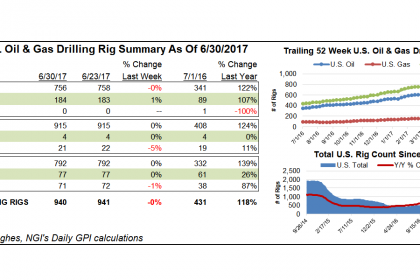

U.S. RIGS DOWN 8 TO 936

U.S. Rig Count is up 430 rigs from last year's count of 506, with oil rigs up 333, gas rigs up 97, and miscellaneous rigs unchanged at 1.

Canada Rig Count is up 80 rigs from last year's count of 132, with oil rigs up 37, gas rigs up 44, and miscellaneous rigs down 1.

2017, September, 15, 09:05:00

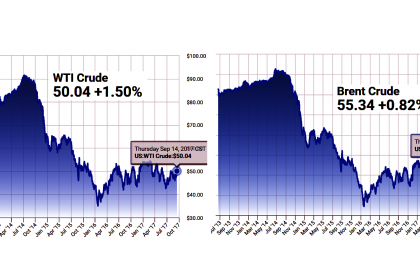

OIL PRICE: NOT ABOVE $56

U.S. West Texas Intermediate crude CLc1 was down 21 cents, or 0.4 percent, at $49.68 a barrel at 0302 GMT. It briefly broke above $50 on Thursday, hitting a four-month high, and finished 1.2 percent higher at $49.89, its highest close since July 31.

Brent crude LCOc1 futures were down 29 cents, or 0.5 percent, at $55.18 a barrel. They gained 0.6 percent to settle at $55.47 the previous session, the highest close since April 13.

2017, September, 15, 09:00:00

OIL PRICES: $50 - $60

Oil prices are expected to hold between $50 and $60 a barrel as bloated global stocks fall after a deal between OPEC and other producers to trim output, BP Chief Executive Bob Dudley said on Thursday.

2017, September, 15, 08:55:00

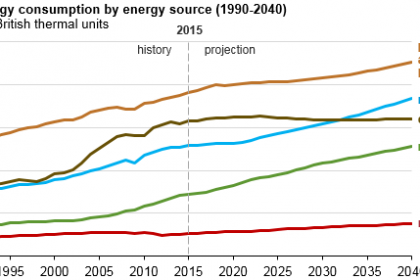

WORLD ENERGY CONSUMPTION UP TO 28%

The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040.

2017, September, 15, 08:50:00

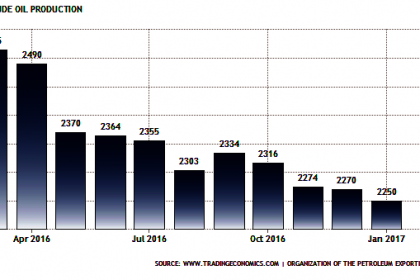

NIGERIA NEEDS TIME

Emmanuel Kachikwu, Nigeria’s minister of state for petroleum resources, told the Financial Times that the west African nation’s energy sector was still suffering from years of violent disruptions and needed more “recovery time” before joining a supply deal agreed last year between some of the world’s biggest oil producers.

2017, September, 15, 08:45:00

SEADRILL'S BANKRUPTCY

Seadrill, one of the world’s largest offshore drilling companies, filed for bankruptcy after it secured agreement from nearly all of its banks to support a plan to inject $1bn in new capital and all but wipe out existing shareholders.

2017, September, 15, 08:30:00

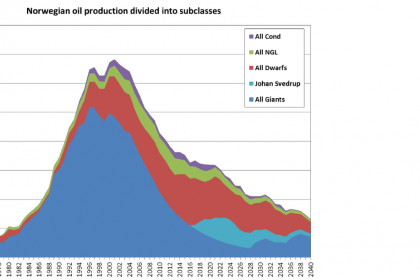

NORWAY'S OIL PRODUCTION DOWN 41 TBD

Preliminary production figures for August 2017 show an average daily production of 1 918 000 barrels of oil, NGL and condensate, which is a decrease of 41 000 barrels per day compared to July.

Total gas sales were 10.4 billion Sm3 (GSm3), which is a decrease of 0.1 GSM3 from the previous month.

2017, September, 13, 15:25:00

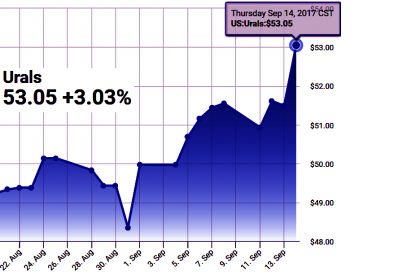

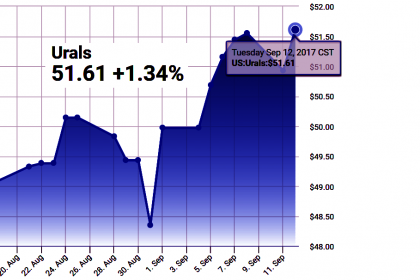

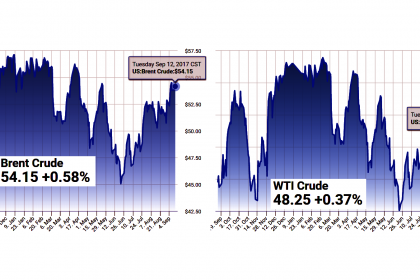

OIL PRICE: NOT ABOVE $55

By 1021 GMT, international benchmark Brent crude LCOc1 was up 27 cents, or 0.5 percent, at $54.54 a barrel.

U.S. West Texas Intermediate (WTI) CLc1 was up 38 cents, or 0.8 percent, at $48.61 a barrel.

2017, September, 13, 15:20:00

OIL PRICES: $51 - $52, GAS PRICES: $3.05 - $3.29

EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018.

Expected growth in natural gas exports and domestic natural gas consumption in 2018 contribute to the forecast Henry Hub natural gas spot price rising from an annual average of $3.05/MMBtu in 2017 to $3.29/MMBtu in 2018.

2017, September, 13, 15:15:00

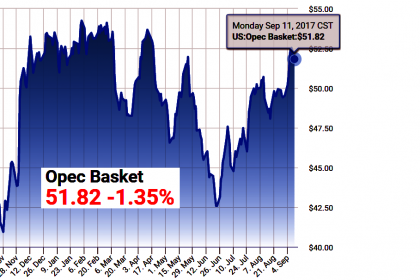

OPEC OIL PRICE UP 6% TO $49.6

The OPEC Reference Basket rose for the second-consecutive month in August to average $49.60/b, representing a gain of $2.67/b or 6%. Year-to-date, the Basket was 30.9% higher at $49.73/b. Crude futures prices also saw gains with ICE Brent increasing 5.5% to $51.87/b and NYMEX WTI up 3.0% at $48.06/b. Year-to-date, crude futures prices were more than 20% higher. During the week of 29 August money

managers cut WTI futures and options net long positions by 105,671 contracts to 147,303 lots, the US Commodity Futures Trading Commission (CFTC) said. Money managers slightly reduced Brent futures and options net length contracts by 1,296 to 416,551 lots during the same week.