Oil

2017, August, 4, 07:54:00

РОССИЯ: БОЛЬШЕ ИНВЕСТИЦИЙ

Говоря о нефтеперерабатывающей отрасли, глава энергетического ведомства отметил, что к 2035 г. планируется увеличить нефтепереработку на Дальнем Востоке почти в 3,5 раза, до 39,0 млн т., также оказывается поддержка строительства Восточного нефтехимического комплекса мощностью 30,8 млн т в год. Проект предусматривает строительство нефтеперерабатывающего и нефтехимического комплекса и поставку нефтепродуктов и продукции нефтехимии в ДФО и страны АТР.

2017, August, 3, 12:50:00

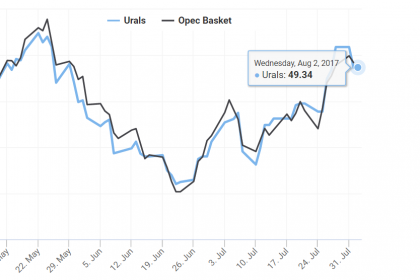

OIL PRICE: ABOVE $52 YET

Benchmark Brent crude was up 20 cents a barrel at $52.56 by 0920 GMT. U.S. light crude was 20 cents higher at $49.79.

2017, August, 3, 12:35:00

SANCTIONS FOREVER

“It represents the will of the American people to see Russia take steps to improve relations with the United States. We hope there will be cooperation between our two countries on major global issues so that these sanctions will no longer be necessary.”

2017, August, 3, 12:10:00

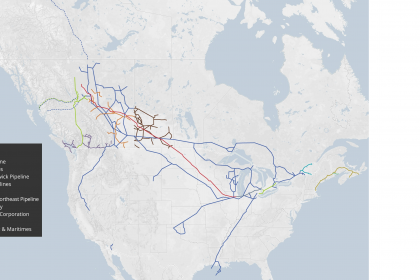

CANADIAN DRILLING UP

The Petroleum Services Association of Canada (PSAC) has updated its 2017 Canadian Drilling Activity Forecast to reflect an increase in its projected total number of wells to be drilled during the year to 7,200 from 6,680.

2017, August, 1, 12:20:00

TRANSCANADA'S NET INCOME $881 MLN

TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for second quarter 2017 of $881 million or $1.01 per share compared to net income of $365 million or $0.52 per share for the same period in 2016. Comparable earnings for second quarter 2017 were $659 million or $0.76 per share compared to $366 million or $0.52 per share for the same period in 2016. TransCanada's Board of Directors also declared a quarterly dividend of $0.625 per common share for the quarter ending September 30, 2017, equivalent to $2.50 per common share on an annualized basis.

2017, July, 31, 14:40:00

OIL PRICE: ABOVE $52

U.S. West Texas Intermediate (WTI) futures briefly jumped over $50 per barrel on Monday and were at $49.97 per barrel at 0654 GMT, still up 25 cents, or 0.5 percent from their last close. That means that virtually the entire WTI curve has moved over $50 per barrel.

Brent crude futures were at $52.85 per barrel, up 33 cents or 0.6 percent. Prices hit $52.90 per barrel earlier in the day, their highest since May 25.

2017, July, 31, 14:35:00

НЕФТЬ: БОЛЬШЕ ИНВЕСТИЦИЙ

«Ранее мы видели, что на 1 триллион долларов сократились инвестиции в период с 2014-го по 2016 годы включительно, в 2017 году этот тренд пошел уже на увеличение инвестиций в нефтяном секторе. Мы видим также, что снизилась волатильность на рынке, и можно сказать о том, что цена в первом полугодии 2017 года нефти марки Brent была на 30% выше первого полугодия 2016 года. И это стало существенным фактором, который способствовал, в том числе и росту доходов бюджета, улучшению торгового баланса экономики», - рассказал глава российского Минэнерго.

2017, July, 31, 14:15:00

EXXON EARNINGS $3.35 BLN

Exxon Mobil Corporation announced estimated second quarter 2017 earnings of $3.4 billion, or $0.78 per diluted share, compared with $1.7 billion a year earlier, as oil and gas realizations increased and refining margins improved.

2017, July, 31, 14:10:00

CHEVRON EARNINGS $1.45 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $1.5 billion ($0.77 per share – diluted) for second quarter 2017, compared with a loss of $1.5 billion ($0.78 per share – diluted) in the second quarter of 2016. Included in the quarter were impairments and other non-cash charges totaling $430 million, partially offset by gains on asset sales of $160 million. Foreign currency effects increased earnings in the 2017 second quarter by $3 million, compared with an increase of $279 million a year earlier.

2017, July, 28, 10:05:00

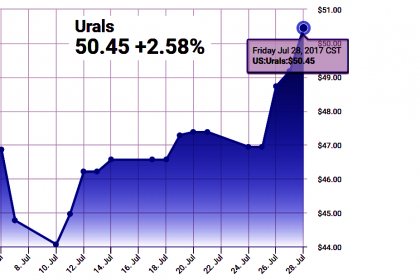

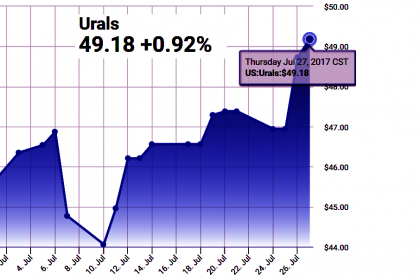

OIL PRICE: ABOVE $51

Brent crude futures were down 8 cents, or 0.2 percent, at $51.41 per barrel at 0651 GMT.

U.S. West Texas Intermediate (WTI) crude futures were down 10 cents, or 0.2 percent, at $48.94 per barrel.

2017, July, 28, 10:00:00

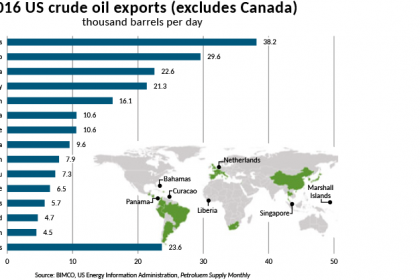

U.S. - CHINA OIL RECORD

China's import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an opportunity to diversify supplies, a trend that could add to the headache of OPEC suppliers.

2017, July, 28, 09:55:00

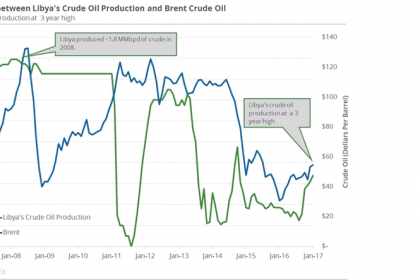

LIBYA'S OIL UP TO 1.069 MBD

Libya's oil production is 1.069 million b/d, and the country hopes to grow its output to as much as 1.25 million b/d this year, a source close to production said Monday.

2017, July, 28, 09:45:00

SHELL INCOME $1.55 BLN

Royal Dutch Shell Chief Executive Officer Ben van Beurden commented: “Shell’s strong results this quarter show that we are reshaping the company following the integration of BG.

Cash generation has been resilient over four consecutive quarters, at an average oil price of just under $50 per barrel. This quarter, we generated robust earnings excluding identified items of $3.6 billion, while over the past 12 months cash flow from operations of $38 billion has covered our cash dividend and reduced gearing to 25%.

2017, July, 28, 09:40:00

STATOIL NET INCOME $1.4 BLN

“Our solid financial results and strong cash flow are driven by good operational performance with high production efficiency and continued cost improvements. At oil prices around 50 dollars per barrel, we have generated 4 billion dollars in free cash flow, and reduced our net debt ratio by 8.1 percentage points since the start of the year. We expect to deliver around 5% production growth this year, and at the same time realise an additional one billion dollars in efficiencies,” says Eldar Sætre, President and CEO of Statoil ASA.

2017, July, 28, 09:35:00

TOTAL NET INCOME $2.5 BLN

"In a price environment that remains volatile, Total again delivered an excellent set of quarterly results with adjusted net income of $2.5 billion, a 14% increase compared to a year ago, and operating cash flow before working capital changes of $5.3 billion, a 33% increase, while Brent only increased by 9%. In the first half of the year, the Group generated more than $3.1 billion of cash flow after investments, excluding acquisitions and divestments.