Oil

2015, May, 15, 18:55:00

U.S. SHALE WILL BACK

Saudi Arabia strategy was an attempt to put pressure on high-cost producers such as the US shale drillers.

2015, May, 15, 18:45:00

U.S. OIL DOWN

EIA’s Drilling Productivity Report (DPR) for April had forecast a 57,000 b/d decline during May in total crude oil production from seven U.S. regions, which together accounted for about 95% of U.S. crude oil production growth during 2011-13. This was the first time the DPR had indicated a decline in expected production since the report was first issued in October 2013. Signs of declining U.S. tight oil production amid lower crude oil prices have been a widely watched market indicator of firming oil market balances. The latest DPR, released on May 11, expects a further decline in crude oil output from the seven regions during June. Overall, EIA is now projecting U.S. oil production to average 9.2 million b/d in 2015, 40,000 b/d lower than in last month’s forecast.

2015, May, 15, 18:35:00

CHINA OWNS AFRICA

The late start of the overseas expansion of Chinese oil companies means that their foreign oil assets are largely located in Africa rather than in main oil producing countries in the Middle East

2015, May, 13, 21:15:00

OIL PRICES OUTLOOK

North Sea Brent crude oil prices averaged $60/barrel (b) in April, a $4/b increase from March and the highest monthly average of 2015. Despite increasing global inventories, several factors contributed to higher prices in April, including indications of higher global oil demand growth, expectations for declining U.S. tight oil production in the coming months, and the growing risk of unplanned supply outages in the Middle East and North Africa.

2015, May, 13, 21:10:00

MAY OIL MARKET

Despite slowing US output of light tight oil, global oil supply growth remained at a steep 3.2 million barrels per day (mb/d) year-on-year in April.

2015, May, 13, 21:05:00

OIL PRICES: BELOW $90

“We’re entering a phase when all the excess capacity will be resized to the new US world market share,” said Subash Chandra, managing director and senior equity analyst at Guggenheim Partners. “I don’t expect prices to go above $70-75/bbl. If it hits $90, US producers will start working full-out again.”

2015, May, 8, 17:50:00

U.S. DARK OIL

Recent and projected increases in U.S. crude oil production have sparked discussion about how current limitations on crude exports affect prices, including world and domestic crude oil and petroleum product prices, and the level of domestic crude production and refining activity.

2015, May, 5, 18:05:00

CHINA'S OIL PURGE

China appointed new heads for each of its three national oil companies on Monday, in a sweeping reshuffle of the industry at the heart of its two-year anti-corruption drive.

2015, April, 16, 20:15:00

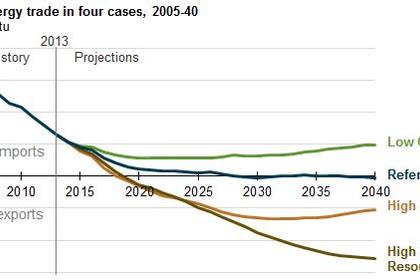

U.S. IMPORT ELIMINATION

U.S. show the potential to eliminate net energy imports sometime between 2020 and 2030. This reflects changes in both supply and demand, as continued growth in oil and natural gas production and the use of renewables combine with demand-side efficiencies to moderate demand growth. The United States has been a net importer of energy since the 1950s.

2015, January, 4, 21:35:00

RUSSIAN LNG INVESTMENTS UP

Russia announced state aid for a major energy project on Wednesday under a drive to shore up strategic firms as well as public faith in its banking system during an economic crisis deepened by Western sanctions.

2014, July, 16, 18:50:00

MADRID APPROVES CANARIES

Madrid to approve Canaries drilling as oil trumps renewables