Oil

2017, November, 3, 12:20:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИ

По линии энергетики Министр отметил потенциал сотрудничества по вопросам совместной разработки нефтяных и газовых месторождений на территории России и Саудовской Аравии, производства нефтегазового оборудования, разработки и внедрения современных технологий в области нефтегазодобычи, а также подготовки кадров для топливно-энергетического сектора Саудовской Аравии.

2017, November, 3, 12:15:00

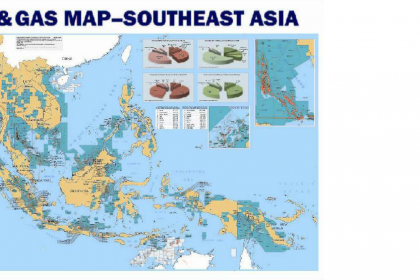

SOUTH CHINA SEA LNG

The South China Sea is a major route for liquefied natural gas (LNG) trade, and in 2016, almost 40% of global LNG trade, or about 4.7 trillion cubic feet (Tcf), passed through the South China Sea.

2017, November, 1, 13:40:00

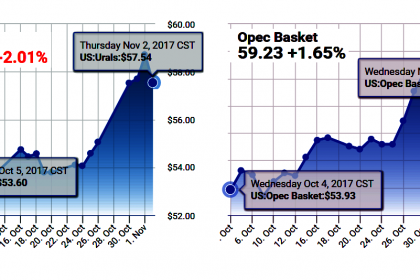

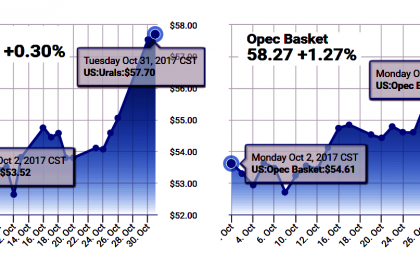

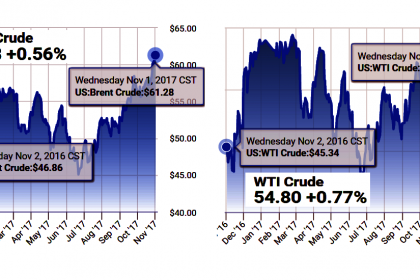

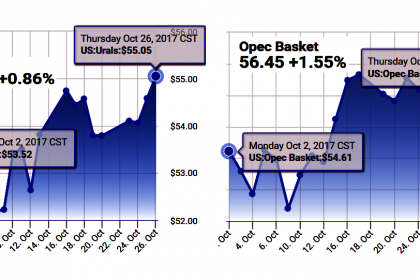

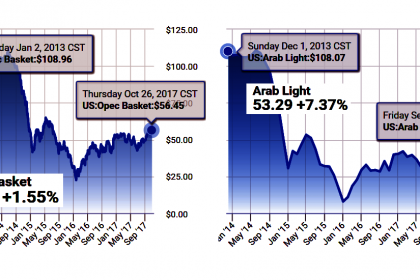

OIL PRICE: ABOVE $61

Brent crude futures LCOc1 were up 59 cents at $61.53 per barrel at 0905 GMT, having hit a session peak of $61.70 earlier, the highest since July 2015.

U.S. West Texas Intermediate (WTI) crude CLc1 was at $55.12 a barrel, up 74 cents.

2017, November, 1, 13:35:00

OIL PRICES MAXIMUM

ICE Brent crude futures remained at 27-month highs in mid-morning trade in Asia Monday, following the gains last week on the expectation that planned supply cuts will be extended to the end of 2018.

2017, November, 1, 13:30:00

SOUTHEAST ASIA NEED ENERGY

Access to modern energy is incomplete. With a total population of nearly 640 million, an estimated 65 million people remain without electricity and 250 million are reliant on solid biomass as a cooking fuel. Investment in upstream oil and gas has been hit by lower prices since 2014 and the region faces a dwindling position as a gas exporter, and a rising dependency on imported oil.

2017, November, 1, 13:15:00

BP PROFIT $4 BLN

Bob Dudley – Group chief executive: “We are steadily building a track record of delivering on our plans and growing across our businesses. This quarter, three new Upstream projects and the highest Downstream earnings in five years, underpinned by reliable operations and disciplined spending, have generated healthy earnings and cash flow. There is still room for further improvement and we will keep striving to increase sustainable free cash flow* and distributions to shareholders.”

2017, November, 1, 13:10:00

SHELL SELLS BRITAIN $3.8 BLN

Shell has completed the sale of a package of UK North Sea assets to Chrysaor for a total of up to $3.8bn, including an initial consideration of $3.0bn and a payment of up to $600m between 2018-2021 subject to commodity price, with potential further payments of up to $180m for future discoveries. This sale was announced on 31 January 2017 and has an effective date of 1 July 2016. Completion follows receipt of all necessary regulatory and partner approvals.

2017, November, 1, 13:05:00

SHELL SELLS GABON $628 MLN

Royal Dutch Shell plc (Shell), through its affiliates, has completed the sale of its entire Gabon onshore oil and gas interests to Assala Energy Holdings Ltd. (Assala Energy) a portfolio company of The Carlyle Group (CG: NASDAQ), for a total of USD $628 million including amount equivalent to interest.

2017, November, 1, 13:00:00

ANADARKO NET LOSS $699 MLN

Anadarko Petroleum Corporation (NYSE: APC) announced its third-quarter 2017 results, reporting a net loss attributable to common stockholders of $699 million, or $1.27 per share (diluted). These results include certain items typically excluded by the investment community in published estimates. In total, these items increased the net loss by $272 million, or $0.50 per share (diluted), on an after-tax basis.(1) Net cash provided by operating activities in the third quarter of 2017 was $639 million.

2017, October, 30, 11:50:00

OIL PRICE: ABOVE $60 YET

Brent crude futures, the international benchmark for oil prices, were at $60.55 per barrel at 0655 GMT, 10 cents or 0.15 percent above their last settlement and near their highest level since July 2015. They have risen more than 36 percent since from 2017-lows marked in June.

U.S. West Texas Intermediate (WTI) crude futures were up 11 cents, or 0.2 percent, at $54.01 a barrel.

2017, October, 30, 11:45:00

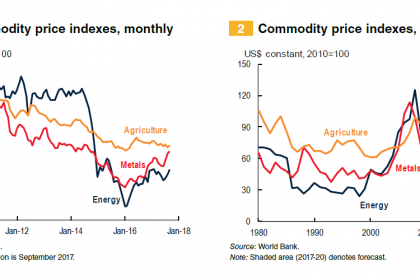

OIL PRICES WILL UP TO $56

WBG - Oil prices are forecast to rise to $56 a barrel in 2018 from $53 this year as a result of steadily growing demand, agreed production cuts among oil exporters and stabilizing U.S. shale oil production, while the surge in metals prices is expected to level off next year, the World Bank said.

2017, October, 30, 11:40:00

SAUDIS PROGRESS

IMF - Saudi Arabia had made good progress in initiating its ambitious reform agenda. Fiscal consolidation efforts are beginning to bear fruit. Progress with reforms to improve the business environment are gaining momentum, and a framework to increase the transparency and accountability of government is in place. Effective prioritization, sequencing, and coordination of the reforms is essential, and they need to be well-communicated and equitable to gain social buy-in to ensure their success.

2017, October, 30, 11:30:00

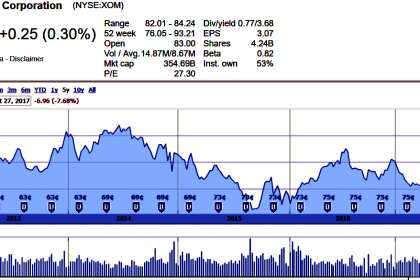

EXXON EARNINGS $11.3 BLN

Exxon Mobil Corporation announced estimated third quarter 2017 earnings of $4 billion, or $0.93 per diluted share, compared with $2.7 billion a year earlier as commodity prices improved and performance in the Upstream and Downstream strengthened. Impacts related to Hurricane Harvey reduced earnings by an estimated 4 cents per share.

2017, October, 30, 11:25:00

TOTAL NET INCOME $7.6 BLN

"Total reported adjusted net income of $2.7 billion this quarter, a 29% increase compared to a year ago while the Brent price increased by 14%. This solid performance was also reflected in a return on equity of close to 10% and strong cash flow generation: excluding acquisitions-divestments, the Group generated $2.1 billion of cash flow after investments in the third quarter 2017 and $5.2 billion in the first nine months. The Group took full advantage of the favorable environment thanks to the performance of its integrated model and its strategy to reduce its breakeven point.

2017, October, 30, 11:20:00

CHEVRON NET INCOME $6 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $2.0 billion ($1.03 per share – diluted) for third quarter 2017, compared with $1.3 billion ($0.68 per share – diluted) in the third quarter of 2016. Included in the quarter was a gain on an asset sale of $675 million and an asset write-off of $220 million. Foreign currency effects decreased earnings in the 2017 third quarter by $112 million, compared with an increase of $72 million a year earlier.

Sales and other operating revenues in third quarter 2017 were $34 billion, compared to $29 billion in the year-ago period.