Oil

2019, November, 13, 13:00:00

NEW ENERGY ERA

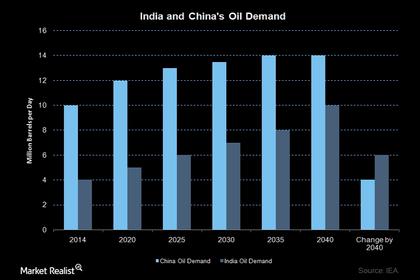

Delivering the opening keynote address, at the event, Dr. Al Jaber said the oil and gas industry is being disrupted by new technologies, new business models, new forms of energy and a new geopolitical order, with the rise of Asia.

2019, November, 13, 12:55:00

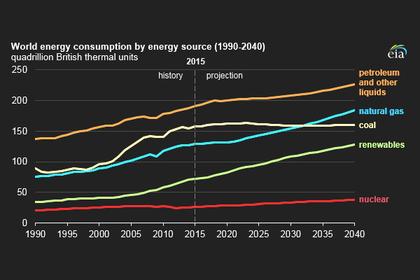

GLOBAL OIL DEMAND PLATEAU: 2030

Global oil demand will hit a plateau around 2030 as the use of more efficient cars and electric vehicles ends an expansion that dominated the past century

2019, November, 13, 12:50:00

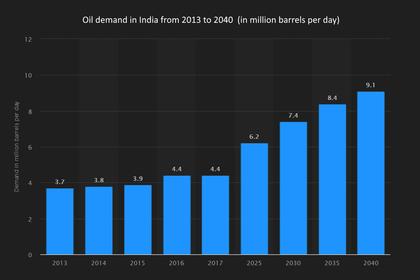

INDIA'S OIL NEED INVESTMENT

Pradhan said Indian Prime Minister Narendra Modi recently met with the chief executives of energy firms in Houston, including those from Exxon Mobil Corp, BP Plc, Royal Dutch Shell, Rosneft Oil Co, Saudi Aramco and Abu Dhabi National Oil Co (Adnoc).

2019, November, 13, 12:45:00

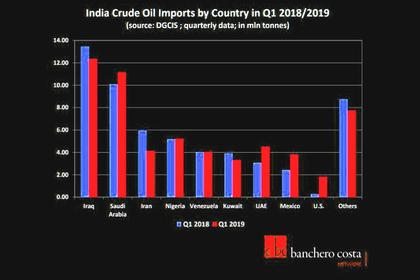

RUSSIA'S OIL FOR INDIA

Rosneft already supplies crude to India, shipping to its subsidiary Nayara Energy which operates the 20 million mt/year Vadinar refinery in Gujarat.

2019, November, 13, 12:30:00

EXXON'S INVESTMENT FOR UAE $6.5 BLN

ExxonMobil has invested around US$6.5 billion in Upper Zakum oilfield since its involvement in the offshore field in 2006, according to Christian G. Lenoble, President and UAE Lead Country Manager of Exxon (Al-Khalij) Inc.

2019, November, 13, 12:20:00

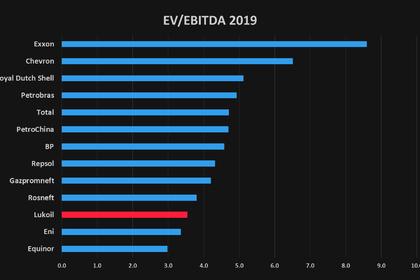

LUKOIL PRODUCTION +1.6%

For the nine months of 2019 LUKOIL Group's average hydrocarbon production excluding the West Qurna-2 project amounted to 2,337 thousand boe per day, which is 1.6% higher year-on-year.

2019, November, 11, 13:25:00

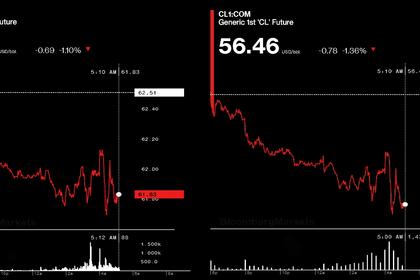

OIL PRICE: NOT ABOVE $62 ANEW

Brent was down 69 cents, or 1.1%, at $61.82, WTI was 63 cents, or 1.1%, lower at $56.61 a barrel

2019, November, 11, 13:10:00

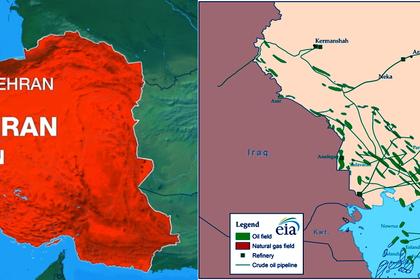

THE NEW IRAN'S OILFIELD 53 BBL

Speaking in the southern province of Yazd on Sunday, Dr. Rouhani said that the field’s reserves were estimated to contain 53 billion barrels of oil in place.

2019, November, 11, 13:05:00

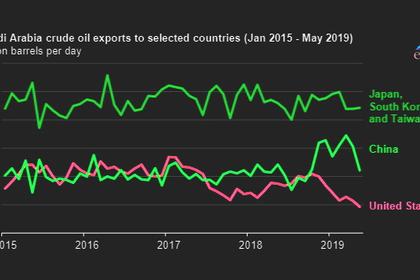

RUSSIAN, SAUDI'S OIL FOR CHINA

China has been relying heavily on Saudi Arabia and Russia for its refinery feedstock requirements over the recent years, with both producers constantly switching between them the top supplier position to Asia's biggest energy consumer.

2019, November, 11, 13:00:00

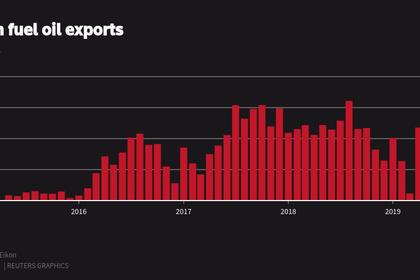

IRAN'S LPG FOR CHINA DOWN

Trader estimates for cargoes loading from Iran bound for China in November generally ranged between seven and 10. Some said the number was lower at six to seven, while one source said it did not exceed nine.

2019, November, 11, 12:50:00

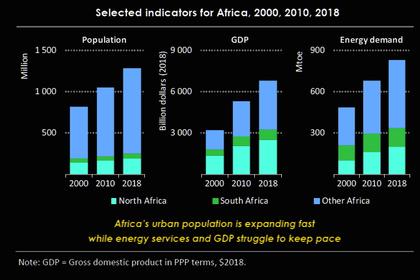

AFRICA'S ENERGY DEMAND GROWTH TWICE

Energy demand in Africa grows twice as fast as the global average, and Africa’s vast renewables resources and falling technology costs drive double-digit growth in deployment of utility-scale and distributed solar photovoltaics (PV), and other renewables, across the continent.

2019, November, 11, 12:40:00

U.S. RIGS DOWN 5 TO 817

U.S. Rig Count is down 5 rigs from last week to 817, Canada Rig Count is down 2 rigs from last week to 140,

2019, November, 8, 11:35:00

OIL PRICE: NOT ABOVE $62

Brent was down 44 cents, or 0.7%, at $61.85 a barrel, WTI was down 50 cents, or 0.9%, at $56.65 a barrel.

2019, November, 8, 11:00:00

SAUDI ARAMCO'S OIL FOR CHINA: +151 TBD

Saudi Aramco signed crude oil sales agreements for 2020 with five Chinese customers, increasing total volume by 151,000 barrels per day compared to their 2019 supply contracts.

2019, November, 8, 10:40:00

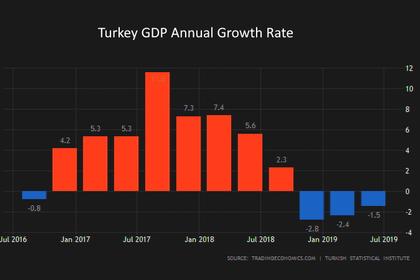

TURKEY'S GDP GROWTH 2.5%

The EBRD expects Turkey’s economy to start growing again in the second half of 2019, although a mild contraction is expected for the year as a whole.