Oil

2017, October, 4, 23:30:00

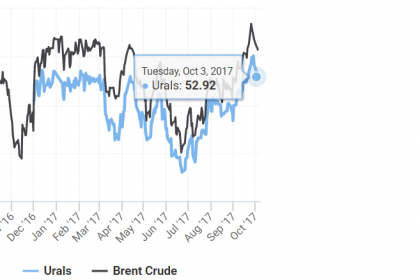

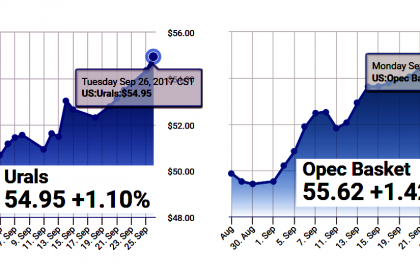

ЦЕНА URALS: $ 50,55

Средняя цена нефти марки Urals по итогам января - сентября 2017 года составила $ 50,55 за баррель.

2017, October, 2, 15:00:00

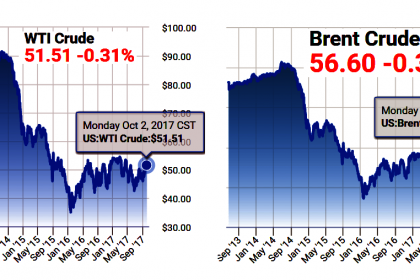

OIL PRICE: ABOVE $56

Brent crude, the global benchmark, was down 12 cents at $56.67 a barrel at 0846 GMT. It notched up a third-quarter gain of around 20 percent, the biggest third-quarter increase since 2004 and traded as high as $59.49 last week.

U.S. crude was down 17 cents at $51.50. The U.S. benchmark posted its strongest quarterly gain since the second quarter of 2016.

2017, October, 2, 14:50:00

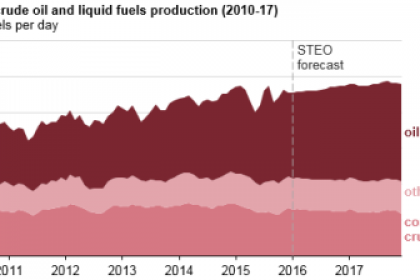

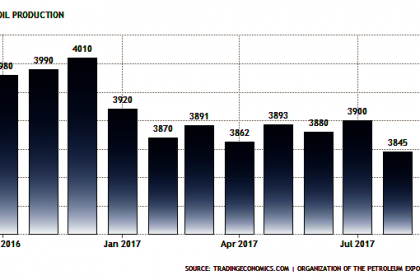

RUSSIAN OIL PRODUCTION: 10.91 MBD

Russian oil output stood at 10.91 million barrels per day (bpd) in September, unchanged from August and staying at a low for the year

2017, October, 2, 14:45:00

OIL PRICES: $50 - $60 AGAIN

A snap poll conducted by price reporting agency S&P Global Platts showed that two-thirds of conference attendees thought crude would hold in a narrow range of between $50 and $60 a barrel in the coming year, exactly where it was today.

2017, October, 2, 14:40:00

SHELL'S INVESTMENT RISKS

“The point that you can be too early was proved by us,” he says. “We were among the first of the big international oil companies to get into solar and we found out we could not make any money out of it.”

2017, September, 29, 12:35:00

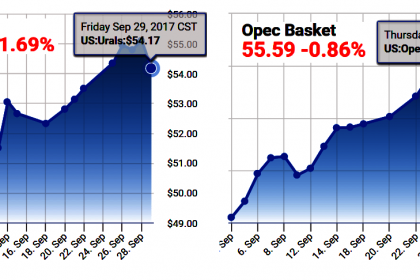

OIL PRICE: ABOVE $57

U.S. crude CLc1 was down 8 cents at $51.48 a barrel at 0641 GMT, after earlier rising slightly. Still, the contract is heading for a fourth consecutively weekly gain and is on track for a 9 percent advance this month.

Brent LCOc1 rose 1 cent to $57.42 a barrel, heading for a fifth weekly climb and a nearly 10 percent gain for September.

2017, September, 29, 12:30:00

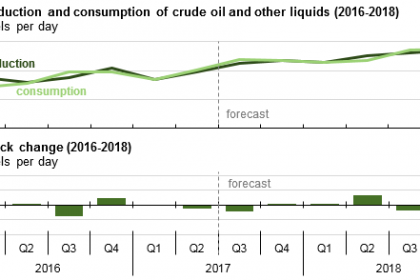

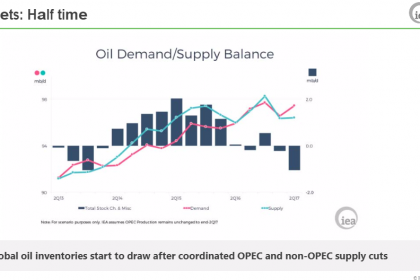

СПРОС ПРЕВЫШАЕТ ПРЕДЛОЖЕНИЕ

Сегодня спрос превышает предложение уже на миллион баррелей в день. При этом уровень запасов нефти в хранилищах превышает средний пятилетний показатель всего на 170 миллионов баррелей – это вдвое меньше, чем было ранее.

2017, September, 29, 12:25:00

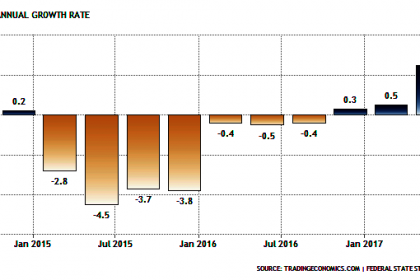

U.S. HIGHEST PELROLEUM DEMAND

Total petroleum deliveries in August moved up by 1.3 percent from August 2016 to average 20.5 million barrels per day. These were the highest August deliveries in 10 years, since 2007. Compared with July, total domestic petroleum deliveries, a measure of U.S. petroleum demand, decreased 0.6 percent. For year-to-date, total domestic petroleum deliveries moved up 1.3 percent compared to the same period last year.

2017, September, 29, 12:20:00

RUSSIA INFLUENCES U.S.

“In light of Facebook’s disclosure of over $100,000 in social media advertising associated with Russian accounts focused on the disruption and influence of US politics through social media, it is likely that Russia undertook a similar effort using social media to influence the US energy market,”

2017, September, 29, 12:15:00

TURKEY NEED IRAQI OIL

The government of Turkey said it will deal exclusively with the Iraqi government on oil exports after voters in the semiautonomous Kurdistan Region of Iraq supported independence in a controversial referendum.

2017, September, 29, 12:10:00

CANADA NEED $60

“Fifty-dollar WTI is not high enough to support a material uptick in oilsands investments,” said Randy Ollenberger, managing director of oil and gas equity research for BMO Capital Markets.

“Sustained US$60-plus oil prices are required to support most projects.”

2017, September, 27, 13:55:00

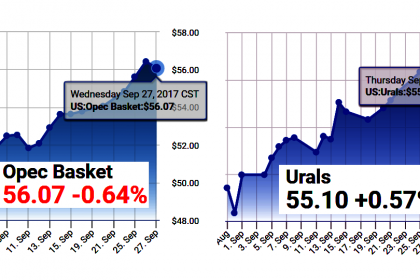

OIL PRICE: NOT ABOVE $58

Brent November crude futures were down 14 cents at $58.30 a barrel at 0832 GMT, while U.S. crude for November delivery edged up 11 cents to $51.99.

2017, September, 27, 13:50:00

ИНВЕСТИЦИИ В РОССИЮ

«Несмотря на все вызовы, в России улучшается предпринимательский климат, что находит отражение в международных рейтингах. Если в 2012 году Россия занимала 120-е место в рейтинге Doing Business Всемирного Банка, то в 2017 году – уже 40-е. Сейчас уже можно сказать, что экономика России нацелена на восстановление. В IV квартале прошлого года падение ВВП было минимальным, а в 2017 году мы вернулись к росту. Также замедлилась инфляция, наметилось восстановление инвестиционной активности, потребительского спроса. Несколько месяцев назад агентство S&P повысило прогноз кредитного рейтинга России с негативного до стабильного», - рассказал Министр.

2017, September, 27, 13:40:00

OPEC NEED ASIA'S MARKET

We expect global demand to increase by nearly 16 million barrels a day until 2040 – at which time it could reach around 111 million barrels a day.

A remarkable 70% of this growth is forecast to come from emerging and developing economies in Asia.

2017, September, 27, 13:35:00

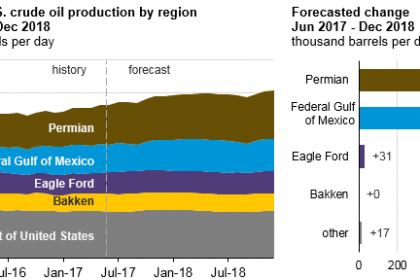

U.S. WANT OIL MARKET

If the US were to reimpose nuclear sanctions on Iran, the Trump administration would do so in a way that would have minimal impact on the global oil market, a senior State Department official said Tuesday.