Trends

2017, December, 1, 12:45:00

RUSSIAN GAS TO GERMANY: 200 BLN

GAZPROM - the Nord Stream gas pipeline transmitted its 200 billionth cubic meter of gas from Russia to Germany via the Greifswald delivery point.

2017, December, 1, 12:45:00

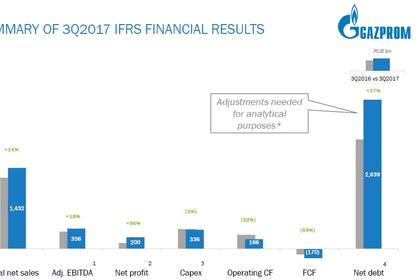

GAZPROM'S PROFIT: RUB 581,834 MLN

GAZPROM -Profit attributable to the owners of PJSC Gazprom for the nine months ended September 30, 2017 totalled RUB 581,834 million which is by RUB 127,487 million, or 18 %, less than for the same period of the prior year.

2017, December, 1, 12:40:00

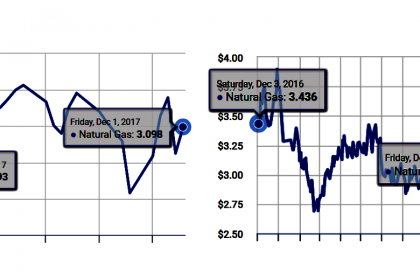

GAS PRICES DOWN TO $3.097/MMBTU

PLATTS - Having gained over 5 cents yesterday as the new front month contract, NYMEX January 2018 natural gas futures were lower ahead of Thursday's open and the morning release of the weekly storage data. At 6:45 am ET (1145 GMT), the contract was down 8.2 cents to $3.097/MMBtu.

2017, December, 1, 12:35:00

CHINA'S LNG GROWTH

PLATTS - Average domestic trucked LNG prices in China jumped more than 47% since November 14, according to Shanghai Petroleum and Natural Gas Exchange which monitors trucked LNG transactions from 50 LNG terminals and factories.

2017, December, 1, 12:30:00

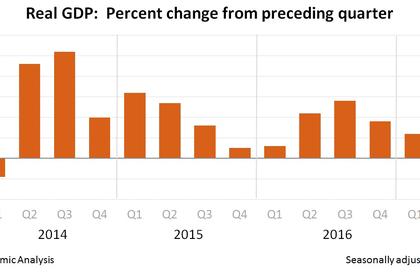

U.S. GDP UP 3.3%

BEA - Real gross domestic product (GDP) increased at an annual rate of 3.3 percent in the third quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.

2017, November, 29, 10:05:00

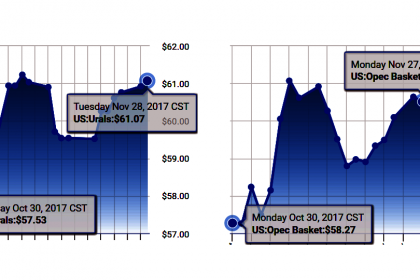

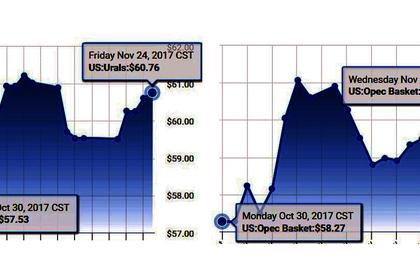

OIL PRICE: ABOVE $63 STILL

REUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $57.67 a barrel at 0427 GMT, down 32 cents, or 0.6 percent below their last settlement.

Brent crude futures, the international benchmark for oil prices, were at $63.14 a barrel, down 47 cents, or 0.7 percent.

2017, November, 29, 10:00:00

OPEC OIL EXPECTATIONS

BLOOMBERG - Implied volatility, a gauge of expected price moves, dropped to about 22 percent on Friday for New York-traded crude. That was the lowest level since early March and close to a three-year low. Other gauges of turbulence have also traded at multi-year lows since the start of October, despite the escalating tensions and meetings this week in Vienna, where OPEC and allied oil-producer states will discuss the extension of supply curbs that propped up the market.

2017, November, 29, 09:50:00

SHELL UPDATES STRATEGY

SHELL - “Our next steps as we re-shape Shell into a world-class investment aim to ensure that our company can continue to thrive, not just in the short and medium term but for many decades to come,” said van Beurden. “These steps build on the foundations of Shell’s strong operational and financial performance, and my confidence in our strategy and our ability to deliver on the promises we make.”

2017, November, 29, 09:45:00

ADNOC INVESTMENT $100 BLN

ADNOC - The SPC approved ADNOC’s plans for capital expenditure of over AED 400 billion, over the next five years, as it embarks on its Upstream and Downstream expansion and growth projects. The SPC also approved ADNOC’s plans to explore and appraise Abu Dhabi’s unconventional gas resources, as the company seeks to enable future value creation from its untapped gas resources. And, the SPC gave the green light to ADNOC to pursue international downstream investments that will position ADNOC as a global player in the downstream market.

2017, November, 29, 09:40:00

SOUTH CHINA SEA OIL

OGJ - Phase II production from Weizhou 12-2 oil field has been brought on stream, CNOOC Ltd. said of its project in Beibu Gulf in the South China Sea.

2017, November, 29, 09:35:00

BRAZIL IN MOVEMENT

OGJ - Total SA announced Nov. 27 that the Petroleo Brasileiro SA (Petrobras)-led Libra consortium has brought production on stream in ultradeep waters 180 km offshore Rio de Janeiro in Brazil’s presalt Santos basin.

2017, November, 27, 20:20:00

OIL PRICE: ABOVE $63 ANEW

BLOOMBERG - West Texas Intermediate for January delivery was at $58.51 a barrel on the New York Mercantile Exchange, down 44 cents, at 10:22 a.m. London time. Total volume traded was about 24 percent above the 100-day average. Prices gained 93 cents to $58.95 on Friday, capping a 4.2 percent weekly advance.

Brent for January settlement fell 21 cents to $63.65 a barrel on the London-based ICE Futures Europe exchange, after rising 1.8 percent last week. The global benchmark crude traded at a premium of $5.11 to WTI.

2017, November, 27, 20:15:00

РОССИЯ ПОДДЕРЖИВАЕТ СОКРАЩЕНИЕ

МИНЭНЕРГО РОССИИ - «Мы видим, что с рынка ушло примерно 50% излишком запасов нефти, мы видим, что цена сбалансировалась и вышла на достаточно приемлемый уровень в районе 60 и выше долларов за баррель марки Brent, инвестиции начали уже в 17-м году расти, а до этого они 15-16-й год падали. Тем не менее, мы не достигли еще до конца цели по балансировке рынка, и сегодня практически все выступают за то, что необходимо продлить сделку дополнительно для того, чтобы достичь окончательных целей. В принципе, Россия тоже поддерживает такие предложения, рассматриваются разные варианты».

2017, November, 27, 20:10:00

БОЛЬШИЕ ВОЗМОЖНОСТИ РОССИИ

МИНЭНЕРГО РОССИИ - «Совместно мы занимаем более 60% рынка газа. Наши общие запасы по последним оценкам составляют 70% от общемировых. По прогнозам к 2040 году глобальные потребности в газе увеличатся на почти на 60%, и данный показатель может быть еще пересмотрен в большую сторону, основываясь на глобальной климатической повестке».

2017, November, 27, 20:05:00

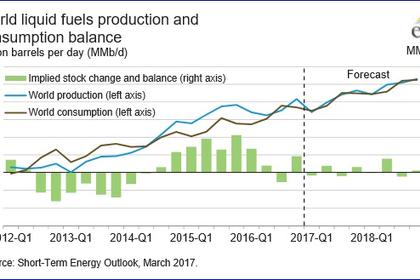

OIL SUPPLY & DEMAND

BLOOMBERG - Global crude inventories are declining and supply and demand are in balance, according to the head of Saudi Aramco, while the United Arab Emirates energy minister said U.S. shale oil doesn’t threaten OPEC’s efforts to support the market.