Trends

2017, November, 9, 13:40:00

CHINA'S INVESTMENT TO U.S.

President Donald Trump can return to the United States claiming to have snagged over $250 billion in deals from his maiden trip to Beijing. Whether those deals live up to the lofty price tag is another question altogether.

Some huge deals were announced. Among them is a 20-year $83.7 billion investment by China Energy Investment Corp in shale gas developments and chemical manufacturing projects in West Virginia, a major energy producing state that voted heavily for Trump in the 2016 election.

2017, November, 9, 13:35:00

U.S. - CHINA LNG

China’s top state oil major Sinopec, one of the country’s top banks and its sovereign wealth fund have agreed to help develop Alaska’s liquefied natural gas sector as part of U.S. President Donald Trump’s visit, the U.S. government said on Thursday.

The agreement will involve investment of up to $43 billion, create up to 12,000 U.S. jobs during construction, reduce the trade deficit between the United States and Asia by $10 billion a year, and give China clean energy.

2017, November, 9, 13:30:00

WORLDWIDE RIG COUNT DOWN 4 TO 2,077

The worldwide rig count for October 2017 was 2,077, down 4 from the 2,081 counted in September 2017, and up 457 from the 1,620 counted in October 2016.

2017, November, 8, 11:12:00

TESCO NET LOSS $38.8 MLN

TESCO reported a U.S. GAAP net loss of $13.0 million, or $(0.28) per share, in the third quarter of 2017. Adjusted net loss for the quarter was $9.2 million, or $(0.20) per share, excluding special items, consisting primarily of charges related to restructuring and transaction costs. Restructuring costs were mainly for facility consolidation and headcount reductions in Latin America. This compares to a U.S. GAAP net loss of $12.1 million, or $(0.26) per diluted share, in the second quarter of 2017, and a U.S. GAAP net loss of $22.1 million, or (0.48) per diluted share, in the third quarter of 2016. Adjusted net loss in the second quarter of 2017 was $11.6 million, or $(0.25) per diluted share, and in the third quarter of 2016 was $17.3 million, or $(0.37) per diluted share.

2017, November, 7, 12:45:00

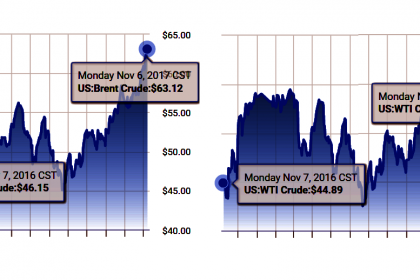

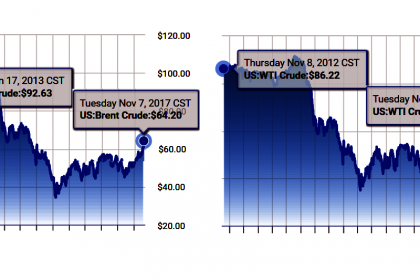

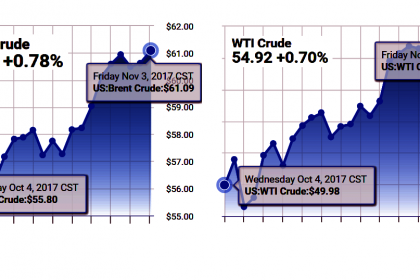

OIL PRICE: ABOVE $64

Brent crude futures LCOc1 were up 5 cents at $64.32 per barrel by 0750 GMT. On Monday, they closed 3.5 percent higher, also their biggest percentage gain in about six weeks.

U.S. West Texas Intermediate (WTI) crude CLc1 was down just 3 cents at $57.32 a barrel. The contract surged 3 percent on Monday, the biggest percentage gain since late September. Both benchmarks hit their highest since mid-2015 during the session.

2017, November, 7, 12:40:00

OIL PRICES MAXIMUM ANEW

West Texas Intermediate for December delivery rose 23 cents to $55.87 a barrel at 10:04 a.m. on the New York Mercantile Exchange after earlier rising to $56.28, the highest intraday price since July 2015.

Brent for January settlement climbed 46 cents to $62.53 on the London-based ICE Futures Europe exchange, and traded at a $6.41 premium to WTI for the same month.

2017, November, 7, 12:35:00

OIL PRICE 2018: $55

Barclays raised its Brent oil price forecast, saying Brent will average $60/bbl during the fourth quarter and will average $55/bbl in 2018. The average 2018 forecast was up $3 compared with Barclays earlier forecast.

2017, November, 7, 12:30:00

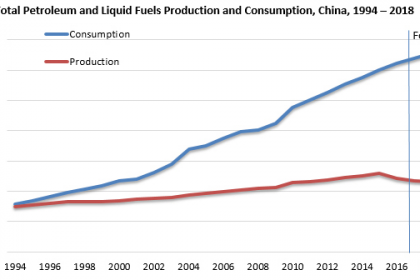

CHINA'S OIL IMPORTS UP TO 11%

Crude oil imports by China's independent refineries in eastern Shandong province, Xinhai Petrochemical in Hebei and Fengli Petrochemical in Henan rebounded 11% month on month to around 7.435 million mt in October, or 1.76 million b/d.

2017, November, 7, 12:25:00

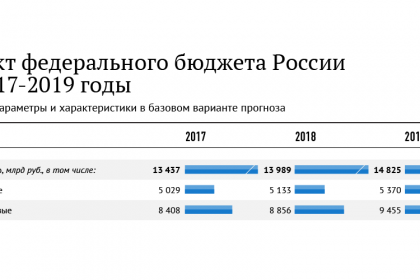

ДОХОДЫ РОССИИ ВЫШЕ

Отклонение нефтегазовых доходов федерального бюджета от месячной оценки, соответствующей Федеральному закону о федеральном бюджете на 2017-2019 годы, в ноябре 2017 года прогнозируется в размере +125,8 млрд руб.

2017, November, 7, 12:20:00

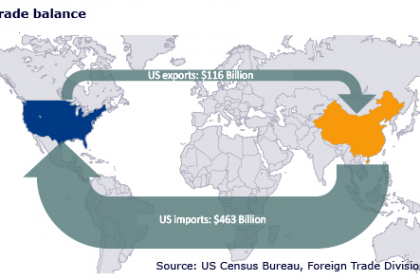

U.S. DEFICIT $43.5 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.5 billion in September, up $0.7 billion from $42.8 billion in August, revised. September exports were $196.8 billion, $2.1 billion more than August exports. September imports were $240.3 billion, $2.8 billion more than August imports.

2017, November, 7, 12:15:00

VERY IMPORTANT VENEZUELA

The step to restructure debt comes as Venezuela stands to receive more revenue for its oil. The country’s crude oil basket price rose to CNY350.75 ($52.90) a barrel Friday, the highest since July 2015. And Venezuela did approve a $1.1 billion principal payment on a PDVSA bond on Thursday.

2017, November, 7, 12:05:00

U.S. RIGS DOWN 11 TO 898

U.S. Rig Count is up 329 rigs from last year's count of 569, with oil rigs up 279, gas rigs up 52, and miscellaneous rigs down 2 to 2.

Canada Rig Count is up 38 rigs from last year's count of 154, with oil rigs up 24 and gas rigs up 14.

2017, November, 3, 12:35:00

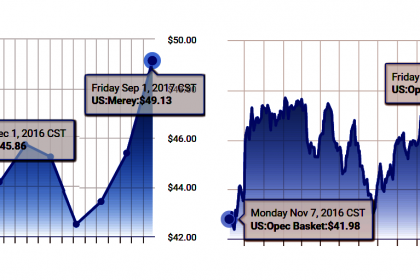

OIL PRICE: ABOVE $61 YET

Brent futures LCOc1 were at $60.75 per barrel at 0739 GMT, up 13 cents, or 0.2 percent, from their last close. Brent has risen by around 37 percent since its low in 2017 reached last June.

U.S. West Texas Intermediate (WTI) crude CLc1 was at $54.70 a barrel, up 16 cents, or 0.3 percent, from the last close. WTI is around 30 percent above its 2017-low in June.

2017, November, 3, 12:30:00

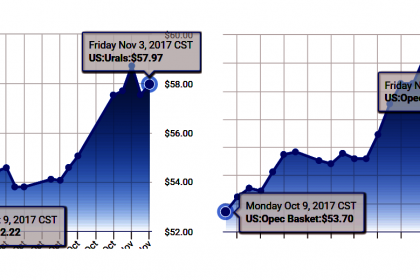

OPEC OIL PRICE: $58.49

OPEC daily basket price stood at $58.49 a barrel Thursday, 2 November 2017

2017, November, 3, 12:25:00

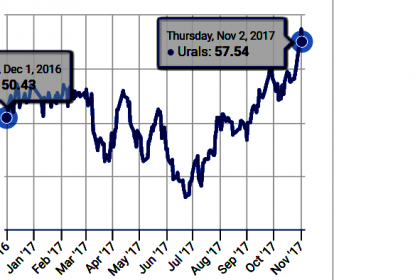

ЦЕНА URALS: $51,15

Средняя цена нефти марки Urals по итогам января – октября 2017 года составила $ 51,15 за баррель.