Trends

2017, November, 13, 10:45:00

OPEC OIL PRICE: $61.72

The price of OPEC basket of fourteen crudes stood at $61.72 a barrel on Thursday, compared with $61.61 the previous day, according to OPEC Secretariat calculations.

2017, November, 13, 10:40:00

SOUTH CHINA CEA CALM

Vietnam’s state television said Chinese President Xi Jinping had told Vietnam’s General Secretary Nguyen Phu Trong he wanted to work with Southeast Asian nations on a code of conduct in the sea. China’s Xinhua news agency said China and Vietnam had agreed to properly handle maritime issues and strive to maintain peace and stability.

2017, November, 13, 10:25:00

VENEZUELA'S OIL PRODUCTION DOWN

Output is expected to slump to 1.84 million barrels a day next year, the lowest compared with official government data since 1989.

2017, November, 13, 10:10:00

TRANSCANADA NET INCOME $2.136 BLN

TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for third quarter 2017 of $612 million or $0.70 per share compared to a net loss of $135 million or $0.17 per share for the same period in 2016. Comparable earnings for third quarter 2017 were $614 million or $0.70 per share compared to $622 million or $0.78 per share for the same period in 2016. TransCanada's Board of Directors also declared a quarterly dividend of $0.625 per common share for the quarter ending December 31, 2017, equivalent to $2.50 per common share on an annualized basis.

2017, November, 13, 10:00:00

U.S. RIGS UP 9 TO 907

U.S. Rig Count is up 339 rigs from last year's count of 568, with oil rigs up 286, gas rigs up 54, and miscellaneous rigs down 1 to 1.

Canada Rig Count is up 27 rigs from last year's count of 176, with oil rigs up 19 and gas rigs up 8.

2017, November, 11, 08:56:00

VIETNAM & GAZPROM: KEY PARTNERS

Vietnam is one of Gazprom’s key partners in Southeast Asia. Together with PetroVietnam, we successfully conduct geological exploration and produce hydrocarbons, as well as make preparations to develop the country’s NGV market.

2017, November, 9, 14:05:00

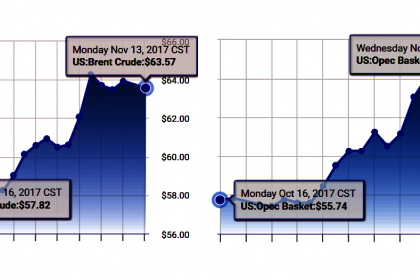

OIL PRICE: ABOVE $63

Benchmark Brent crude oil LCOc1 was unchanged at $63.49 a barrel by 0840 GMT. On Tuesday, Brent reached an intra-day high of $64.65, its highest since June 2015.

U.S. light crude CLc1 was steady at $56.81, not too far off this week’s more than two-year high of $57.69 a barrel.

2017, November, 9, 14:00:00

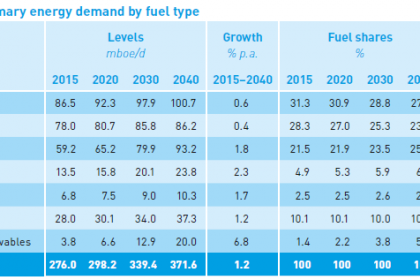

OPEC: 2040 GLOBAL ENERGY CHANGES

Within the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d.

2017, November, 9, 13:55:00

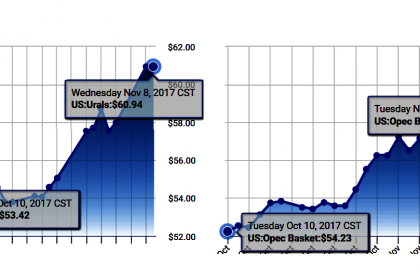

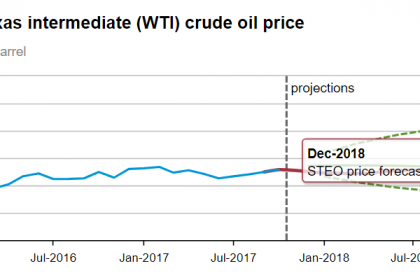

EIA: OIL PRICE $53 - $56

North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

2017, November, 9, 13:50:00

EIA: NUCLEAR ENERGY WILL UP

EIA projects that global nuclear capacity will grow at an average annual rate of 1.6% from 2016 through 2040, led predominantly by countries outside of the Organization for Economic Cooperation and Development (OECD). EIA expects China to continue leading world nuclear growth, followed by India. This growth is expected to offset declines in nuclear capacity in the United States, Japan, and countries in Europe.

2017, November, 9, 13:45:00

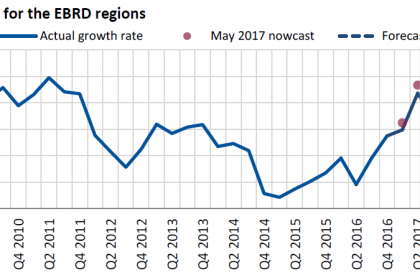

EUROPEAN ECONOMY UP 3.3%

Average growth across the EBRD region is seen at 3.3 per cent this year, a rise of 0.9 percentage points against the previous forecast from May, and compared with growth of just 1.9 per cent in 2016.

The economy in Russia, the largest in the EBRD region and a major influence on output in many other EBRD countries of operations, has now pulled out of recession after a cumulative contraction of 3 per cent over the last two years. Russia is expected to see GDP growth of 1.8 and 1.7 per cent in 2017 and 2018, respectively.

2017, November, 9, 13:40:00

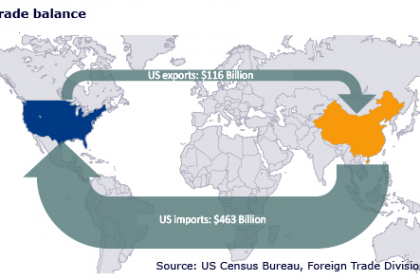

CHINA'S INVESTMENT TO U.S.

President Donald Trump can return to the United States claiming to have snagged over $250 billion in deals from his maiden trip to Beijing. Whether those deals live up to the lofty price tag is another question altogether.

Some huge deals were announced. Among them is a 20-year $83.7 billion investment by China Energy Investment Corp in shale gas developments and chemical manufacturing projects in West Virginia, a major energy producing state that voted heavily for Trump in the 2016 election.

2017, November, 9, 13:35:00

U.S. - CHINA LNG

China’s top state oil major Sinopec, one of the country’s top banks and its sovereign wealth fund have agreed to help develop Alaska’s liquefied natural gas sector as part of U.S. President Donald Trump’s visit, the U.S. government said on Thursday.

The agreement will involve investment of up to $43 billion, create up to 12,000 U.S. jobs during construction, reduce the trade deficit between the United States and Asia by $10 billion a year, and give China clean energy.

2017, November, 9, 13:30:00

WORLDWIDE RIG COUNT DOWN 4 TO 2,077

The worldwide rig count for October 2017 was 2,077, down 4 from the 2,081 counted in September 2017, and up 457 from the 1,620 counted in October 2016.

2017, November, 8, 11:12:00

TESCO NET LOSS $38.8 MLN

TESCO reported a U.S. GAAP net loss of $13.0 million, or $(0.28) per share, in the third quarter of 2017. Adjusted net loss for the quarter was $9.2 million, or $(0.20) per share, excluding special items, consisting primarily of charges related to restructuring and transaction costs. Restructuring costs were mainly for facility consolidation and headcount reductions in Latin America. This compares to a U.S. GAAP net loss of $12.1 million, or $(0.26) per diluted share, in the second quarter of 2017, and a U.S. GAAP net loss of $22.1 million, or (0.48) per diluted share, in the third quarter of 2016. Adjusted net loss in the second quarter of 2017 was $11.6 million, or $(0.25) per diluted share, and in the third quarter of 2016 was $17.3 million, or $(0.37) per diluted share.