All publications by tag «»

2021, November, 11, 15:10:00

CLIMATE: NO ONE-SIZE-FITS-ALL-SOLUTION

The narrative that the energy transition is from oil and other fossil fuels to renewables is misleading and potentially dangerous to a world that will continue to be thirsty for all energy sources.

2021, November, 11, 15:05:00

CHINA, U.S. CLIMATE COOPERATION

China and the United States have agreed to collaborate more closely on climate action

2021, November, 11, 15:00:00

THE NEW NUCLEAR FOR FRANCE

This is why, to guarantee France's energy independence, to guarantee our country's electricity supply and achieve our objectives, in particular carbon neutrality in 2050, we are going, for the first time in decades, to relaunch the construction of nuclear reactors in our country and continue to develop renewable energies.

2021, November, 11, 14:55:00

NUCLEAR FOR TURKEY

"It is impossible for those who have the slightest sensitivity in their hearts about the economic independence of Turkey and the well-being of the Turkish nation to oppose nuclear energy."

2021, November, 11, 14:50:00

ALGERIA'S GAS FOR SPAIN

In 2020, Algeria exported 8.7 bcm of natural gas via pipelines to Spain, accounting for about a quarter of the country's total gas imports, and 1.3 bcm to Portugal.

2021, November, 11, 14:45:00

WIND ENERGY FOR VIETNAM 3.9 GW

Wind account for around 1% of Vietnam’s installed capacity, with 600 MW (2020).

2021, November, 11, 14:40:00

MAERSK, NOBLE COMBINATION

Noble and Maersk shareholders will each hold 50% in the combined entity, which will be named Noble Corp. with headquarters in Houston.

2021, November, 11, 14:35:00

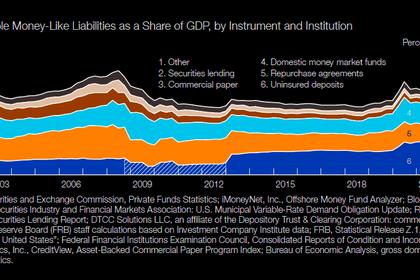

U.S. RISKY ASSET PRICES RISE

Prices of risky assets generally rose further, and most valuations are high relative to history

2021, November, 10, 12:25:00

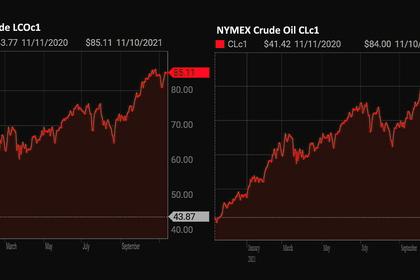

OIL PRICE: NEAR $85 ANEW

Brent were at $85.22 a barrel, WTI rose 16 cents, or 0.2%, to $84.31 a barrel.

2021, November, 10, 12:20:00

OIL PRICES 2021-22: $82-$72

We expect Brent prices will remain near current levels for the rest of 2021, averaging $82/b in the fourth quarter of 2021. In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining from current levels to an annual average of $72/b.