All publications by tag «ENERGY»

2017, September, 8, 09:00:00

U.S. ENERGY INVESTMENT: $1.3 TLN

“We welcome the President’s commitment to pro-growth tax reform, and look forward to working with the administration and Congress on continuing our nation’s energy leadership. Pro-growth tax reform and economic policies can further strengthen our energy infrastructure and benefit consumers. As an industry that invests billions in the U.S. economy each year, pro-growth policies would allow us to accelerate these economic investments while keeping energy affordable. Private investment in our nation’s energy infrastructure could exceed $1.3 trillion and support 1 million jobs annually through 2035.”

2017, July, 19, 14:35:00

CLEAN ENERGY PROBLEMS

A transition from fossil fuels to mitigate the impacts of climate change will require large amounts of metals and rare earth elements that could create environmental challenges, the World Bank has warned.

2017, July, 17, 14:10:00

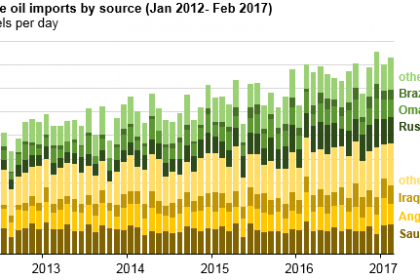

CHINA'S ENERGY DEMAND UP

CHINA will accelerate expanding oil and gas distribution in the next decade to ensure energy security and help boost industry, its top economic and energy planners said.

2017, July, 12, 14:10:00

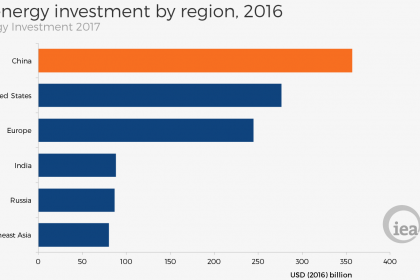

IEA: ENERGY INVESTMENT UPDOWN

Total energy investment worldwide in 2016 was just over $1.7 trillion, accounting for 2.2% of global GDP. Investment was down by 12% compared to IEA’s revised 2015 energy investment estimate of $1.9 trillion.

2017, July, 10, 12:25:00

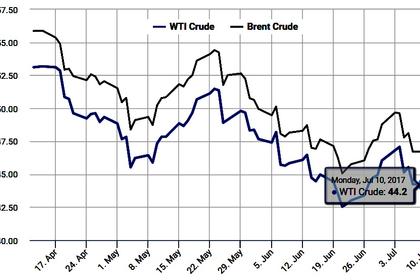

ENERGY PRICES DOWN MORE

Because two major crude oil price benchmarks, West Texas Intermediate (WTI) and Brent, account for 70% of the weighting in the S&P GSCI energy index, the energy index tends to follow major price movements in the crude oil market. During the first half of 2017, WTI crude oil prices declined by 12%, while Brent prices fell 14%.

2017, July, 3, 13:35:00

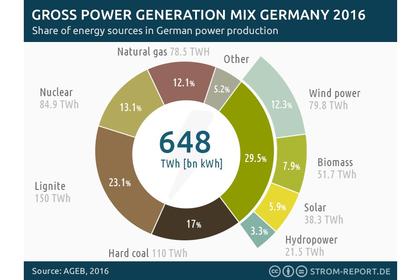

GERMANY'S RENEWABLE UP

Germany raised the proportion of its power produced by renewable energy to 35 percent in the first half of 2017 from 33 percent the previous year, according to the BEE renewable energy association.

2017, June, 26, 23:40:00

RENEWABLE ENERGY EFFICIENCY: 90%

Keeping the rise of global temperatures below 2 degrees Celsius means reducing energy-related carbon dioxide emissions by more than 70 per cent by 2050 (compared to 2015 levels). Analysis by IRENA for the G20 Presidency has shown that renewable energy and energy efficiency could potentially achieve 90 per cent of those reductions.

2017, June, 24, 09:50:00

U.S. RENEWABLE ENERGY

Wind and solar developers together have added about 40 gigawatts to the U.S. grid over the past two years, bringing total installed wind and solar capacity to about 120 gigawatts.

2017, June, 21, 11:25:00

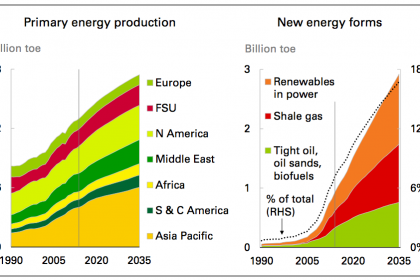

BP ENERGY REVIEW

Bob Dudley, BP group chief executive, said: “Global energy markets are in transition. The longer-term trends we can see in this data are changing the patterns of demand and the mix of supply as the world works to meet the challenge of supplying the energy it needs while also reducing carbon emissions. At the same time markets are responding to shorter-run run factors, most notably the oversupply that has weighed on oil prices for the past three years."

2017, May, 17, 11:30:00

IEA: OIL CAN DOWN

Looking at 2Q17, if we assume that April’s OPEC crude oil production level of 31.8 mb/d is maintained, and nothing changes elsewhere in the balance, there is an implied stock draw of 0.7 mb/d. Adopting the same scenario approach for the second half of 2017, the stock draws are likely to be even greater. Even if this turns out to be the case, stocks at the end of 2017 might not have fallen to the five-year average, suggesting that much work remains to be done in the second half of 2017 to drain them further. In addition to production cuts and steady demand growth, a major contribution to falling crude stocks in the next few months will be a ramp-up in global crude oil runs. Starting in March, refinery activity is building up and by July global crude throughputs will have increased by 2.7 mb/d.