Analysis

2021, February, 10, 11:30:00

SAUDI ARAMCO PIPELINE INVESTMENT $10 BLN

Aramco is in talks with banks to provide “staple financing”, which is a financing package provided by the seller that buyers can use to back their purchase.

2021, February, 10, 11:20:00

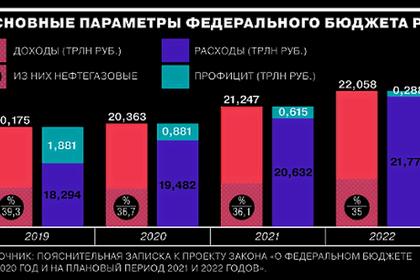

ЦЕНА URALS: $54,41

Средняя цена на нефть марки Urals в январе 2021 года сложилась в размере $54,41 за баррель, в январе 2020 года - $61,67 за баррель.

2021, February, 10, 11:15:00

ДОХОДЫ РОССИИ + 47,1 МЛРД.РУБ.

Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета, связанный с превышением фактически сложившейся цены на нефть над базовым уровнем, прогнозируется в феврале 2021 года в размере +47,1 млрд руб.

2021, February, 10, 11:10:00

ФНБ РОССИИ $179 МЛРД.

По состоянию на 1 февраля 2021 г. объем ФНБ составил 13 649 302,8 млн. рублей или 11,8% ВВП, что эквивалентно 179 000,9 млн. долл. США.

2021, February, 9, 15:55:00

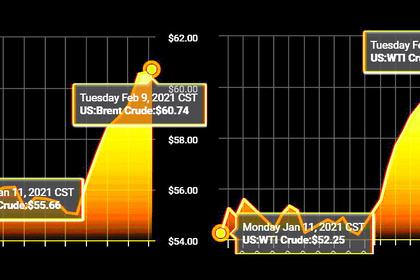

OIL PRICE: NEAR $61

Brent gained 41 cents, or 0.7%, to $60.97 a barrel. WTI was at $58.25 a barrel, up 28 cents, or 0.5%.

2021, February, 9, 15:50:00

INDIA: GLOBAL ENERGY DRIVER

An expanding economy, population, urbanisation and industrialisation mean that India sees the largest increase in energy demand of any country, across all of our scenarios to 2040.

2021, February, 9, 15:45:00

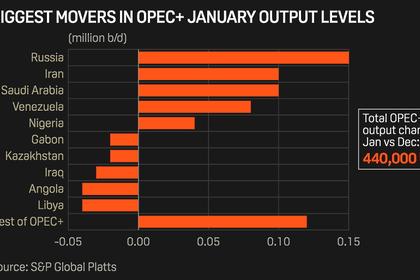

OPEC+ OIL PRODUCTION UP 440 TBD

OPEC's 13 members pumped 25.70 million b/d in the month, up 270,000 b/d from December, while their nine non-OPEC partners, led by Russia, produced 12.91 million b/d, a rise of 170,000 b/d,

2021, February, 9, 15:40:00

LNG PRODUCTION DOWN

LNG Canada initially is to consist of two trains that together would provide 14 million metric tons/year of gas.

2021, February, 9, 15:30:00

RUSSIA'S TURKSTREAM FOR EUROPE

Like the Nord Stream and Nord Stream 2 pipeline projects, TurkStream was designed to enable Russian gas to reach European markets without having to flow through Ukraine.

2021, February, 9, 15:25:00

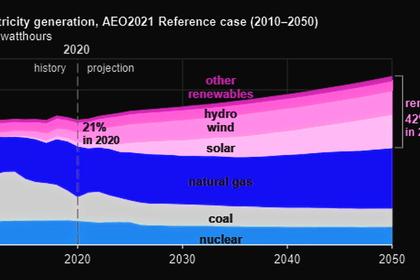

U.S. RENEWABLES WILL DOUBLE

the share of renewables in the U.S. electricity generation mix will increase from 21% in 2020 to 42% in 2050.

2021, February, 9, 15:20:00

LUKOIL PRODUCTION +9.5%

In the fourth quarter of 2020 LUKOIL Group's average hydrocarbon production was 2,065 kboe per day, which is 9.5% higher quarter-on-quarter.

2021, February, 8, 12:55:00

OIL PRICE: NEAR $60

Brent touched an intraday high of $60.06 a barrel. WTI advanced 60 cents, or 1.1%, to $57.45 a barrel.

2021, February, 8, 12:35:00

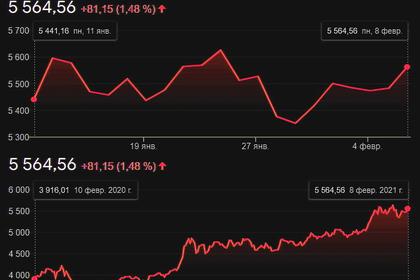

CHINA INDEXES UP

The blue-chip CSI300 index rose 1.5% to 5,564.56, while the Shanghai Composite Index added 1% to 3,532.45 points.

2021, February, 8, 12:30:00

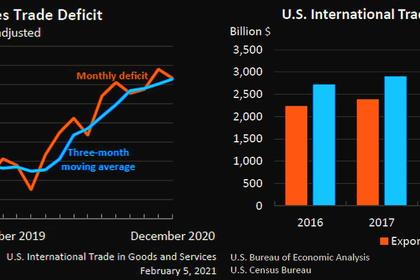

U.S. INTERNATIONAL TRADE DEFICIT DOWN TO $66.6 BLN

the U.S. goods and services deficit was $66.6 billion in December, down $2.4 billion from $69.0 billion in November

2021, February, 8, 12:05:00

WORLDWIDE RIG COUNT UP 79 TO 1,183

The Worldwide Rig Count for January was 1,183, up 79 from the 1,104 counted in December 2020, and down 890 from the 2,073 counted in January 2020.