Analysis

2020, November, 16, 12:25:00

EUROPEAN SHARES UP ANEW

The pan-European STOXX 600 .STOXX rose 0.7% by 0805 GMT, with banks .SX7P and travel stocks .SXTP gaining the most.

2020, November, 16, 12:10:00

U.S. RIGS UP 12 TO 312

U.S. Rig Count is up 12 from last week to 312 , Canada Rig Count is up 3 from last week to 89

2020, November, 13, 13:35:00

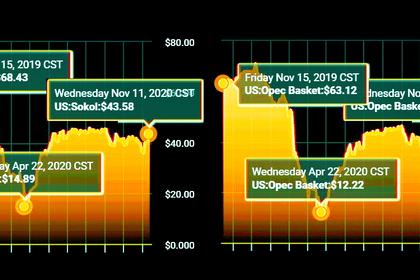

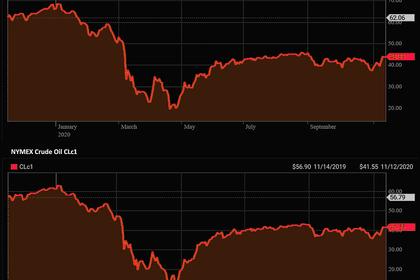

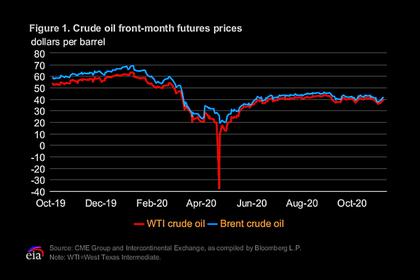

OIL PRICE: NEAR $43

Brent was down 51 cents, or 1.2%, at $43.02 a barrel. WTI fell 66 cents, or 1.6%, to $40.46 a barrel.

2020, November, 13, 13:25:00

OPEC+ RUSSIA REDUCING

Saudi Arabia and Russia, leaders of the 23-nation coalition, have already indicated publicly that they are thinking twice about easing production cuts in January as the resurgent pandemic hits fuel demand.

2020, November, 13, 13:20:00

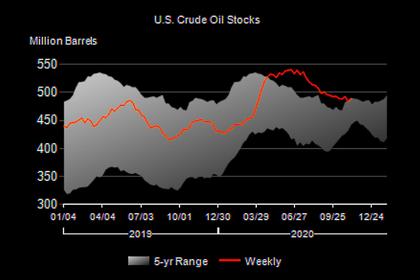

U.S. OIL INVENTORIES UP 4.3 MB TO 488.7 MB

U.S. commercial crude oil inventories increased by 4.3 million barrels to 488.7 million barrels

2020, November, 13, 13:15:00

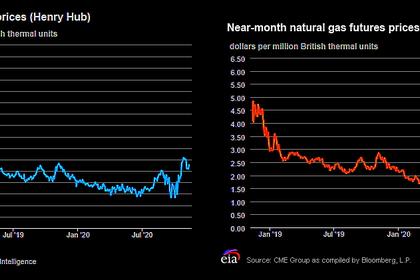

U.S. GAS PRICES UP TO $3

the natural gas spot price at the Henry Hub reached $3.00 per million British thermal units (MMBtu), its highest value since March 2019,

2020, November, 13, 13:05:00

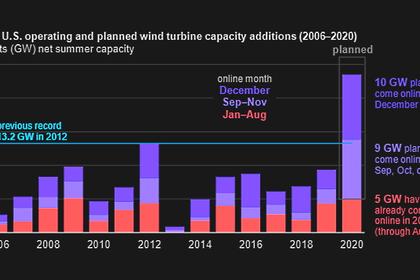

U.S. WIND ELECTRICITY WILL UP TO 10.3%

EIA forecasts wind’s share to reach 10.3% in 2021.

2020, November, 13, 12:55:00

ФНБ РОССИИ $167,6 МЛРД.

По состоянию на 1 ноября 2020 г. объем ФНБ составил 13 298 628,4 млн. рублей, или 11,7% ВВП, что эквивалентно 167 632,0 млн. долл. США,

2020, November, 13, 12:45:00

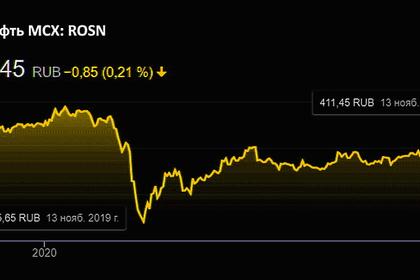

ROSNEFT NET LOSS RUB 177 BLN

In 9M 2020 negative Net income was RUB -177 bln (USD -2.1 bln). The reduction compared to 9M 2019 was a result of the negative effect of price fluctuations due to COVID-19 pandemic as well as the negative effect of non-monetary factors.

2020, November, 13, 12:40:00

ROSNEFT PRODUCTION 4.19 MBD

Brent fell 34 cents, or 0.8%, to $43.46 a barrel. WTI fell 30 cents, or 0.7%, to $41.15 a barrel.

2020, November, 12, 14:15:00

OIL PRICE: BELOW $44

Brent fell 34 cents, or 0.8%, to $43.46 a barrel. WTI fell 30 cents, or 0.7%, to $41.15 a barrel.

2020, November, 12, 14:10:00

GLOBAL OIL DEMAND UPDOWN

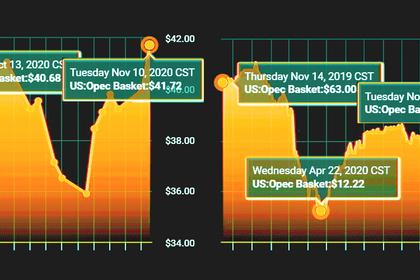

The global oil demand forecast for 2020 is revised down by 0.3 mb/d. For 2021, oil demand growth is expected to grow by 6.2 mb/d, y-o-y, representing a downward revision of 0.3 mb/d compared to last month’s assessment.

2020, November, 12, 14:05:00

OPEC CUTS 7.7 MBD

OPEC+ alliance's current 7.7 million b/d in output cuts could be maintained into 2021 instead of being eased as originally planned, or even extended.

2020, November, 12, 13:50:00

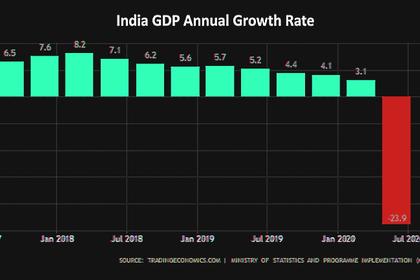

INDIA'S ECONOMY STIMULUS $16 BLN

The government will spend 1.2 trillion rupees ($16.1 billion) on the latest stimulus program in addition to the 1.45 trillion rupees announced on Wednesday,

2020, November, 12, 13:35:00

GREEN HYDROGEN IS COUNTERPRODUCTIVE

I regard the strictly green position as irrational and counterproductive. It is an impediment to efforts to quickly slash carbon emissions and limit the effects of global warming.