Analysis

2020, October, 12, 11:15:00

GLOBAL LNG: CAUTIOUSLY OPTIMISTIC

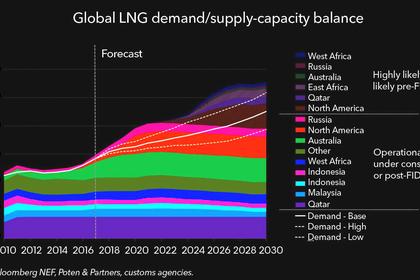

We expect LNG demand to increase by 4 billion cubic metres (bcm) this winter and that’s led by growth in China, Japan, and South Asia. LNG supply is expected to grow by 3 bcm led by the United States.

2020, October, 12, 11:05:00

U.S. RIGS UP 3 TO 269

U.S. Rig Count is up 3 from last week to 269, Canada Rig Count is up 5 from last week to 80

2020, October, 9, 12:25:00

OIL PRICE: NOT BELOW $43

Brent was up 16 cents at $43.50 a barrel, WTI rose 14 cents to $41.33.

2020, October, 9, 12:20:00

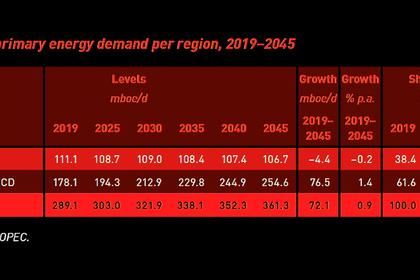

GLOBAL ENERGY DEMAND WILL UP BY 25%

Despite the large drop in 2020, global primary energy demand is forecast to continue growing in the medium- and long-term, increasing by a significant 25% in the period to 2045.

2020, October, 9, 12:10:00

JAPAN STOCKS UPDOWN

The Nikkei 225 Index ended 0.12% lower at 23,619.69 on Friday.

2020, October, 9, 12:05:00

AUSTRALIA'S SHARES: THE BEST

The S&P/ASX 200 index .AXJO closed unchanged at 6,102.2 after flitting between small gains and losses throughout the session.

2020, October, 9, 12:00:00

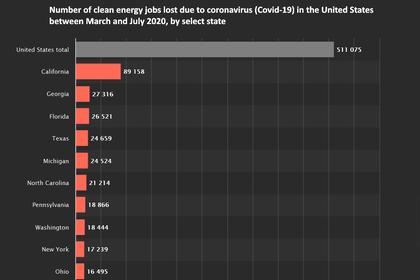

U.S. RENEWABLES EMPLOYMENT DOWN

The total number of jobs lost for the broader category of "clean energy" totaled over 477,862 at the end of September.

2020, October, 9, 11:55:00

ФНБ РОССИИ $172,3 МЛРД.

По состоянию на 1 октября 2020 г. объем ФНБ составил 13 733 051,0 млн. рублей, что эквивалентно 172 342,8 млн. долл. США,

2020, October, 8, 12:55:00

OIL PRICE: NOT BELOW $42 ANEW

Brent rose 59 cents, or 1.4%, to $42.58 a barrel, WTI added 45 cents, or 1.1%, to $40.40.

2020, October, 8, 12:50:00

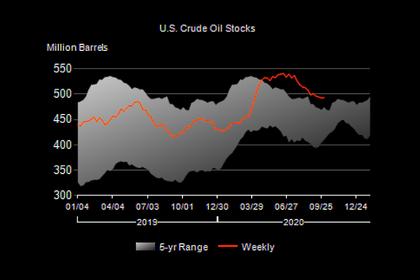

U.S. OIL INVENTORIES UP BY 0.5 MB TO 492.9 MB

U.S. commercial crude oil inventories increased by 0.5 million barrels to 492.9 million barrels.

2020, October, 8, 12:40:00

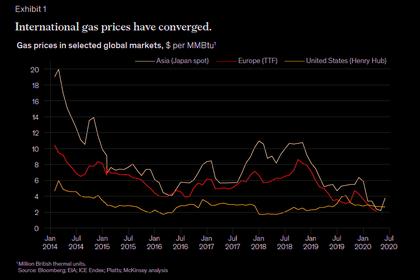

LNG: CHALLENGES & OPPORTUNITIES

The emergence of large-scale North American LNG exports has made it easier for low-cost US gas to reach Asia’s LNG importing markets.

2020, October, 7, 10:40:00

OIL PRICE: NOT BELOW $42

Brent crude futures fell 30 cents, or 0.7%, to $42.35 a barrel, WTI crude oil futures declined 42 cents, or 1%, to $40.25 a barrel.