Analysis

2018, February, 27, 14:10:00

RUSSIAN GAS FOR AUSTRIA UP

GAZPROM - In early 2018, the demand for gas is still on the rise in the country. According to estimates, from January 1 through February 21, 2018, Gazprom delivered to Austria 1.8 billion cubic meters of gas, a rise of 60.6 per cent against the same period of 2017 (1.1 billion cubic meters).

2018, February, 27, 14:05:00

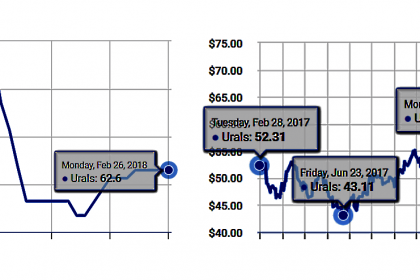

ЦЕНА URALS: $66,26457

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

2018, February, 27, 13:55:00

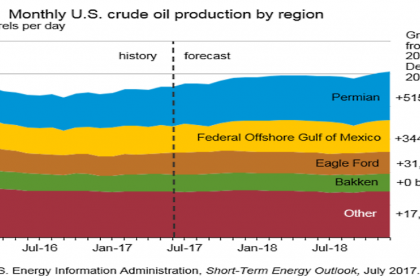

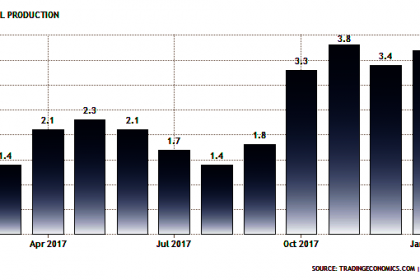

U.S. OIL PRIODUCTION UP TO 10.2 MBD

API - U.S. crude production rose to 10.2 million barrels per day (MBD) in January – the highest monthly output on record, according to API’s monthly statistical report. This was an increase of 1.1 percent versus December and 15.1 percent from January 2017.

2018, February, 27, 13:50:00

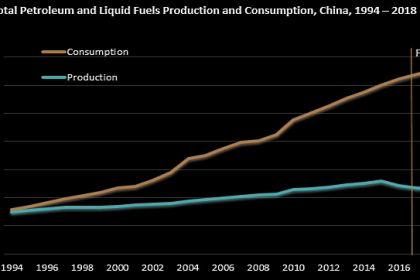

U.S. - CHINA OIL RECORD

PLATTS - China's crude oil imports from the US hit a new record high at 2.01 million mt or 474,450 b/d in January, General Administration of Customs data showed Monday.

2018, February, 27, 13:45:00

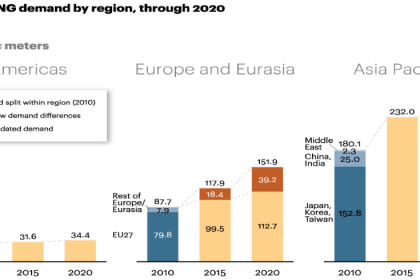

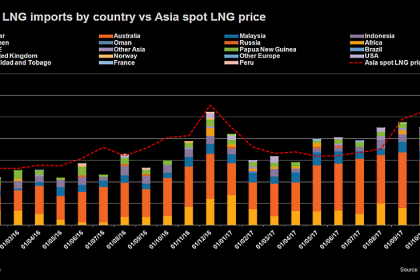

GLOBAL LNG DEMAND UP TO 293 MT

SHELL - The global liquefied natural gas (LNG) market has continued to defy expectations of many market observers, with demand growing by 29 million tonnes to 293 million tonnes in 2017, according to Shell’s annual LNG Outlook. Such strong growth in demand is consistent with Shell’s first LNG Outlook, published in 2017. Based on current demand projections, Shell sees potential for a supply shortage developing in mid-2020s, unless new LNG production project commitments are made soon.

2018, February, 27, 13:40:00

CHINA'S LNG IMPORTS UP BY 46%

EIA - China surpassed South Korea to become the world’s second-largest importer of liquefied natural gas (LNG) in 2017, according to data from IHS Markit and official Chinese government statistics. Chinese imports of LNG averaged 5 billion cubic feet per day (Bcf/d) in 2017, exceeded only by Japanese imports of 11 Bcf/d. Imports of LNG by China, driven by government policies designed to reduce air pollution, increased by 1.6 Bcf/d (46%) in 2017, with monthly imports reaching 7.8 Bcf/d in December.

2018, February, 27, 13:30:00

THE LOWEST U.S. URANIUM

EIA - U.S. uranium concentrate production totaled 2.44 million pounds in 2017, down 16% from 2016 and the lowest annual total since 2.28 million pounds of uranium concentrate was produced in 2004. Domestic concentrate production peaked at 43.7 million pounds in 1980 but has remained lower than 5 million pounds annually since 1997.

2018, February, 27, 13:15:00

NORWAY'S OIL UP 89 TBD

NPD - Preliminary production figures for January 2018 show an average daily production of 2 019 000 barrels of oil, NGL and condensate, which is an increase of 89 000 barrels per day compared to December.

2018, February, 27, 13:10:00

NOVATEK'S PROFIT DOWN BY 39.3%

NOVATEK - Profit attributable to shareholders of PAO NOVATEK decreased to RR 156.4 billion (RR 51.85 per share), or by 39.3%, as compared to 2016.

2018, February, 27, 13:00:00

U.S. RIGS UP 3 TO 978

BAKER HUGHES A GE - U.S. Rig Count is up 3 rigs from last week at 978, with oil rigs up 1 to 799, gas rigs up 2 at 179, and miscellaneous rigs unchanged.

Canada Rig Count is down 12 rigs from last week to 306, with oil rigs down 9 to 209 and gas rigs down 3 to 97.

2018, February, 16, 23:45:00

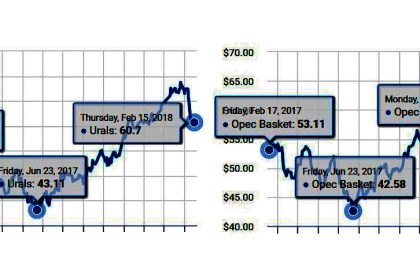

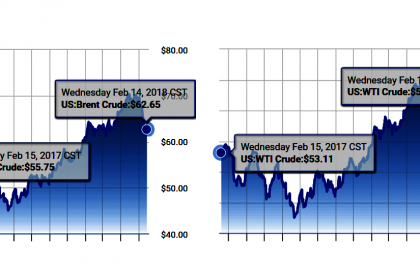

OIL PRICE: ABOVE $64 AGAIN

REUTERS - NYMEX crude for March delivery CLc1 was up 17 cents, or 0.3 percent, at $61.51 a barrel by 0750 GMT, after earlier touching a one-week high of $61.82. For the week, the contract has risen about 4 percent after losing nearly 10 percent last week.

London Brent crude LCOc1 was up 25 cents, or 0.4 percent, at $64.58 after settling down 3 cents. Brent is up nearly 3 percent for the week after falling more than 8 percent last week.

2018, February, 16, 23:35:00

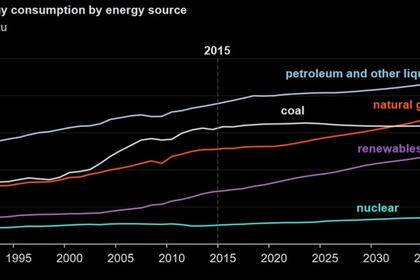

ФУНДАМЕНТАЛЬНЫЕ ПРЕОБРАЗОВАНИЯ РЫНКА

МИНЭНЕРГО РОССИИ - Александр Новак поделился своим видением будущего углеводородной энергетики: «Она обладает огромным потенциалом цифровизации своих процессов, гибкой подстройки под нужды потребителей. Доля углеводородов, безусловно, будет снижаться, но с учетом роста населения, автопарка, спроса на энергию, абсолютное потребление продолжит расти. Если мы хотим надежно обеспечить мир энергией, нам придется найти разумный баланс между традиционной и новой энергетикой».

2018, February, 16, 23:10:00

TRANSCANADA NET INCOME $3.0 BLN

TRANSCANADA - TransCanada Corporation (TSX:TRP) (NYSE:TRP) (TransCanada or the Company) announced net income attributable to common shares for fourth quarter 2017 of $861 million or $0.98 per share compared to a net loss of $358 million or $0.43 per share for the same period in 2016. For the year ended December 31, 2017, net income attributable to common shares was $3.0 billion or $3.44 per share compared to net income of $124 million or $0.16 per share in 2016.

2018, February, 16, 23:00:00

U.S. INDUSTRIAL PRODUCTION DOWN 0.1%

FRB - Industrial production edged down 0.1 percent in January following four consecutive monthly increases. Manufacturing production was unchanged in January. Mining output fell 1.0 percent, with all of its major component industries recording declines, while the index for utilities moved up 0.6 percent. At 107.2 percent of its 2012 average, total industrial production was 3.7 percent higher in January than it was a year earlier. Capacity utilization for the industrial sector fell 0.2 percentage point in January to 77.5 percent, a rate that is 2.3 percentage points below its long-run (1972–2017) average.

2018, February, 14, 10:20:00

OIL PRICE: ABOVE $62

REUTERS - Brent futures LCOc1 hit a two-month low early in the day’s session, but the benchmark settled at $62.72 a barrel, up 13 cents or 0.2 percent. U.S. West Texas Intermediate crude futures CLc1 closed 10 cents, or 0.2 percent, lower at $59.19 a barrel.