Analysis

2017, August, 7, 08:45:00

U.S. RIGS DOWN 4 TO 954

U.S. Rig Count is up 490 rigs from last year's count of 464, with oil rigs up 384, gas rigs up 108, and miscellaneous rigs down 2 to 0.

Canadian Rig Count is up 95 rigs from last year's count of 122, with oil rigs up 64, gas rigs up 33, and miscellaneous rigs down 2 to 0.

2017, August, 3, 12:50:00

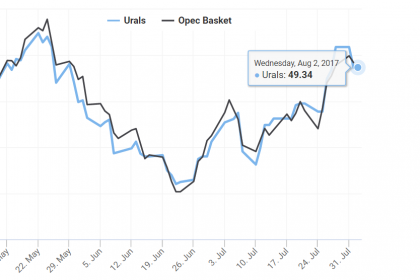

OIL PRICE: ABOVE $52 YET

Benchmark Brent crude was up 20 cents a barrel at $52.56 by 0920 GMT. U.S. light crude was 20 cents higher at $49.79.

2017, August, 3, 12:05:00

BP PROFIT $553 MLN

“We continue to position BP for the new oil price environment, with a continued tight focus on costs, efficiency and discipline in capital spending. We delivered strong operational performance in the first half of 2017 and have considerable strategic momentum coming into the rest of the year and 2018, with rising production from our new Upstream projects and marketing growth in the Downstream.”

2017, August, 3, 09:21:00

NABORS NET LOSS $282 MLN

Nabors Industries Ltd. ("Nabors" or the "Company") (NYSE: NBR) reported second quarter 2017 operating revenues of $631 million, compared to operating revenues of $563 million in the prior quarter. Net income from continuing operations attributable to Nabors for the quarter was a loss of $117 million, or $0.41 per diluted share, compared to a loss of $149 million, or $0.52 per diluted share, in the first quarter of 2017. The second quarter results include $7.3 million in net after-tax charges, or $0.03 per diluted share, primarily due to premiums paid on a debt redemption.

2017, July, 31, 14:30:00

ВВП РОССИИ: БОЛЬШЕ НА 2,7%

Минэкономразвития России скорректировало оценку темпа роста ВВП за май до 3,5% г/г. В июне 2017 года рост ВВП, по оценке, составил 2,9% г/г, темп роста ВВП во 2 кв. 2017 г. оценивается в 2,7% г/г.

2017, July, 31, 14:15:00

EXXON EARNINGS $3.35 BLN

Exxon Mobil Corporation announced estimated second quarter 2017 earnings of $3.4 billion, or $0.78 per diluted share, compared with $1.7 billion a year earlier, as oil and gas realizations increased and refining margins improved.

2017, July, 31, 14:10:00

CHEVRON EARNINGS $1.45 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $1.5 billion ($0.77 per share – diluted) for second quarter 2017, compared with a loss of $1.5 billion ($0.78 per share – diluted) in the second quarter of 2016. Included in the quarter were impairments and other non-cash charges totaling $430 million, partially offset by gains on asset sales of $160 million. Foreign currency effects increased earnings in the 2017 second quarter by $3 million, compared with an increase of $279 million a year earlier.

2017, July, 31, 14:05:00

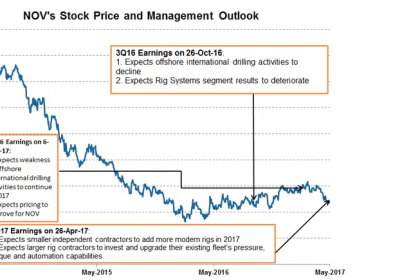

NOV VARCO NET LOSS $75 MLN

National Oilwell Varco, Inc. (NYSE: NOV) reported a second quarter 2017 net loss of $75 million, or $0.20 per share. Excluding other items, net loss for the quarter was $54 million, or $0.14 per share. Other items totaled $30 million, pretax, and primarily consisted of charges related to severance and facility closures.

2017, July, 31, 14:00:00

U.S. RIGS UP 8 TO 958

U.S. Rig Count is up 495 rigs from last year's count of 463, with oil rigs up 392, gas rigs up 106, and miscellaneous rigs down 3 to 0.

Canadian Rig Count is up 101 rigs from last year's count of 119, with oil rigs up 69, gas rigs up 33, and miscellaneous rigs down 1 to 0.

2017, July, 29, 09:31:00

WEATHERFORD NET LOSS $171 MLN

Weatherford International plc (NYSE: WFT) reported a net loss of $171 million, or a loss of $0.17 per share, and a non-GAAP net loss of $282 million before charges and credits ($0.28 non-GAAP loss per share) on revenues of $1.36 billion for the second quarter of 2017.

2017, July, 28, 10:00:00

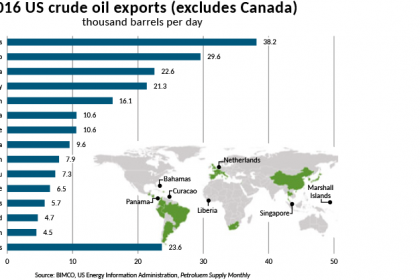

U.S. - CHINA OIL RECORD

China's import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an opportunity to diversify supplies, a trend that could add to the headache of OPEC suppliers.

2017, July, 28, 09:45:00

SHELL INCOME $1.55 BLN

Royal Dutch Shell Chief Executive Officer Ben van Beurden commented: “Shell’s strong results this quarter show that we are reshaping the company following the integration of BG.

Cash generation has been resilient over four consecutive quarters, at an average oil price of just under $50 per barrel. This quarter, we generated robust earnings excluding identified items of $3.6 billion, while over the past 12 months cash flow from operations of $38 billion has covered our cash dividend and reduced gearing to 25%.

2017, July, 28, 09:40:00

STATOIL NET INCOME $1.4 BLN

“Our solid financial results and strong cash flow are driven by good operational performance with high production efficiency and continued cost improvements. At oil prices around 50 dollars per barrel, we have generated 4 billion dollars in free cash flow, and reduced our net debt ratio by 8.1 percentage points since the start of the year. We expect to deliver around 5% production growth this year, and at the same time realise an additional one billion dollars in efficiencies,” says Eldar Sætre, President and CEO of Statoil ASA.

2017, July, 28, 09:35:00

TOTAL NET INCOME $2.5 BLN

"In a price environment that remains volatile, Total again delivered an excellent set of quarterly results with adjusted net income of $2.5 billion, a 14% increase compared to a year ago, and operating cash flow before working capital changes of $5.3 billion, a 33% increase, while Brent only increased by 9%. In the first half of the year, the Group generated more than $3.1 billion of cash flow after investments, excluding acquisitions and divestments.

2017, July, 26, 14:40:00

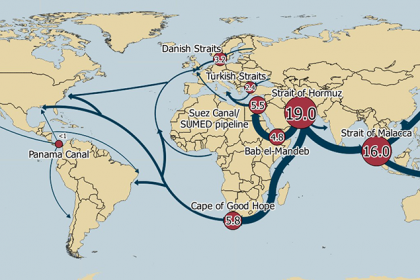

WORLD OIL CHOKEPOINTS

EIA - World chokepoints for maritime transit of oil are a critical part of global energy security. About 61% of the world's petroleum and other liquids production moved on maritime routes in 2015. The Strait of Hormuz and the Strait of Malacca are the world's most important strategic chokepoints by volume of oil transit.