Analysis

2024, September, 9, 06:20:00

WORLDWIDE RIG COUNT UP 22 TO 1,735

The Worldwide Rig Count for August was 1,735, up 22 from the 1,713 counted in July 2024, and down 53, from the 1,788 counted in August 2023.

2024, September, 6, 07:00:00

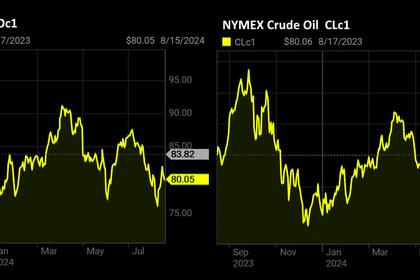

OIL PRICE: BRENT NEAR $73, WTI ABOVE $69

Brent rose 19 cents, or 0.26%, to $72.88, WTI were up 22 cents, or 0.32%, to $69.37.

2024, September, 6, 06:20:00

GLOBAL MARKETS : TRIFLE TAWDRY

Our benchmark BRENT has slipped in further escalating talks of SPR replenishment vis a vis supply conversations amidst the Chinese Data and US PMI data.We are at the confluence of both head and tail winds friends.

2024, September, 3, 07:00:00

OIL PRICE: BRENT ABOVE $77, WTI ABOVE $73

Brent were down 37 cents, or 0.48%, to $77.15 a barrel. WTI was 28 cents up from its Friday close of $73.55.

2024, September, 3, 06:55:00

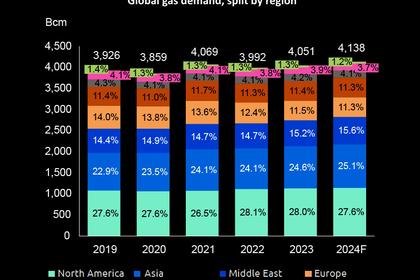

GLOBAL GAS DEMAND RISE

Global gas demand sustained its growth in 2023, increasing 59 Bcm (1.5%) from 2022. This trend is expected to continue in 2024 with a further estimated ~87 Bcm (2.1%) rise in demand.

2024, September, 3, 06:45:00

EUROPEAN GAS PRICES WILL RISE

Russian gas is delivered to Turkey via the Blue Stream and TurkStream pipelines, while a number of countries in southeast and central Europe still import Russian gas via TurkStream and onshore pipeline infrastructure.

2024, August, 28, 07:00:00

OIL PRICE: BRENT NEAR $80, WTI NEAR $76

Brent were up 25 cents, or 0.31%, at $79.80 a barrel, WTI rose 17 cents, or 0.23%, to trade at $75.70.

2024, August, 28, 06:25:00

EUROPEAN GAS PRICES UP ANEW

Benchmark futures rose as much as 2.4% on Monday. The market has been sensitive to geopolitical events and outages this summer, even with storage sites exceeding targets ahead of Europe’s heating season.

2024, August, 22, 07:00:00

OIL PRICE: BRENT NEAR $76, WTI NEAR $72

Brent were 3 cents up to $76.08 a barrel, WTI fell 5 cents to trade at $71.88.

2024, August, 22, 06:30:00

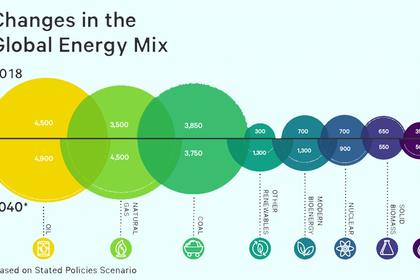

GLOBAL ENERGY SYSTEM CHANGES

Clean energy technologies like solar, wind, electric cars, and heat pumps seem to be reshaping the power that we deploy today in factories, vehicles, home appliances and heating systems.

2024, August, 15, 07:00:00

OIL PRICE: BRENT NEAR $80, WTI ABOVE $77

Brent climbed 17 cents, or 0.21%, to $79.93 a barrel, WTI increased by 21 cents, or 0.27%, to $77.19 per barrel.

2024, August, 15, 06:45:00

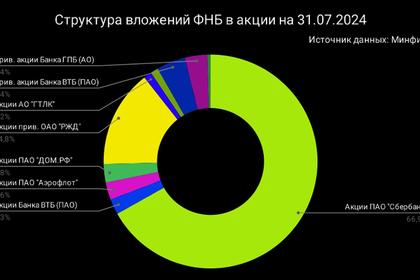

ФНБ РОССИИ $142,2 МЛРД.

По состоянию на 1 августа 2024 г. объем ФНБ составил 142 216,0 млн долл. США.

2024, August, 15, 06:40:00

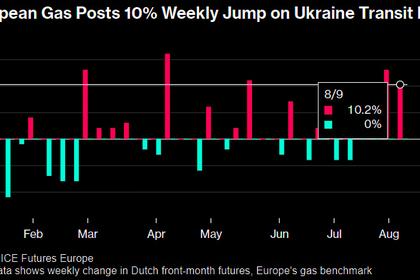

EUROPEAN GAS PRICES UP

European natural gas prices posted a double-digit advance for a second consecutive week after fears of possible disruptions to Russian fuel supplies crossing Ukraine.

2024, August, 6, 07:00:00

OIL PRICE: BRENT ABOVE $77, WTI NEAR $74

Brent gained 97 cents, or 1.27%, to $77.27 a barrel, WTI climbed $1.14, or 1.56%, to $74.08.

2024, August, 6, 06:25:00

U.S., SWEDEN NUCLEAR COOPERATION

Sweden and the USA have signed a memorandum of understanding aimed at pursuing cooperation in industrial collaboration, technology development, and research and innovation in technologies related to nuclear energy for peaceful purposes.