Finance

2022, March, 11, 12:30:00

СТАБИЛИЗАЦИЯ ЭНЕРГЕТИКИ РОССИИ

Как сообщил вице-премьер, российские компании ТЭК до сих пор не получали письменных обращений от своих иностранных партнёров о выходе из российских проектов.

2022, March, 10, 10:45:00

UAE ENERGY INVESTMENT $163 BLN

"With IRENA forecasting that energy transition investments will have to increase by 30% over planned investment to a total of $131 trillion between now and 2050, the UAE is committed to supporting this transition through domestic and foreign investment. To achieve our ambition, we plan to invest $163 billion to diversify our energy mix."

2022, March, 4, 11:50:00

EXXON LEAVE RUSSIA

ExxonMobil operates the Sakhalin-1 project on behalf of an international consortium of Japanese, Indian and Russian companies.

2022, March, 3, 14:10:00

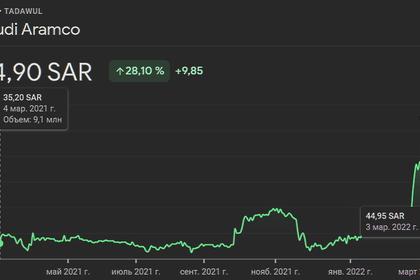

SAUDI ARAMCO $2.3 TLN

Shares in oil giant Aramco touched the highest level in its history of SR43.1 ($11.5) on Wednesday, propelled by a rally in the energy market.

2022, March, 2, 11:20:00

JOINT IMF, WBG STATEMENT

“We are deeply shocked and saddened by the devastating human and economic toll brought by the war in Ukraine. People are being killed, injured, and forced to flee, and massive damage is caused to the country’s physical infrastructure.

2022, March, 2, 11:15:00

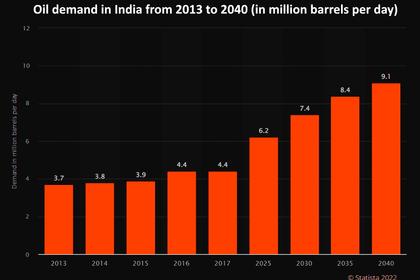

OIL PRICES FOR INDIA

Russia and India in December signed new energy cooperation agreements, including a contract for Rosneft to ship almost 15 million barrels of crude to India in 2022, according to government and company statements.

2022, March, 2, 11:05:00

U.S. OFFSHORE WIND 5.6 GW, $4.4 BLN

The United States aims to instal 30 GW of offshore wind by 2030. At the regional level, New York and New Jersey have set the target of installing 16 GW of offshore wind by 2035.

2022, March, 1, 11:50:00

SHELL LEAVES GAZPROM

The Board of Shell plc (“Shell”) announced its intention to exit its joint ventures with Gazprom and related entities, including its 27.5 percent stake in the Sakhalin-II liquefied natural gas facility, its 50 percent stake in the Salym Petroleum Development and the Gydan energy venture. Shell also intends to end its involvement in the Nord Stream 2 pipeline project.

2022, February, 28, 13:10:00

EUROPEAN, JAPAN RUSSIA SANCTIONS

In response to the tougher sanctions, Russian President Vladimir Putin on Feb. 27 ordered nuclear deterrent forces on high alert, further escalating tension.

2022, February, 28, 13:00:00

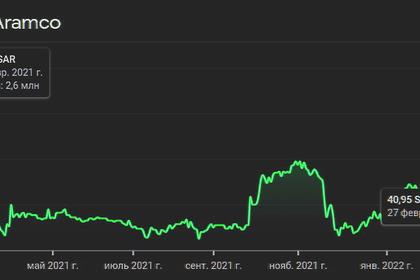

ARAMCO INVESTMENT DEAL $15.5 BLN

The consortium has acquired 49% stake in Aramco Gas Pipelines Company, a subsidiary of Aramco, for $15.5 billion.

2022, February, 28, 12:55:00

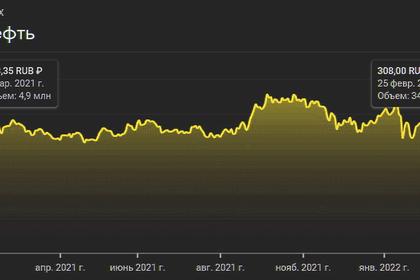

BP LEAVES ROSNEFT

The bp board announced that bp will exit its shareholding in Rosneft. bp has held a 19.75% shareholding in Rosneft since 2013.

2022, February, 28, 12:50:00

EQUINOR LEAVES RUSSIA

Equinor's (OSE: EQNR, NYSE: EQNR) Board of Directors has decided to stop new investments into Russia, and to start the process of exiting Equinor’s Russian Joint Ventures.

2022, February, 28, 12:45:00

NORWAY FUND LEAVES RUSSIA

Norway's $1.3 trillion sovereign wealth fund will pull out of all investments in Russia because of its invasion of Ukraine, the Norwegian government said Feb. 27.

2022, February, 24, 11:50:00

RENEWABLES FOR BRITAIN 2 GW

Copenhagen Infrastructure Partners (CIP) has entered into a partnership with Bute Energy (Bute) to invest in a 2,000 MW portfolio of onshore wind and solar projects, some with co-located battery energy storage systems, under development in Wales (United Kingdom).

2022, February, 23, 12:30:00

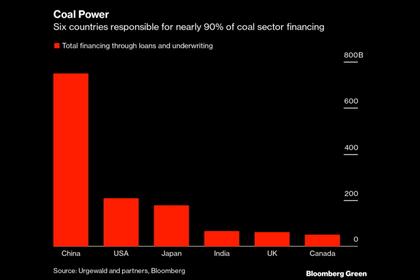

GLOBAL COAL INVESTMENT $1.5 TLN

The world coal industry has secured $363 billion in bank credits in the period from January 2019 to November 2021, and banks continued to support transactions on the sale of securities of companies in the industry, with their combined sum totalling $1.2 trillion.