Finance

2021, November, 19, 11:45:00

CHINA CLEAN COAL SUPPORT $31 BLN

Coal, a major contributor to carbon emissions, accounted for 56.8% of China's primary energy consumption in 2020, down from around 68% a decade earlier.

2021, November, 19, 11:35:00

RUSSIA'S NUCLEAR LOANS FOR TURKEY $0.8 BLN

The bank opened two credit lines (in the amount of $500 million and $300 million) for a period of seven years, Sberbank said on 17 November. The funds will be used for the construction of the plant’s four VVER-1200 reactors.

2021, November, 19, 11:30:00

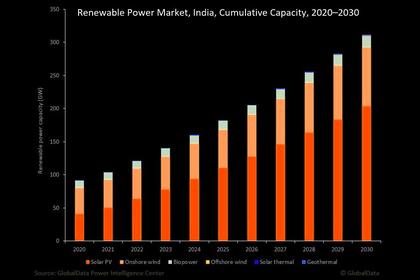

RENEWABLES FOR INDIA 5.5 GW

The renewable capacity additions planned by India's largest coal miner Coal India Ltd. and its subsidiaries, along with other state-run coal miners Singareni Coal Company Ltd. and NLC India Ltd., will see an investment of over Indian Rupees 150 billion ($2.02 billion) by 2030

2021, November, 18, 13:20:00

U.S. LNG FOR JAPAN $2.5 BLN

The Freeport LNG liquefaction terminal comprises three trains with an annual production capacity of approximately 15.45 Mt/year, built by McDermott, Zachry and Chiyoda on the site of an existing LNG import terminal.

2021, November, 18, 13:00:00

ROSNEFT, SHELL DEAL

Rosneft exercised the pre-emption right for 37.5% share of the PCK (Schwedt) refinery from Shell.

2021, November, 17, 13:15:00

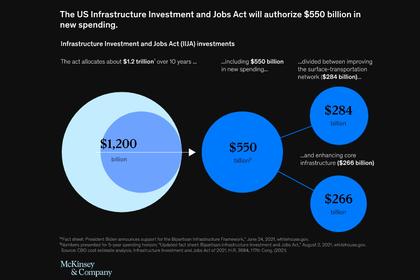

U.S. CLEAN ENERGY LAW

The USD1.2 trillion package is a key part of the president's Build Back Better agenda and contains a total of more than USD62 billion for the US Department of Energy (DOE) to deliver a "more equitable clean energy future", including preventing the premature retirement of existing nuclear plants and investing in advanced nuclear projects.

2021, November, 17, 13:05:00

CHINA RENEWABLE SUBSIDY $600 MLN

China's finance ministry has set the 2022 renewable power subsidy at 3.87 billion yuan ($607.26 million),

2021, November, 16, 14:40:00

RUSSIA'S URANIUM GROWTH

Russia is the world's seventh-largest producer of uranium, with an output of 2,846 t in 2020. The country's uranium reserves reach 256,000 t.

2021, November, 16, 14:30:00

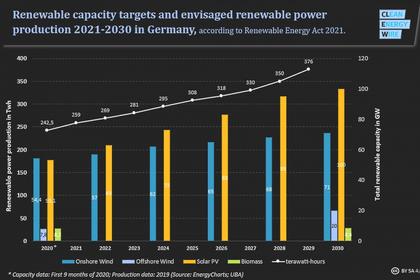

GERMANY RENEWABLE INVESTMENT €50 BLN

RWE aims at tripling its offshore wind capacity by 2030 from 2.4 GW to 8 GW and expanding its onshore wind and solar capacity from 7 GW to 20 GW.

2021, November, 16, 14:25:00

BRITAIN'S RENEWABLE INVESTMENT FOR TURKEY

Russia is the world's seventh-largest producer of uranium, with an output of 2,846 t in 2020. The country's uranium reserves reach 256,000 t.

2021, November, 16, 14:20:00

INDIA RENEWABLES NEED INVESTMENT

India’s energy demand will increase by 35% from 2019 to 2030.

2021, November, 15, 11:40:00

INDIA'S RENEWABLE INVESTMENT $20 BLN

Overall, AGEL's investments in renewables and hydrogen could total US$70bn by 2030.

2021, November, 12, 12:20:00

IRAN GAS INVESTMENT $11 BLN

Gas accounts for around 70% of fuel use in Iran, with the household sector being the largest consumer at up to 400 million cu m/d on cold days, followed by power plants and petrochemical facilities.

2021, November, 11, 15:00:00

THE NEW NUCLEAR FOR FRANCE

This is why, to guarantee France's energy independence, to guarantee our country's electricity supply and achieve our objectives, in particular carbon neutrality in 2050, we are going, for the first time in decades, to relaunch the construction of nuclear reactors in our country and continue to develop renewable energies.

2021, November, 11, 14:40:00

MAERSK, NOBLE COMBINATION

Noble and Maersk shareholders will each hold 50% in the combined entity, which will be named Noble Corp. with headquarters in Houston.