Oil&Gas

2024, January, 29, 06:40:00

CHINA NEED OIL & GAS

CNOOC expects production to continue growing over the next two years, with plans to reach 2.25 million boe/d in 2026.

2024, January, 22, 06:50:00

PHILIPPINES NEED OIL

Beijing’s agenda in the South China Sea may also be spurred by energy interests

2023, December, 6, 06:35:00

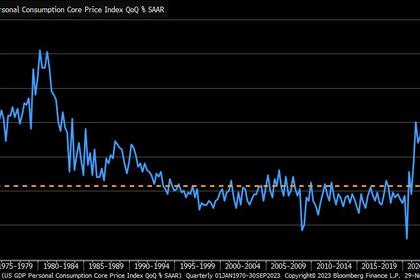

CLIMATIC MARKETS CARTHASIS

Extreme weather events,food supply disruption add urgency to energy transition.Panama Canal drought has effectively reduced carrying capacity due to climate change.

Green deal creating incentives on critical minerals.

2023, November, 23, 06:50:00

RUSSIAN OIL GAS PRODUCTION DOWN

Russia is expected to reduce both oil and natural gas production this year, according to Deputy Prime Minister Alexander Novak. Oil is projected to fall by 8 million tons to 527 million tons, compared to 535 million tons last year, he said.

2023, November, 17, 06:50:00

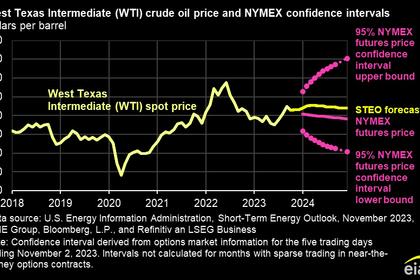

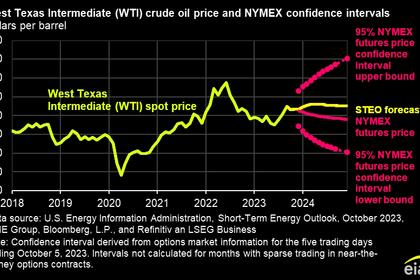

OIL PRICES 2023-24: $90 - $93

The Brent crude oil price will increase from an average of $90 per barrel (b) in the fourth quarter of 2023 to an average of $93/b in 2024.

2023, November, 3, 06:55:00

RUSSIAN OIL, GAS FOR CHINA

Russia is counting on a planned new pipeline to China as it seeks to make up for lost gas sales in Europe, but industry insiders see major political risks around a project that is overly dependent on one buyer and question whether it will justify the huge costs.

2023, November, 3, 06:25:00

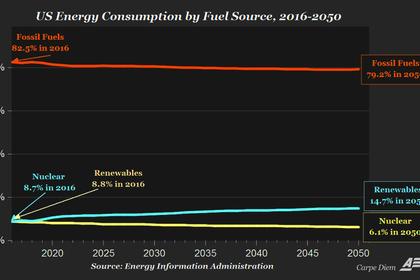

U.S. FOSSIL FUELS CHOICE

In the United States last year, according to the Energy Information Administration, natural gas accounted for 39.9 percent of electricity production; coal, 19.7 percent; nuclear, 18.2 percent; and renewables, the rest, although these are coming on fast.

2023, October, 27, 06:55:00

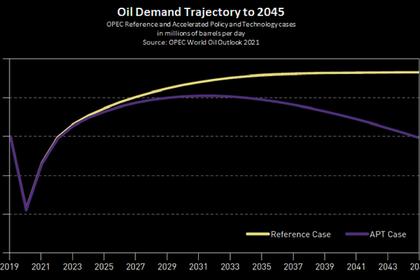

GLOBAL OIL WILL STAY

Prince Abdulaziz said that the energy transition will require hydrocarbons including petrochemicals.

2023, October, 27, 06:50:00

ПРОМЫШЛЕННЫЙ КОНГРЕСС РОССИИ

Национальный промышленный конгресс Prom Space объединяет представителей промышленности, заинтересованных ФОИВ и крупных институтов развития.

2023, October, 27, 06:45:00

ЦИФРОВАЯ ЭНЕРГЕТИКА РОССИИ

Минэнерго России ведёт работу по реализации проектов в рамках функционирования индустриальных центров компетенций (ИЦК) «Нефтегаз, нефтехимия и недропользование»

2023, October, 20, 06:55:00

СОТРУДНИЧЕСТВО РОССИИ, САУДОВСКОЙ АРАВИИ

По итогам семи месяцев 2023 года товарооборот между Россией и Саудовской Аравией вырос почти на 20%. Страны нацелены на дальнейший рост.

2023, October, 20, 06:45:00

СОТРУДНИЧЕСТВО РОССИИ, ВЕНЕСУЭЛЫ

Стороны ведут совместную работу по стабилизации мирового рынка энергоносителей, в том числе в формате ОПЕК+ и Форума стран – экспортёров газа.

2023, October, 13, 06:55:00

СТРАТЕГИЧЕСКОЕ ПАРТНЕРСТВО РОССИИ, ИНДИИ, КИТАЯ

«Китай и Индия – стратегические партнёры России в части выстраивания нового, справедливого энергорынка и торговой инфраструктуры. Реализуются совместные инвестиционные проекты на территориях обеих стран. Прорабатываются или уже имеются планы по расширению трубопроводных мощностей по доставке нефти и газа из России в Китай», – заявил Николай Шульгинов.

2023, October, 13, 06:50:00

OIL PRICES 2023-24: $84 - $95

The Brent spot price increasing to average $95 per barrel (b) in 2024.

2023, October, 6, 06:05:00

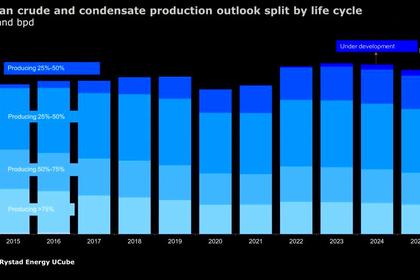

NORWAY OIL, GAS PRODUCTION 2.006 MBD

Preliminary production figures for August 2023 show an average daily production of 2 006 000 barrels of oil, NGL and condensate.