Oil

2019, September, 25, 15:05:00

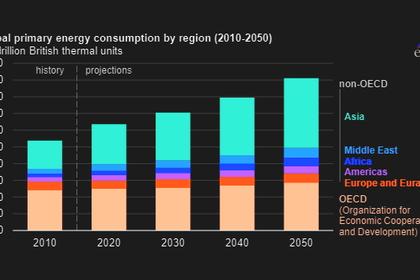

WORLD ENERGY CONSUMPTION WILL UP BY 50%

the U.S. Energy Information Administration (EIA) projects that world energy consumption will grow by nearly 50% between 2018 and 2050. Most of this growth comes from countries that are not in the Organization for Economic Cooperation and Development (OECD), and this growth is focused in regions where strong economic growth is driving demand, particularly in Asia.

2019, September, 25, 15:00:00

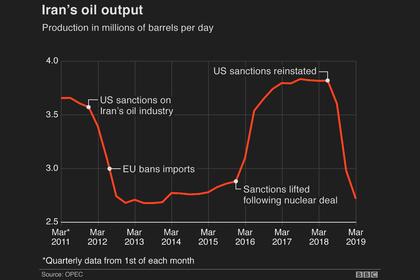

IRAN'S ECONOMY NETWORK

To circumvent U.S. banking and financial sanctions, Iran’s rulers have built up a network of traders, companies, exchange offices, and money collectors in different countries,

2019, September, 25, 14:55:00

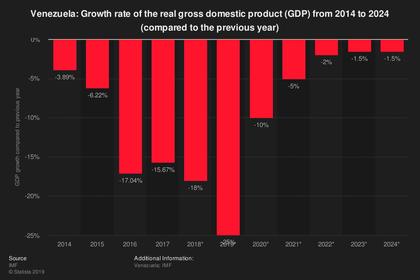

VENEZUELA, CUBA SANCTIONS

Though trade between Venezuela and Cuba has not ceased amid sanctions, the flow of PDVSA’s oil has been insufficient to keep the Communist-ruled island well-supplied. Cubans have faced long lines at gas stations and for public transportation amid lack of vessels to receive imports.

2019, September, 24, 18:15:00

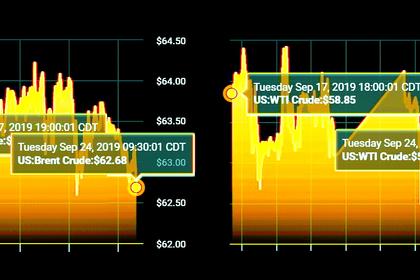

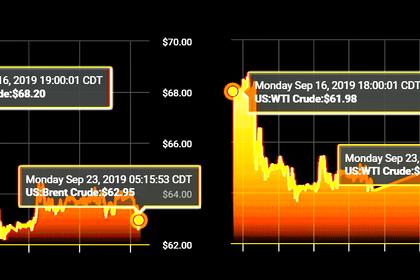

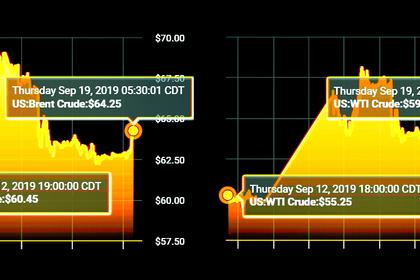

OIL PRICE: ABOVE $62

Brent dropped 58 cents to $64.19 a barrel, WTI were at $58.15, down 49 cents.

2019, September, 24, 17:40:00

NORWAY'S AUGUST PRODUCTION 1.647 MBD

Preliminary production figures for August 2019 show an average daily production of 1 647 000 barrels of oil, NGL and condensate, which is a decrease of 67 000 barrels per day compared to July.

2019, September, 23, 14:30:00

OIL PRICE: NEAR $63

Brent crude fell 30 cents to $63.98 a barrel, WTI was down 38 cents to $57.71.

2019, September, 23, 14:25:00

ПОЛЕЗНЫЕ ИСКОПАЕМЫЕ РОССИИ: 93 411,945 МЛРД. РУБ.

Минприроды России произвело оценку запасов полезных ископаемых в натуральном и стоимостном измерениях по итогам 2018 года и их изменений относительно результатов оценки по итогам 2017 года.

2019, September, 23, 14:00:00

U.S. PETROLEUM DEMAND 21.5 MBD

Total U.S. petroleum demand of 21.5 mb/d was highest for any month since August 2005;

Improved infrastructure helped increase supply and lower prices;

Highest U.S. petroleum exports (8.1 mb/d) for the month of August; and

Total inventories increased year-on-year for the ninth consecutive month.

2019, September, 23, 13:45:00

ROSNEFT INVESTMENT FOR INDIA

Минприроды России произвело оценку запасов полезных ископаемых в натуральном и стоимостном измерениях по итогам 2018 года и их изменений относительно результатов оценки по итогам 2017 года.

2019, September, 23, 13:40:00

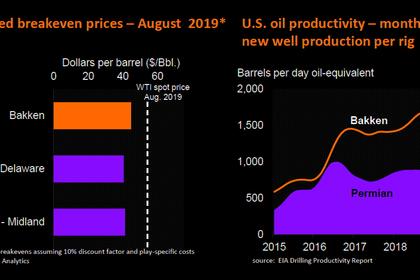

U.S. RIGS DOWN 18 TO 868

U.S. Rig Count is down 18 rigs from last week to 868, with oil rigs down 14 to 719, gas rigs down 5 to 148, and miscellaneous rigs up 1 to 1. Canada Rig Count is down 15 rigs from last week to 119, with oil rigs down 11 to 82 and gas rigs down 4 to 37.

2019, September, 20, 15:45:00

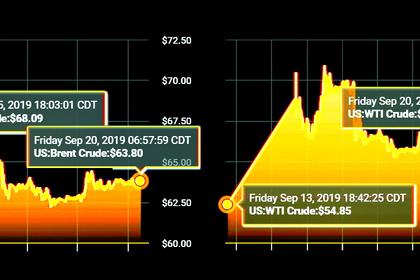

OIL PRICE: NEAR $64

Brent crude LCOc1 was up 7.7% since last Friday’s close, the biggest weekly rise since January. The front-month November contract was at $64.88 a barrel, up 48 cents, by 1113 GMT. U.S. West Texas Intermediate (WTI) crude futures CLc1 rose 59 cents to $58.72 a barrel, set to post a gain of over 7% for the week.

2019, September, 20, 15:30:00

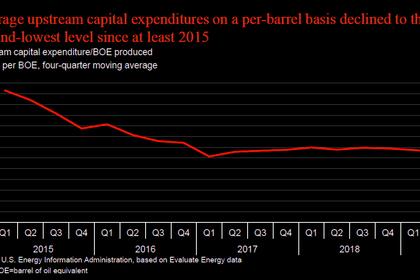

GLOBAL OIL, GAS FINANCES DOWN

Brent crude oil daily average prices were 9% lower in second-quarter 2019 than in second-quarter 2018 and averaged $68 per barrel

2019, September, 20, 15:00:00

PETRONAS PROFIT UP 9% ANEW

Petronas Profit After Tax (PAT) rose 9.0 per cent to RM28.9 billion, from RM26.6 billion in the corresponding period last year. The improved results were delivered on the back of higher revenue, but the increase was partially offset by higher product costs.

2019, September, 19, 14:35:00

OIL PRICE: ABOVE $64

Brent gained $1.44 to $65.04 a barrel, WTI was up 89 cents at $59 a barrel.

2019, September, 19, 14:30:00

КООРДИНАЦИЯ РОССИИ, САУДОВСКОЙ АРАВИИ

в ходе разговора Владимир Путин и Мухаммед Бен Сальман Аль Сауд обсудили ситуацию на глобальном рынке углеводородов, в том числе ход реализации договоренностей в формате ОПЕК+, а также выразили обоюдный настрой на продолжение тесной координации в целях дальнейшей стабилизации мировых цен на нефть