Oil

2018, November, 5, 12:10:00

RUSSIA'S HELP TO IRAN

FT - Russia has vowed to help Iran counter US attempts to throttle its oil sales when sanctions come into effect next week, saying it will continue trading Tehran’s crude in defiance of Washington.

2018, November, 5, 11:50:00

ADNOC'S CAPEX $132 BLN

MEOG - ADNOC plans $132bn Capex until 2023, gas self-sufficiency and oil production capacity of 4mn bpd in 2020

2018, November, 5, 11:45:00

EXXON'S NET INCOME $6.24 BLN

EXXONMOBIL - Exxon Mobil Corporation announced estimated third quarter 2018 earnings of $6.2 billion, or $1.46 per share assuming dilution, compared with $4 billion a year earlier.

2018, November, 2, 12:20:00

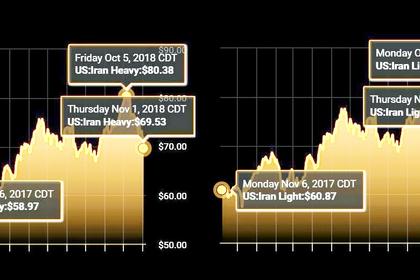

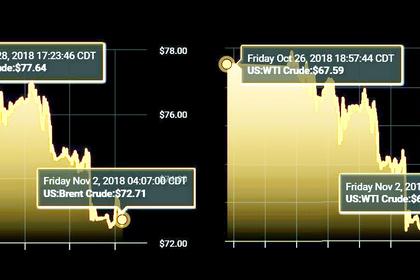

OIL PRICE: NOT ABOVE $73

REUTERS - Front-month Brent crude futures were at $72.88 per barrel at 0737 GMT on Friday, 1 cent below their last close. They first fell on Friday on surging supplies, before rising with global markets and then dipping again on the back of the reported Iran sanctions waivers. U.S. West Texas Intermediate (WTI) crude futures were down 33 cents, or 0.5 percent, at $63.36 a barrel.

2018, November, 2, 12:15:00

СОТРУДНИЧЕСТВО РОССИИ И ГЕРМАНИИ

МИНЭНЕРГО РОССИИ - Александр Новак отметил, что энергетическое сотрудничество России и Германии на сегодняшний день развивается сразу в нескольких направлениях – от поставок природного газа и нефти до энергетического машиностроения в России и производства нефтепродуктов на территории Германии.

2018, November, 2, 12:10:00

ЦЕНА URALS: $71.55

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – октября 2018 года составила $ 71,55 за баррель.

2018, November, 2, 12:05:00

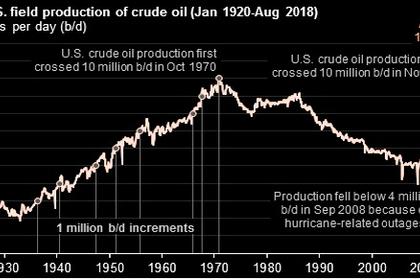

U.S. OIL PRODUCTION 11.3 MBD

U.S. EIA - U.S. crude oil production reached 11.3 million barrels per day (b/d) in August 2018,

2018, November, 2, 11:45:00

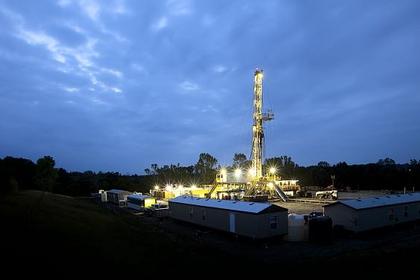

BP - BHP ACQUISITION: $10.5 BLN

BP - BP has completed the $10.5 billion acquisition of BHP’s U.S. unconventional assets in a landmark deal that will significantly upgrade BP’s U.S. onshore oil and gas portfolio and help drive long-term growth.

2018, November, 2, 11:40:00

SHELL EARNINGS $5.6 BLN

SHELL - CCS earnings attributable to shareholders excluding identified items were $5.6 billion, compared with $4.1 billion in the third quarter 2017. Earnings primarily benefited from increased realised oil, gas and LNG prices as well as higher contributions from trading in Integrated Gas, partly offset by lower margins in Downstream, higher deferred tax charges in Upstream and adverse currency exchange effects.

2018, November, 2, 11:35:00

SHELL: THE SECOND BUYBACK

SHELL - Royal Dutch Shell plc (the ‘company’) announces the commencement of trading in the second tranche of its share buyback programme previously announced on July 26, 2018. The company’s intention is to buy back at least $25 billion of its shares by the end of 2020, subject to further progress with debt reduction and oil price conditions.

2018, November, 2, 11:30:00

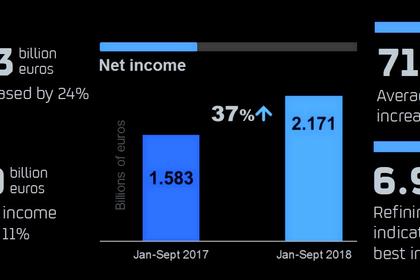

REPSOL NET INCOME €2.171 BLN

REPSOL - Repsol posted net income of 2.171 billion euros in the first nine months of the year, an increase of 37% over the same period of the previous year, and the highest 9-month result in the last decade.

2018, November, 2, 11:25:00

TRANSCANADA'S NET INCOME $928 MLN

TRANSCANADA - TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for third quarter 2018 of $928 million or $1.02 per share compared to net income of $612 million or $0.70 per share for the same period in 2017.

2018, November, 2, 11:20:00

NOBLE NET INCOME $227 MLN

NOBLE ENERGY - The Company reported third quarter net income attributable to Noble Energy of $227 million, or $0.47 per diluted share. Net income including noncontrolling interest was $248 million.

2018, October, 31, 13:20:00

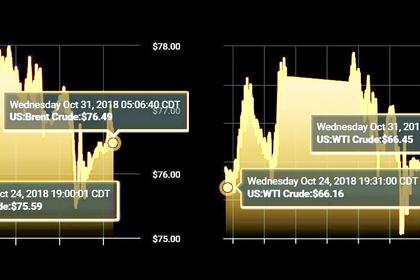

OIL PRICE: NEAR $77 AGAIN

REUTERS - Benchmark Brent crude oil LCOc1 was up 80 cents at $76.71 a barrel by 0840 GMT. The contract fell 1.8 percent on Tuesday, at one point touching its lowest since Aug. 24 at $75.09. U.S. light crude CLc1 was up 60 cents at $66.78. It hit a two-month low of $65.33 a barrel on Tuesday.

2018, October, 31, 13:15:00

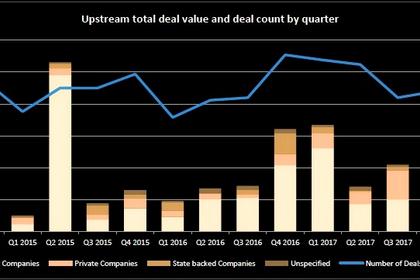

OIL & GAS CONSOLIDATION

PLATTS - Consolidation through the oil and gas sector is heating up, spurred in many cases by too many small companies, lack of operator scale, profits and in the oilfield services segment, an inability to raise prices after the recent downturn, industry executives said