Oil

2018, August, 3, 09:00:00

NOBLE NET LOSS $628 MLN

NOBLE - Noble Corporation plc (NYSE: NE, the Company) reported a net loss attributable to the Company for the three months ended June 30, 2018 of $628 million, or $2.55 per diluted share, on revenues of $258 million. The results included a non-cash charge totaling $793 million, or $2.06 per diluted share, ($507 million, net of tax and noncontrolling interests) relating to the impairment of three rigs and certain capital spares. Excluding the non-cash charge, the Company's net loss attributable to Noble Corporation for the three months ended June 30, 2018 would have been $121 million, or $0.49 per diluted share.

2018, August, 1, 09:40:00

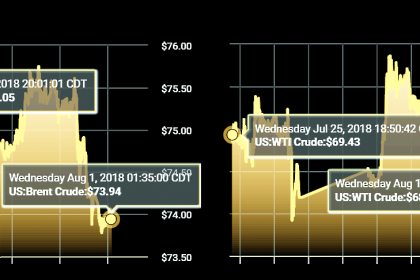

OIL PRICE: NEAR $74 YET

REUTERS - Brent spot crude oil futures dropped 30 cents, or 0.4 percent, to $73.91 a barrel by 0435 GMT, adding to a 1.8 percent loss in the previous session. U.S. crude futures were down 38 cents, or 0.6 percent, at $68.38 a barrel, having dropped nearly 2 percent on Tuesday.

2018, August, 1, 09:30:00

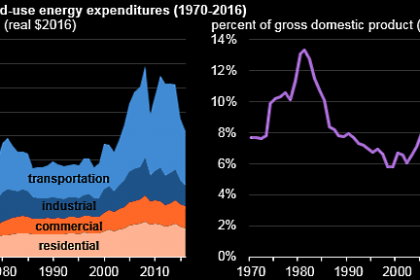

U.S. ENERGY EFFICIENCY UP

U.S. EIA - U.S. energy expenditures declined for the fifth consecutive year, reaching $1.0 trillion in 2016, a 9% decrease in real terms from 2015. Adjusted for inflation, total energy expenditures in 2016 were the lowest since 2003. Expressed as a percent of gross domestic product (GDP), total energy expenditures were 5.6% in 2016, the lowest since at least 1970.

2018, August, 1, 09:25:00

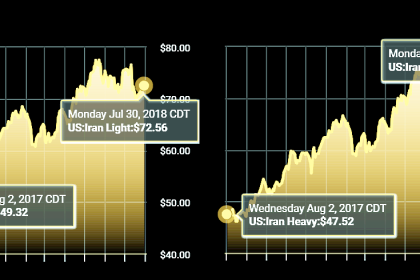

IRANIAN OIL EXPORTS 2.3 MBD

SHANA - Iran exported an average of 2.3 million barrels per day of crude oil to Asian and European countries during the four months. This is while exports for last calendar year's corresponding period stood at 2.115 mbd.

2018, July, 30, 13:55:00

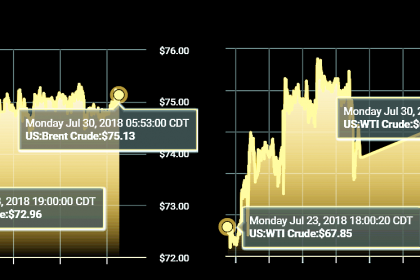

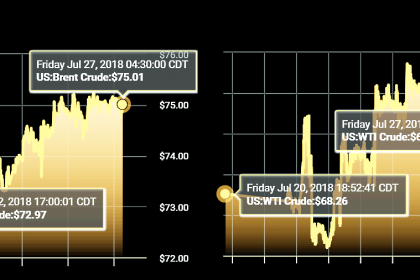

OIL PRICE: NEAR $75 YET

REUTERS - October Brent crude futures were last up 36 cents at $75.12 a barrel by 0902 GMT. The September contract expires on Tuesday. U.S. crude futures were up 78 cents at $69.47 a barrel.

2018, July, 30, 13:50:00

RUSSIA WILL INCREASE OIL PRODUCTION

PLATTS - "We [expect] that some 200,000-250,000 b/d, out of the 300,000 b/d cut under the production cut deal, will be restored [this month]," Novak said on the sidelines of the BRICS summit in Johannesburg, according to a statement by the ministry's press office.

2018, July, 30, 13:40:00

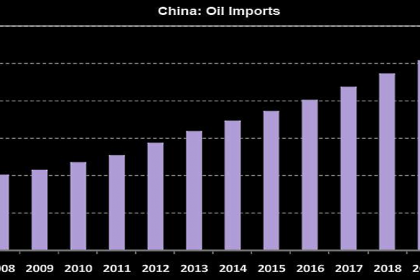

PETROBRAS NEEDS CHINA

REUTERS - The new supply could enlarge Brazil’s market share in China as buyers there cut oil imports from the United States following Beijing’s announcement it would impose tariffs on U.S. crude in retaliation against similar moves by Washington.

2018, July, 30, 13:30:00

EXXONMOBIL EARNINGS $4 BLN

EXXONMOBIL - Exxon Mobil Corporation announced estimated second quarter 2018 earnings of $4 billion, or $0.92 per share assuming dilution, compared with $3.4 billion a year earlier. Cash flow from operations and asset sales was $8.1 billion, including proceeds associated with asset sales of $307 million. During the quarter, the corporation distributed $3.5 billion in dividends to shareholders. Capital and exploration expenditures were $6.6 billion, up 69 percent from the prior year, reflecting key investments in Brazil, the U.S. Permian Basin and Indonesia.

2018, July, 30, 13:25:00

CHEVRON EARNINGS $3.4 BLN

CHEVRON - Chevron Corporation (NYSE: CVX) reported earnings of $3.4 billion ($1.78 per share – diluted) for second quarter 2018, compared with $1.5 billion ($0.77 per share – diluted) in the second quarter of 2017. Included in the current quarter was a receivable write-down of $270 million charged to operating expense. Foreign currency effects increased earnings in the 2018 second quarter by $265 million, compared with an increase of $3 million a year earlier.

2018, July, 30, 13:20:00

ENI NET PROFIT €1.2 BLN

ENI - Group results

Adjusted operating profit: €2.56 billion, up by 152% on a quarterly basis; €4.94 billion in the first half (up by 73% vs. first half of 2017).

Adjusted net profit: €0.77 billion, up by 66% q-o-q; €1.74 billion, up by 45% in the first half of 2018.

Net profit: €1.25 billion in the second quarter (€2.20 billion in the first half).

2018, July, 30, 13:15:00

WEATHERFORD NET LOSS $264 MLN

WEATHERFORD - Weatherford’s non-GAAP net loss for the second quarter of 2018, which excludes unusual charges and credits, was $156 million,

or $0.16, diluted loss per share. This compares to a $188 million non-GAAP net loss in the prior quarter, or $0.19 diluted loss per share, and a $282 million non-GAAP net loss for the second quarter of 2017, or $0.28 diluted loss per share.

2018, July, 27, 12:53:57

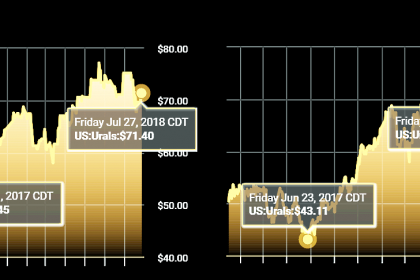

OIL PRICE: ABOVE $74 YET

REUTERS - Brent futures were down 5 cents at $74.49 a barrel by 0319 GMT, after gaining 0.8 percent on Thursday. They are heading for a near 2 percent gain this week, the first weekly increase in four. U.S. West Texas Intermediate futures were 5 cents lower, at $69.56, after rising nearly 0.5 percent in the previous session. The contract is heading for a 1.3 percent weekly loss, a fourth week of declines.

2018, July, 27, 12:50:00

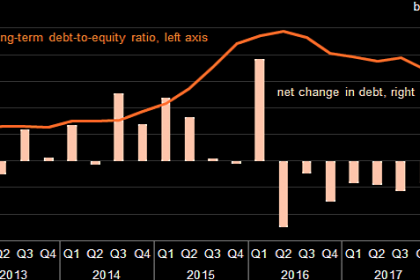

U.S. OIL INVESTMENT UP, DEBT DOWN

EIA - Capital expenditures for these 46 companies totaled almost $19 billion in the first quarter of 2018, a year-over-year increase of nearly $2 billion (10%). Most of these companies have announced that they expect to increase full-year 2018 capital expenditures from 2017 levels.

2018, July, 27, 12:45:00

U.S. OIL TO CHINA DOWN

PLATTS - China's crude oil imports from the US for July have fallen sharply from June, and are expected to drop even further for August, vessel tracking data showed, as Beijing's tariffs on US crude imports get closer to implementation.

2018, July, 27, 12:20:00

SHELL EARNINGS $4.7 BLN

SHELL - the main numbers for this quarter:

$4.7 billion earnings on a current cost of supplies basis excluding identified items.

$9.5 billion cash flow from operations

$9.5 billion free cash flow

and all of this at an oil price of $74 per barrel.

Return on average capital employed reached 6.5%.

Since the beginning of the year we reduced net debt by some $4 billion and gearing was 23.6% at the end of the second quarter.

This performance builds upon the strong results delivered in 2017.