Trends

2017, July, 14, 09:45:00

EIA OIL PRICES FORECASTS: $51 - $52

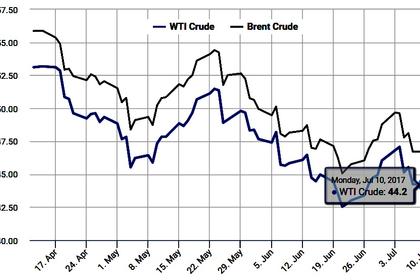

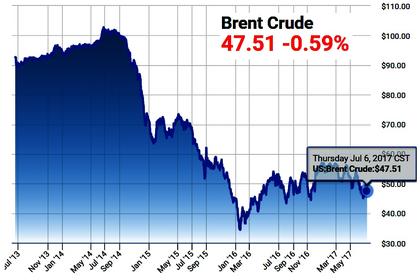

EIA now forecasts Brent crude oil spot prices to average $51 per barrel (b) in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are expected to be $2/b lower than Brent prices in 2017 and 2018.

2017, July, 14, 09:40:00

BP: EXCELLENCE, SUSTAINABILITY, COLLABORATION

I think there are three areas where we should focus our efforts.

The first is excellence in our operations, or as this session’s title puts it, leadership in responsible operations.

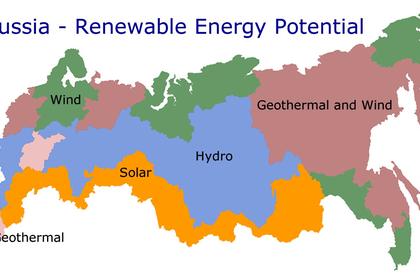

The second, is sustainability in our products - fully realising the benefits of both natural gas and renewables as well as our Downstream product range.

And the third is collaboration, or simply working together, in our partnerships - the kind of working together that makes new things happen and drives real change.

2017, July, 14, 09:35:00

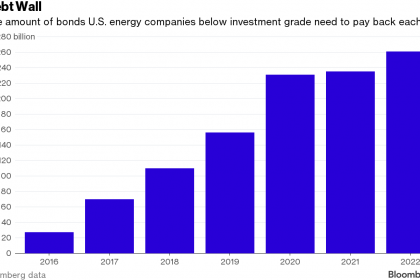

U.S. OIL DEBT

From 2012 through the end of 2015, debt was a significant source of capital for the producers included in the analysis, with the addition of a cumulative $55.3 billion in net debt. Since the beginning of 2016, however, these producers have reduced debt by $1.4 billion. The combination of higher equity and lower debt has resulted in the long-term debt-to-equity ratio, a measure of financial leverage, declining from 88% to 80% for the group of companies as a whole between the first quarter of 2016 and the first quarter of 2017.

2017, July, 14, 09:30:00

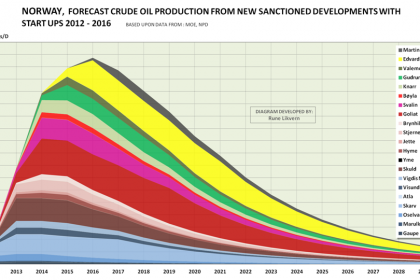

NORWAY'S PRODUCTION DOWN 116 TBD

Preliminary production figures for June 2017 show an average daily production of 1 884 000 barrels of oil, NGL and condensate, which is a decrease of 116 000 barrels per day compared to May.

2017, July, 12, 14:35:00

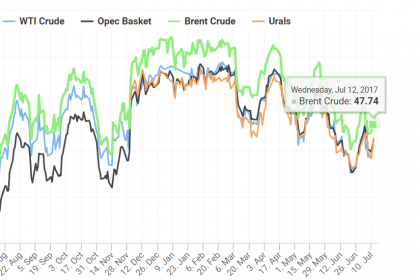

OIL PRICES: ABOVE $48

Oil prices rose more than 1 percent on Wednesday, extending gains from the previous day as the U.S. government cut its crude production outlook for next year and as fuel inventories plunged.

Brent crude futures were up 60 cents, or 1.3 percent, at $48.12 per barrel by 0657 GMT, while U.S. West Texas Intermediate (WTI) crude futures were at $45.72 per barrel, up 68 cents, or 1.5 percent.

2017, July, 12, 14:25:00

РОСТ ПОТРЕБЛЕНИЯ ЭНЕРГИИ

«Будет происходить глубинное переформатирование географической структуры рынка – так, при ожидаемой стагнации или уменьшении объемов энергопотребления в странах ОЭСР, центр роста потребления сместится в страны Азии, Ближнего Востока, Африки, где потребление вырастет не менее чем в 1,5 раза»

2017, July, 12, 14:20:00

СНИЖЕНИЕ ЗАПАСОВ НЕФТИ

«Мы должны выйти на балансировку рынка и снижение запасов до среднего пятилетнего уровня к 1 апреля следующего года»

2017, July, 12, 14:10:00

IEA: ENERGY INVESTMENT UPDOWN

Total energy investment worldwide in 2016 was just over $1.7 trillion, accounting for 2.2% of global GDP. Investment was down by 12% compared to IEA’s revised 2015 energy investment estimate of $1.9 trillion.

2017, July, 12, 14:05:00

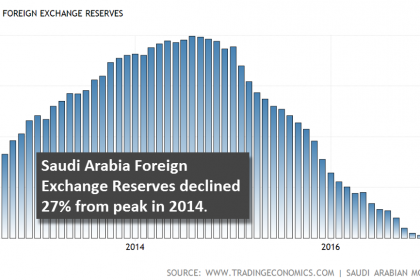

SAUDI ARAMCO INVESTMENT: $300 BLN

“Saudi Aramco plans to invest more than $300 billion over the coming decade to reinforce our preeminent position in oil, maintain our spare oil production capacity and pursue a large exploration and production program centered on conventional and unconventional gas resources.”

2017, July, 10, 12:30:00

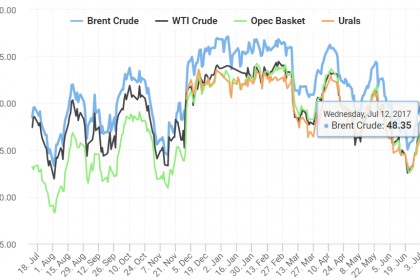

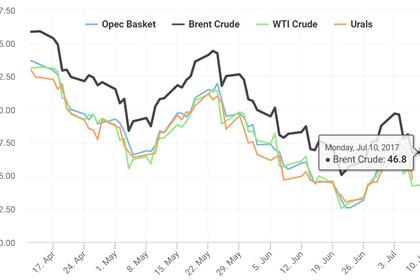

OIL PRICES: ABOVE $46

Brent crude futures, the international benchmark for oil prices, were at $47.08 per barrel at 0537 GMT, up 37 cents, or 0.8 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures were at $44.60 per barrel, up 37 cents, or 0.8 percent.

2017, July, 10, 12:25:00

ENERGY PRICES DOWN MORE

Because two major crude oil price benchmarks, West Texas Intermediate (WTI) and Brent, account for 70% of the weighting in the S&P GSCI energy index, the energy index tends to follow major price movements in the crude oil market. During the first half of 2017, WTI crude oil prices declined by 12%, while Brent prices fell 14%.

2017, July, 10, 12:20:00

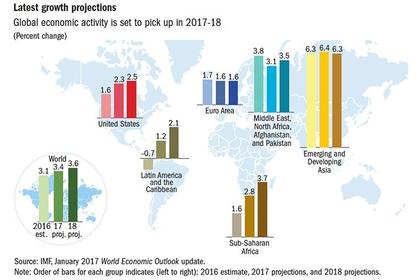

IMF NEEDS SAFEGUARD

“The current period of growth should be used as an opportunity: to further safeguard the financial sector--by building up capital buffers and strengthening corporate and bank balance sheets; to address the issue of stagnant real wages--which can undermine the recovery and fuel discontent; and to confront the problem of excessive current account imbalances--with both surplus and deficit countries playing their part."

2017, July, 10, 12:01:00

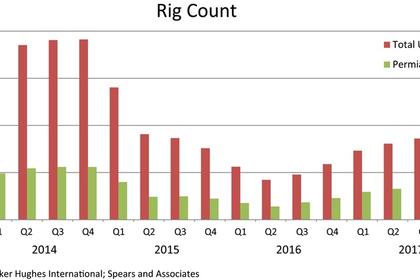

U.S. RIGS UP 12 TO 952

U.S. Rig Count is up 512 rigs from last year's count of 440, with oil rigs up 412, gas rigs up 101, and miscellaneous rigs down 1 to 0.

Canadian Rig Count is up 94 rigs from last year's count of 81, with oil rigs up 68, gas rigs up 27, and miscellaneous rigs down 1 to 0.

2017, July, 7, 08:15:00

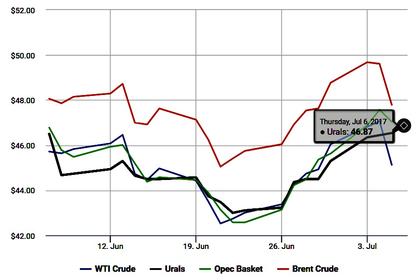

OIL & GAS PRICES: DOWN TO $47

The August light, sweet crude contract on NYMEX dropped $1.94 on July 5 to settle at $45.13/bbl. The September contract was down $1.95 to close at $45.34/bbl.

The NYMEX natural gas price for August declined 11¢ to a rounded $2.84/MMbtu. The Henry Hub cash gas price was $2.90/MMbtu on July 5, down 4¢ from June 30, the last available price for the US gas spot price.

The Brent crude contract for September on London’s ICE decreased $1.82 to $47.79/bbl while the October contract dropped $1.83 to $48.07/bbl. The July gas oil contract was down $6.75 to $442.25/tonne.

The Organization of Petroleum Exporting Countries’ basket of crudes on July 5 was $47.04/bbl, down 53¢.

2017, July, 7, 08:10:00

MARKET WILL BE BETTER

Novak said prices had room to rise from current levels and said inventories in industrialized nations were expected to ease back to the five-year average thanks to the decision by OPEC and its allies to extend supply curbs from the first half of 2017 to the first quarter of 2018.