Trends

2017, October, 25, 12:20:00

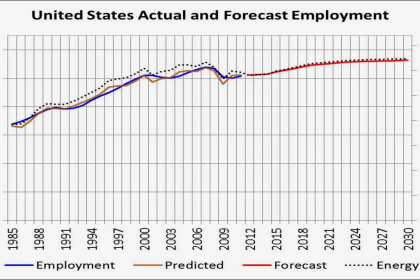

U.S. ECONOMY & EMPLOYMENT 2016 - 2026

Changing demographics in the population will have far-reaching effects on the labor force, the economy, and employment over the 2016–26 decade. The overall labor force participation rate is projected to decline as older workers leave the labor force, constraining economic growth. The aging baby-boomer segment of the population will drive demand for healthcare services and related occupations.

2017, October, 25, 12:15:00

RENEWABLE INVESTMENT $3.7 BLN

A group of private-equity investors led by New York-based Global Infrastructure Partners and China’s sovereign wealth fund will acquire a portfolio of Asian wind and solar energy projects from Singapore-based Equis Pte Ltd for $3.7bn.

2017, October, 25, 10:53:00

NABORS NET LOSS $430 MLN

Nabors Industries Ltd. ("Nabors" or the "Company") (NYSE: NBR) reported third-quarter 2017 operating revenues of $662 million, compared to operating revenues of $631 million in the second quarter of 2017. The net loss from continuing operations, attributable to Nabors, for the current quarter was $121 million, or $0.42 per diluted share, compared to a loss of $117 million, or $0.41 per diluted share, last quarter.

2017, October, 23, 11:45:00

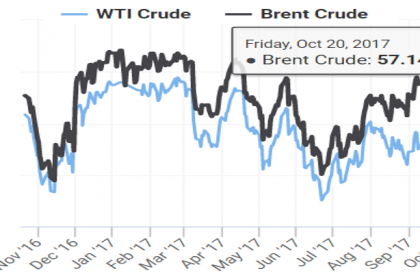

OIL PRICE: STILL ABOVE $57

Brent crude futures were at $57.87 at 0622 GMT, up 12 cents, or 0.21 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude was at $52.04 per barrel, up 20 cents, or 0.39 percent.

2017, October, 23, 11:40:00

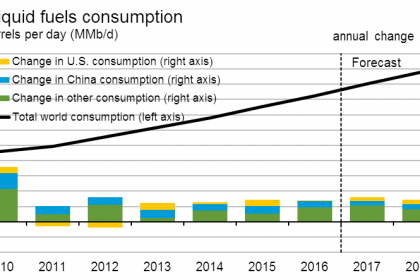

U.S. PETROLEUM DEMAND UP TO 2.4%

Total petroleum deliveries increased 2.4 percent from September 2016. These September deliveries were the highest September deliveries in a decade. For the third quarter 2017, total petroleum deliveries, a measure of U.S. petroleum demand, increased 2.1 percent from the same period last year to nearly 20.4 million barrels per day. For year to date 2017, total domestic petroleum deliveries increased 1.2 percent compared to the same period last year.

2017, October, 23, 11:30:00

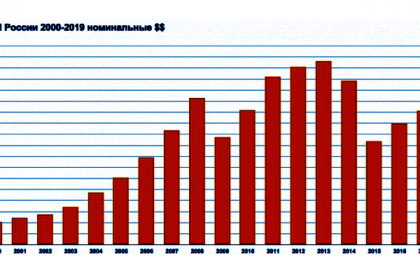

РОССИЯ: РОСТ КОНКУРЕНТОСПОСОБНОСТИ

Мы должны будем увидеть рост конкурентоспособности за счёт снижения себестоимости продукции, технологическое обновление в проблемных секторах, в том числе в жилищно-коммунальном хозяйстве. Достигнем заданных целей по Парижскому соглашению. И, конечно же, высвобождающиеся энергоресурсы будут способствовать дополнительному экономическому росту.

2017, October, 23, 11:25:00

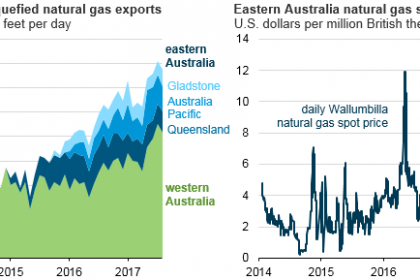

AUSTRALIAN LNG UP ANEW

Australia became the world’s second-largest exporter of liquefied natural gas (LNG) in 2015 and is likely to overtake Qatar as the world’s largest LNG exporter by 2019. As Australia’s LNG exports have increased, primarily from LNG projects in eastern Australia, the country has had natural gas supply shortages in eastern and southeastern Australia and an increase in domestic natural gas prices.

2017, October, 23, 11:20:00

U.S. DEFICIT - 2017: $666 BLN

U.S. Treasury Secretary Steven T. Mnuchin and Office of Management and Budget (OMB) Director Mick Mulvaney today released details of the fiscal year (FY) 2017 final budget results. The deficit in FY 2017 was $666 billion, $80 billion more than in the prior fiscal year, but $36 billion less than forecast in the FY 2018 Mid-Session Review (MSR). As a percentage of Gross Domestic Product (GDP), the deficit was 3.5 percent, 0.3 percentage point higher than the previous year.

2017, October, 23, 11:15:00

LIBYAN OIL PRODUCTION 1 MBD

Libya’s oil production increased steeply to the current level of 850,000 b/d from a low point in August 2016 of below 300,000 b/d. Production surpassed 1 million b/d in July.

2017, October, 23, 11:10:00

SCHLUMBERGER NET INCOME $545 MLN

- Revenue of $7.9 billion increased 6% sequentially

- Pretax operating income of $1.1 billion increased 11% sequentially

- GAAP EPS, including Cameron integration-related charges of $0.03 per share, was $0.39

- EPS, excluding Cameron integration-related charges, was $0.42

- Cash flow from operations was $1.9 billion; free cash flow was $1.1 billion

2017, October, 23, 11:05:00

BAKER HUGHES NET LOSS $104 BLN

“The combination of GE Oil & Gas and Baker Hughes closed on July 3, and we are pleased with our progress during our first operating quarter. Despite the continuing challenging environment, we delivered solid orders growth and secured important wins from customers, advanced existing projects and enhanced our technology offerings in the quarter. We also achieved key integration milestones and made significant progress working as a combined company. I am now more convinced than ever that we combined the right companies at the right time,” said Lorenzo Simonelli, BHGE chairman and chief executive officer.

2017, October, 23, 11:00:00

U.S. RIGS DOWN 15 TO 913

U.S. Rig Count is up 360 rigs from last year's count of 553, with oil rigs up 293, gas rigs up 69, and miscellaneous rigs down 2 to 2.

Canada Rig Count is up 59 rigs from last year's count of 143, with oil rigs up 38 and gas rigs up 21.

2017, October, 20, 12:40:00

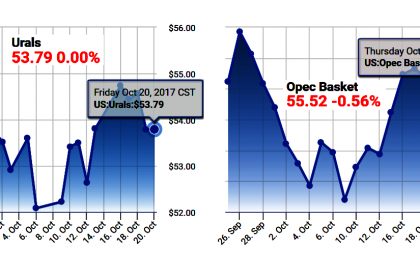

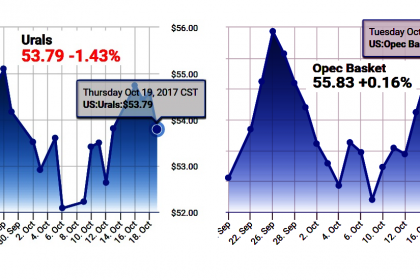

OIL PRICE: ABOVE $56 AGAIN

Brent crude futures LCOc1, the international benchmark for oil prices, were at $57.45 at 0639 GMT, up 22 cents, or 0.4 percent from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $51.54 per barrel, up 25 cents, or 0.5 percent.

2017, October, 20, 12:35:00

OPEC AND RUSSIA CUTTING

Russia’s readiness to back an extension of the supply cuts agreement between Opec and its allies until the end of 2018 has prompted oil ministers to seek widespread support for the proposal, Opec’s secretary-general said on Thursday.

2017, October, 20, 12:30:00

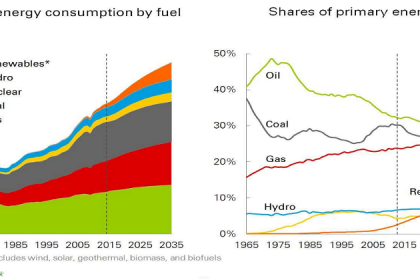

OIL & GAS WILL CRUTIAL

OGJ - Oil and gas will remain crucial energy components as their share of the total global mix falls from 53% now to 43% in 2050, Torstad said during a presentation at the National Press Club sponsored by the US Energy Association. “We’ve assumed a generally steady change toward 2050, with less crude oil production but more natural gas and electricity, where solar and wind power will grow because of cost reductions,” she said.