Trends

2016, October, 14, 18:50:00

WORLD OIL DEMAND WILL UP BY 1.15 MBD

World oil demand in 2016 is seen increasing by 1.24 mb/d to average 94.40 mb/d. Positive revisions were primarily a result of higher-than-expected demand in the Other Asia region, while downward revisions were a result of lower-than-expected performance from OECD America. In 2017, world oil demand is anticipated to rise by 1.15 mb/d, to average 95.56 mb/d.

2016, October, 5, 18:30:00

LNG FOR AFRICA

With hundreds of millions of people living without electricity in the world's poorest continent, African countries are increasingly turning to gas to take advantage of lower global LNG prices amid a supply glut.

2016, October, 4, 18:45:00

HEALTHY RUSSIAN OIL

Russian oil production continuing its slow climb for at least the next five years.

2016, September, 30, 18:40:00

OIL DEMAND WILL RISE

Demand for land rigs will rise 29 percent next year to 579, the S&P Global Platts unit said in a report released at the Benposium East conference in New York on Wednesday. Platts RigData forecasts average West Texas Intermediate crude prices to climb 23 percent to $52.18 a barrel in 2017. The Henry Hub natural gas benchmark is seen increasing 26 percent to $3.05 per million British thermal units.

2016, September, 19, 18:55:00

PRICES MAY JUMP

Prices may jump more than 35 percent from current levels as they start to reflect the risk of a supply squeeze, according to Citigroup Inc. and trader Gunvor Group.

2016, September, 19, 18:30:00

HIGH RISK FOREVER

“We see 2017-2020 as still having the potential for much higher prices. After 2020, there is a high risk that electric vehicle penetration will change the oil market forever.”

2016, September, 15, 18:40:00

UNSTABLE OIL PRICES

The collapse of oil prices has forced Canadian and global producers to slash costs and curtail investment over the past two years. Even after a rebound from a 12-year low earlier this year, oil futures in New York are still about 60 percent down from their 2014 peak. Prices have been mostly stuck in the $40-$50 range for the past four months.

2016, September, 14, 15:20:00

GROWTH IS SLOWING

Global oil demand growth is slowing at a faster pace than initially predicted.

2016, September, 14, 15:15:00

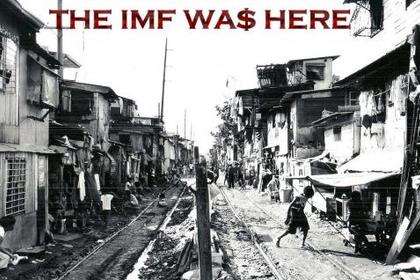

IMF WANTS WHOLE WORLD

Growth has also been unequal: in major advanced economies, incomes for the top 10 percent increased by 40 percent in the past two decades, while growing only modestly at the bottom.

2016, September, 13, 14:50:00

MARKET IS OWERSUPPLIED

The producer cartel revised higher for this year and next oil supply forecasts from non-member countries, implying that demand for its crude will remain far lower than current near record output of more than 33m barrels a day.

2016, September, 9, 14:05:00

REFINING PROFITS DOWN

The decline in earnings was driven largely by the decline in crack spreads (the price difference between crude oil and petroleum products) in the second quarter. In addition to changes in crack spreads, which serve as an indicator of refinery profits, earnings per barrel reflect transportation costs and other operating expenses. Also, refiners use different crude oil blends and produce different yields of refined products, which changes the per barrel earnings among refiners.

2016, September, 8, 18:55:00

OIL PRICES: $42 - $52

Brent crude oil prices are forecast to average $43/b in 2016 and $52/b in 2017. West Texas Intermediate (WTI) crude oil prices are forecast to average $1/b less than Brent in 2016 and 2017.

2016, September, 8, 18:45:00

E&P WILL UP BY 5%

Oil and gas companies are poised to increase spending on exploration and production globally by 5% in 2017, while offshore spending may continue to fall next year, based on Barclays’ midyear global spending survey of more than 200 companies.

2016, September, 8, 18:35:00

INTERNATIONAL RIG COUNT DOWN 200

The international rig count for August 2016 was 937 down 1 from the 938 counted in July 2016, and down 200 from the 1,137 counted in August 2015. The international offshore rig count for August 2016 was 228, up 2 from the 226 counted in July 2016, and down 42 from the 270 counted in August 2015.

2016, September, 7, 19:00:00

IRAN SUPPORTS PRICE $50 - $60

“Iran wants a stable market and therefore any measure that helps the stabilisation of the oil market is supported by Iran,” Mr Zanganeh said. “We support oil prices between $50 and $60 per barrel.”