All publications by tag «Россия»

2017, October, 9, 21:55:00

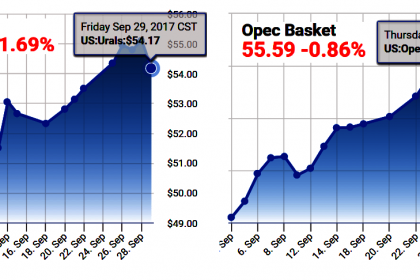

OIL PRICE: NOT BELOW $55

Global benchmark Brent crude LCOc1 was down 2 cents at $55.60 a barrel at 11:31 a.m. EDT (1531 GMT). Earlier in the session it touched a three-week low of $55.06. It ended last week 3.3 percent lower, its biggest weekly loss since June 2017.

U.S. West Texas Intermediate crude futures CLc1 were trading at $49.46, up 17 cents. They came close to a four-week low when they fell to $49.13 earlier in the session. WTI’s losses last week came to 4.6 percent.

2017, October, 9, 21:50:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИ

"В рамках визита Короля Салмана Аль-Сауда был подписан большой пакет документов, что в полной мере способствует углублению взаимодействия в контексте задач расширения торгово-экономического, промышленного и инвестиционного сотрудничества между Россией и Саудовской Аравией, а также продвижения перспективных совместных проектов, в том числе в сфере энергетики», - подчеркнул Александр Новак.

2017, October, 9, 21:40:00

NOVATEK DOWN 7.5%

NOVATEK’s marketable hydrocarbons production totaled 374.7 million barrels of oil equivalent (boe), including 46.03 billion cubic meters (bcm) of natural gas and 8,806 thousand tons of liquids (gas condensate and crude oil), resulting in a decrease in total hydrocarbons production by 30.4 million boe, or by 7.5%, as compared with the nine months 2016.

2017, October, 6, 13:00:00

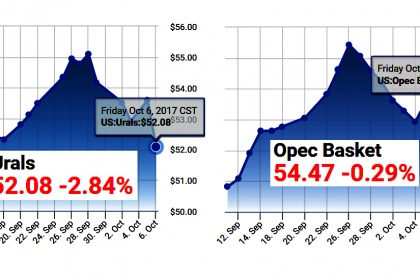

OIL PRICE: ABOVE $56 YET

Global benchmark Brent crude futures were up 7 cents at $57.07 a barrel at 0848 GMT. Week on week, the contract was set for a near 1 percent loss, snapping a five-week winning streak that was the longest since June 2016.

U.S. West Texas Intermediate (WTI) crude was at $50.59, down 20 cents. It was set to close the week down more than 2 percent, the biggest weekly loss in three months.

2017, October, 6, 12:55:00

ДОВЕРИЕ НА РЫНКЕ

Говоря о результатах заключения соглашения о сокращении добычи нефти, глава Минэнерго России сообщил, что «мы достигаем целей, которые были обозначены в рамках сделки с ОПЕК». «Мы наблюдаем возврат инвестиций в отрасль, постепенно рынок балансируется. В соглашении об ограничении участвует 24 страны, на которые приходится 55 млн баррелей добычи нефти в стуки. Между нашими странами возникло доверие, и мы рады будем привлечению других участников», - сказал Александр Новак.

2017, October, 6, 12:45:00

RUSSIAN GAS TO HUNGARY: +26.9%

In the first nine months of 2017 Gazprom had supplied to Hungary 5.5 billion cubic meters of gas, an increase of 26.9 per cent, or 1.2 billion cubic meters, against the January-September period of 2016.

2017, October, 4, 23:59:00

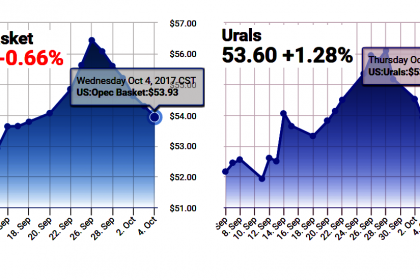

OIL PRICE: ABOVE $55

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $50.16 per barrel at 0648 GMT, down 26 cents, or 0.5 percent, from their last close. They fell below $50 per barrel earlier in the session.

Brent crude futures LCOc1 were down 22 cents, or 0.4 percent, at $55.78 a barrel.

2017, October, 4, 23:50:00

ДОПОЛНИТЕЛЬНЫЕ ДОХОДЫ РОССИИ

Дополнительные доходы бюджету от балансировки рынка нефти Министр оценил в 700 млрд - 1 трлн рублей. По словам Александра Новака, компании также оказались в выигрыше за счет повышения цен на нефть примерно на 30% от начала 2016 года.

2017, October, 4, 23:30:00

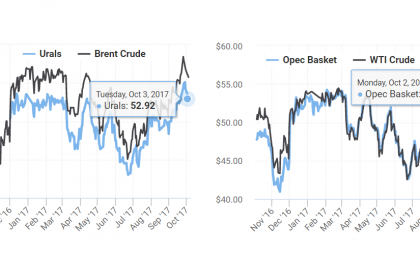

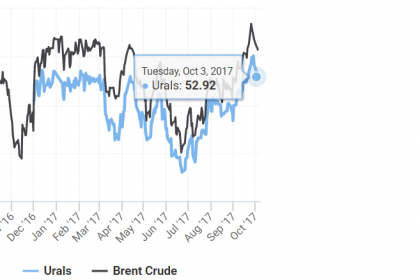

ЦЕНА URALS: $ 50,55

Средняя цена нефти марки Urals по итогам января - сентября 2017 года составила $ 50,55 за баррель.

2017, October, 2, 15:00:00

OIL PRICE: ABOVE $56

Brent crude, the global benchmark, was down 12 cents at $56.67 a barrel at 0846 GMT. It notched up a third-quarter gain of around 20 percent, the biggest third-quarter increase since 2004 and traded as high as $59.49 last week.

U.S. crude was down 17 cents at $51.50. The U.S. benchmark posted its strongest quarterly gain since the second quarter of 2016.