All publications by tag «usa»

2018, September, 28, 09:35:00

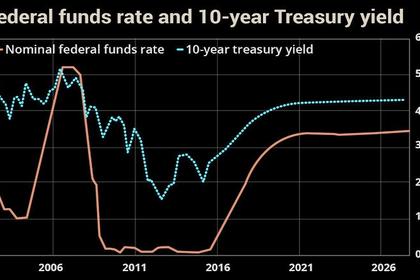

U.S. FEDERAL FUNDS RATE 2.25%

FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2 to 2-1/4 percent.

2018, September, 26, 09:25:00

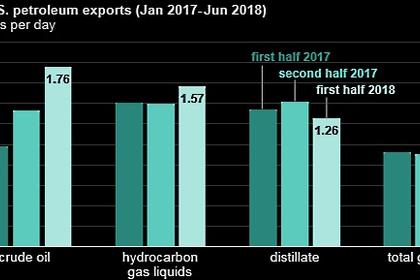

U.S. OIL EXPORT RECORD

U.S. EIA - Crude oil surpassed hydrocarbon gas liquids (HGL) to become the largest U.S. petroleum export, with 1.8 million barrels per day (b/d) of exports in the first half of 2018. U.S. crude oil exports increased by 787,000 b/d, or almost 80%, from the first half of 2017 to the first half of 2018 and set a new monthly record of 2.2 million b/d in June.

2018, September, 26, 09:10:00

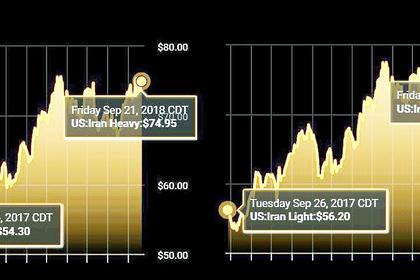

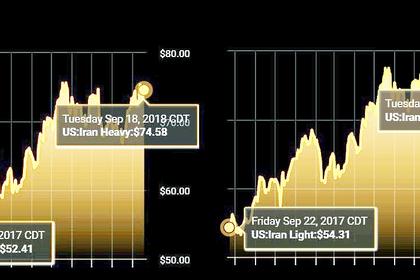

THREATS FOR IRANIAN OIL

SHANA - Iran’s OPEC governor Hossein Kazempour Ardebily said regarding the current market conditions and the production level of the producing countries in or outside of the Organization of the Petroleum Exporting Countries (OPEC), threats to bring Iran’s oil exports are not practical.

2018, September, 24, 15:15:00

THE TRADE WAR LIMITING U.S.

API - “Placing constraints on exports of American-made energy works against America’s energy future,” said API Chief Economist Dean Foreman. “While the picture is still a bit muddied, it seems to be getting clearer – the trade war appears to be limiting the United States’ access to crude export markets. As we produce more energy here at home, the U.S. needs markets for its products in order for our economy to continue to grow. There’s no question that the 1.6 MBD increase U.S. petroleum net imports, which undid a full year’s worth progress, is a setback to the United States’ goal of energy dominance.”

2018, September, 24, 15:00:00

U.S. RIGS DOWN 2 TO 1,053

BAKER HUGHES A GE - U.S. Rig Count is down 2 rigs from last week to 1,053, with oil rigs down 1 to 866, gas rigs unchanged at 186, and miscellaneous rigs down 1 to 1. Canada Rig Count is down 29 rigs from last week to 197, with oil rigs down 13 to 135 and gas rigs down 16 to 62.

2018, September, 21, 10:45:00

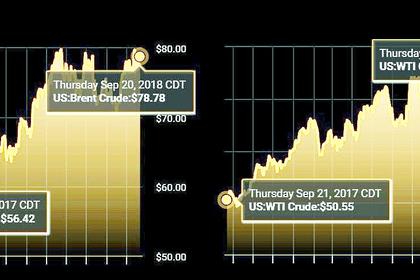

UNEXPECTED OIL PRICES

SHANA - What is common in oil market is that no price levels could be forecast for the future there. Only its unpredictability is predictable. Rarely may you find an expert to say with full certainty in which direction oil prices are headed.

2018, September, 21, 10:40:00

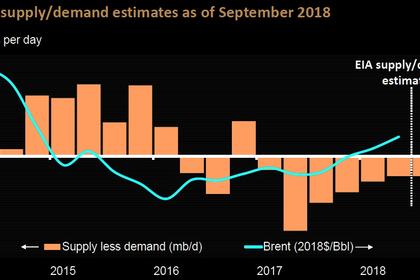

OIL MARKET UNCERTAINTY

PLATTS - 1.4 million b/d of Iranian oil supplies to leave the market by November, when the US sanctions go into force. Venezuela, which pumped 1.22 million b/d in August could see output fall to 1 million b/d in 2019. Politically unstable Libya also presents a supply risk.

2018, September, 21, 10:35:00

OPEC-NON-OPEC DECISIONS

SHANA - Iran’s Minister of Petroleum Bijan Zangeneh said the Joint OPEC/Non-OPEC Ministerial Monitoring Committee (JMMC) is not legally competent to make decisions about adjustment of production quotas.

2018, September, 21, 10:30:00

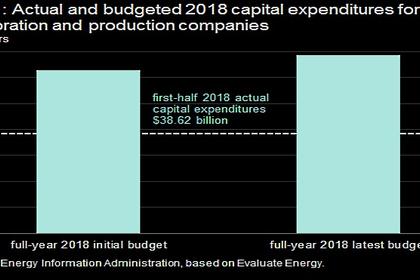

U.S. CAPITAL EXPENDITURES UP

U.S. EIA - Second-quarter 2018 financial results for 45 U.S. oil exploration and production companies that the U.S. Energy Information Administration (EIA) regularly tracks reveal that most companies increased their capital expenditure budgets for 2018 compared with initial budgets made at the beginning of the year.

2018, September, 21, 10:25:00

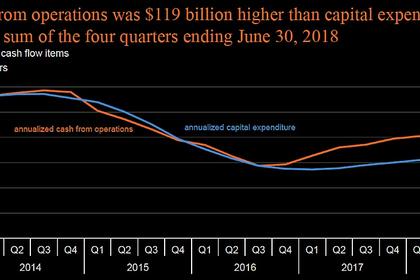

U.S. ENERGY CASH: $119 BLN

U.S. EIA - Energy companies’ free cash flow—the difference between cash from operations and capital expenditure—was $119 billion for the four quarters ending June 30, 2018, the largest four-quarter sum during 2013–18

Companies reduced debt for seven consecutive quarters, contributing to the lowest long-term debt-to-equity ratio since third-quarter 2014