Analysis

2020, November, 27, 12:00:00

OIL PRICE: NOT BELOW $47

Brent was down by 10 cents at $47.70 . WTI was down by 86 cents, or 1.9%, at $44.85.

2020, November, 27, 11:40:00

RUSHYDRO NET PROFIT +72%

RusHydro Group (hereinafter referred to as the “Group”, ticker symbol: MOEX, LSE: HYDR; OTCQX: RSHYY) announces its condensed consolidated interim unaudited financial information prepared in accordance with International Financial Reporting Standards (IFRS) for the 3rd quarter and 9 months of 2020.

2020, November, 27, 11:25:00

JAPAN'S NIKKEI UP TO 26 644,71

Nikkei rose 0.41% to close at 26,644.71. The index has gained 15.96% this month, and is on track for its best performance since January 1994. The broader Topix rose 0.47% to hit a 25-month high at 1,786.52.

2020, November, 26, 12:20:00

OIL PRICE: NOT BELOW $48 ANEW

Brent were down 1 cent at $48.60 a barrel . WTI was off by 4 cents at $45.67 a barrel.

2020, November, 26, 12:15:00

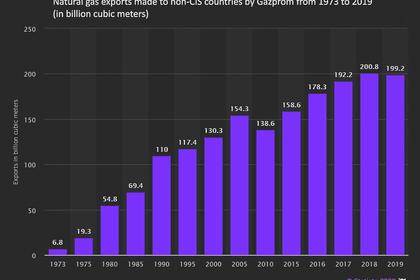

RUSSIAN GAZPROM'S BENEFIT

"The macroeconomic situation has had a negative impact on the long-term development prospects of the LNG industry," Gazprom said, adding that so far in 2020 only one final investment decision had been made for a new LNG production project.

2020, November, 26, 12:05:00

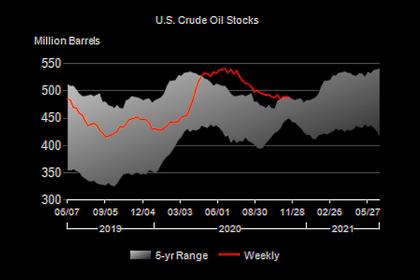

U.S. OIL INVENTORIES DOWN 0.8 MB TO 488.7 MB

U.S. commercial crude oil inventories decreased by 0.8 million barrels to 488.7 million barrels

2020, November, 26, 12:00:00

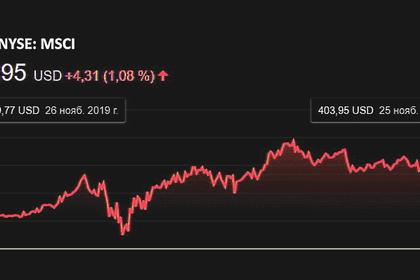

ASIA'S INDEXES UP

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.39% while Japan’s Nikkei gained 0.91%.

2020, November, 26, 11:55:00

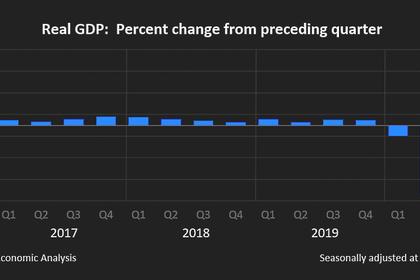

U.S. GDP UP 31%

U.S. Real gross domestic product (GDP) increased at an annual rate of 33.1 percent in the third quarter of 2020

2020, November, 26, 11:40:00

U.S. RIGS UP 10 TO 320

U.S. Rig Count is up 10 from last week to 320 , Canada Rig Count is up 1 from last week to 102,

2020, November, 25, 12:05:00

OIL PRICE: NOT BELOW $48

Brent was up 44 cents, or 0.9%, at $48.30 a barrel . WTI gained 33 cents, or 0.7%, to $45.24.

2020, November, 25, 11:40:00

LUKOIL PROFIT RUB 50.4 BLN

In the third quarter of 2020, profit attributable to shareholders amounted to RUB 50.4 bln as compared to a loss of RUB 18.7 bln in the previous quarter.

2020, November, 25, 11:35:00

RUSHYDRO RATINGS ‘BBB’

PJSC RusHydro (ticker symbol: MOEX, LSE: HYDR; OTCQX: RSHYY) announces that Fitch Ratings raised long-term corporate credit ratings on PJSC RusHydro and the company’s bonds to sovereign grade ‘BBB’ (outlook stable).

2020, November, 24, 12:45:00

OIL PRICE: BELOW $47

Brent rose 45 cents, or 1%, to $46.51 a barrel . WTI added 46 cents, or 1.1%, to $43.52.

2020, November, 24, 12:30:00

NORWAY'S OIL, GAS PRODUCTION 1.88 MBD

Preliminary production figures for October 2020 show an average daily production of 1 877 000 barrels of oil, NGL and condensate.