Analysis

2020, November, 23, 12:45:00

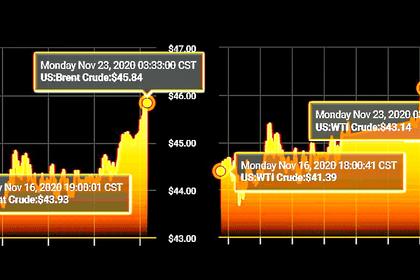

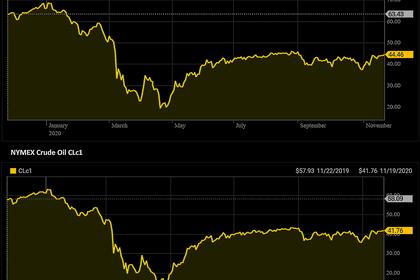

OIL PRICE: NOT BELOW $45

Brent rose 63 cents, or 1.4%, to $45.59 a barrel . WTI gained 49 cents, or 1.2%, to $42.91 a barrel.

2020, November, 23, 12:30:00

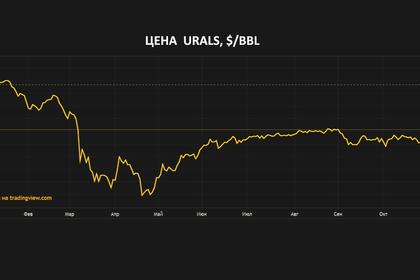

ЦЕНА URALS: $40,4225

Средняя цена на нефть Urals за период мониторинга с 15 октября по 14 ноября 2020 года составила $40,4225 за баррель, или $295,1 за тонну.

2020, November, 23, 12:15:00

INDIA'S SOLAR ENERGY WILL UP

The solar capacity addition in India in the first quarter of 2020 was the lowest since 2016.

2020, November, 23, 12:10:00

ASIAN SHARES UP

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.71% on Monday,

2020, November, 23, 12:00:00

CORRUPTION IN ENERGY INDUSTRY

Corruption and unethical behavior in the energy industry have an international dimension because often projects involve international actors.

2020, November, 23, 11:55:00

KENYAN RENEWABLES WILL UP

With renewable energy making up a staggering 70% of Kenya’s energy mix in 2018 (Onyango, 2018) and as high as 87% as of January 2020, (Zarembka, 2020) one would be curious to see what steps Kenya took to shape its renewable energy landscape and attract private sector investment.

2020, November, 23, 11:50:00

U.S. RIGS DOWN 2 TO 310

U.S. Rig Count is down 2 from last week to 310 , Canada Rig Count is up 12 from last week to 101

2020, November, 20, 13:40:00

OIL PRICE: NOT BELOW $44

Brent were up 2 cents, or 0.05% at $44.22 a barrel . WTI dipped 4 cents to $41.86 a barrel.

2020, November, 20, 13:30:00

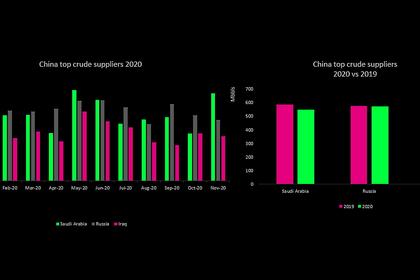

SAUDI ARABIA, RUSSIA OIL FOR CHINA

Saudi Arabia was catching up with Russia which has exported about 1.7 million bpd of oil to China so far in 2020, with Iraq at a third place with about 1.2 million bpd.

2020, November, 20, 13:20:00

EUROPEAN SHARES UP AGAIN

The pan-European STOXX 600 index rose 0.2% , on track for marginal weekly gains after signs of progress on COVID-19 vaccine pushed the index to February highs earlier this week.

2020, November, 20, 13:15:00

AUSTRALIA'S LNG FOR CHINA DOWN

Australian gas exporters argue that their projects are not contingent on Chinese buyers in a growing Asian market.

2020, November, 19, 14:35:00

OIL PRICE: NEAR $44 AGAIN

Brent were down 27 cents to $44.07 a barrel . WTI slipped 43 cents to $41.39 a barrel.

2020, November, 19, 14:25:00

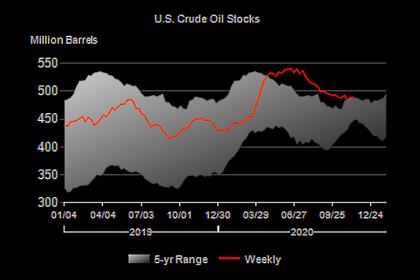

U.S. OIL INVENTORIES UP 0.8 MB TO 489.5 MB

U.S. commercial crude oil inventories increased by 0.8 million barrels to 489.5 million barrels