Analysis

2017, August, 30, 10:30:00

GAZPROM'S PROFIT: DOWN BY 37%

Profit attributable to the owners of PJSC Gazprom for the six months ended June 30, 2017 totalled RUB 381,346 million which is RUB 225,814 million, or 37 % less than for the same period of the prior year.

2017, August, 29, 18:20:00

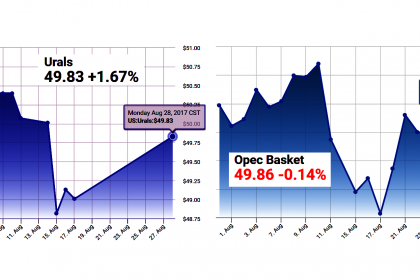

OIL PRICE: NOT ABOVE $52 AGAIN

International Brent crude futures LCOc1 were 32 cents lower at $51.57 per barrel, having traded as high as $52.19 earlier in the day.

U.S. West Texas Intermediate (WTI) crude CLc1 edged down 5 cents to $46.52 a barrel, after falling more than 2 percent in the previous session.

2017, August, 28, 20:00:00

OIL PRICE: NOT ABOVE $53 AGAIN

U.S. West Texas Intermediate (WTI) crude futures CLc1 were down 52 cents at $47.35 a barrel.

Brent crude LCOc1 was down 12 cents at $52.29 per barrel.

2017, August, 28, 19:50:00

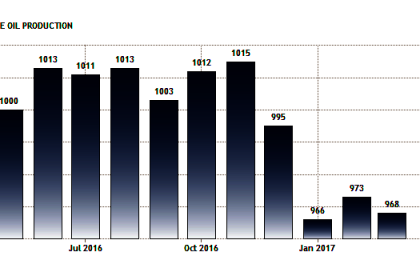

OMAN OIL PRODUCTION DOWN TO 970 TBD

Oman’s petroleum and other liquids production averaged more than 1 million barrels per day in 2016, its highest production level ever. Oman was on track to maintain this production level in 2017, but it reduced production to approximately 970,000 barrels per day in early 2017 to meet the production cut it agreed to, along with members of the Organization of the Petroleum Exporting Countries (OPEC).

2017, August, 28, 19:45:00

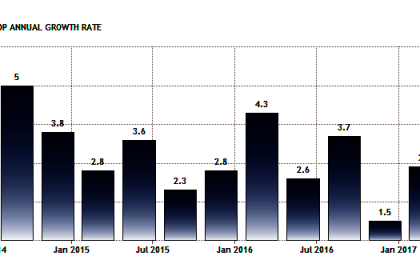

IMF: BAHRAIN'S VULNERABILITY UP

Bahrain’s fiscal and external vulnerabilities have increased in the wake of the oil price decline. Overall GDP grew 3 percent in 2016, supported by strong growth of 3.7 percent in the non-oil sector aided by the implementation of GCC-funded projects. Average inflation remained moderate at 2.8 percent. Bank deposit and private sector credit growth slowed. The banking sector remains well capitalized and liquid. Despite the implementation of significant fiscal adjustment, lower oil prices meant that the overall fiscal deficit reached nearly 18 percent of GDP and government debt rose to 82 percent of GDP. The current account deficit widened to 4.7 percent. International reserves have declined.

2017, August, 28, 19:40:00

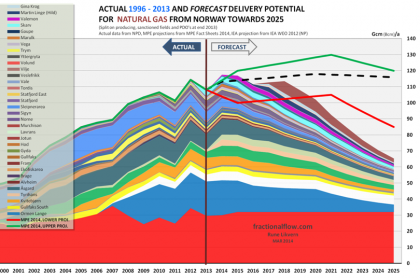

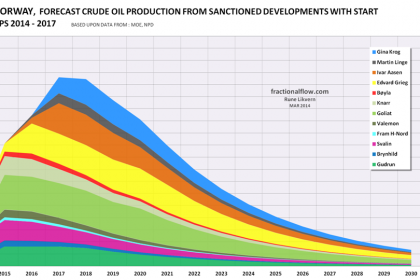

HUGE NORWAY'S OIL & GAS

“We have been producing oil and gas in Norway for nearly 50 years and we are still not halfway done. Vast volumes of oil and gas have been discovered on the Norwegian shelf that are still waiting to be produced. We want companies with the ability and willingness to utilise new knowledge and advanced technology. This will yield profitable production for many decades in the future,” says Ingrid Sølvberg, Director of development and operations in the Norwegian Petroleum Directorate.

2017, August, 28, 19:30:00

U.S. RIGS DOWN 6 TO 940

U.S. Rig Count is up 451 rigs from last year's count of 489, with oil rigs up 353, gas rigs up 99, and miscellaneous rigs down 1 to 1.

Canada Rig Count is up 71 rigs from last year's count of 146, with oil rigs up 31 and gas rigs up 40.

2017, August, 24, 14:30:00

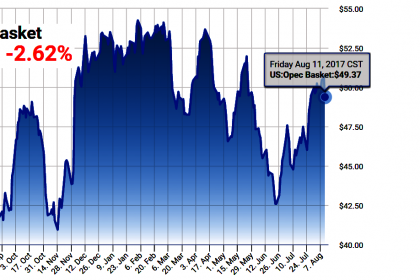

OIL PRICE: NOT ABOVE $53

Brent crude futures, LCOc1 the international benchmark for oil prices, were at $51.92 per barrel at 0652 GMT, down 18 cents, or 0.4 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $48.70 a barrel, down 12 cents, or 0.3 percent.

2017, August, 24, 13:55:00

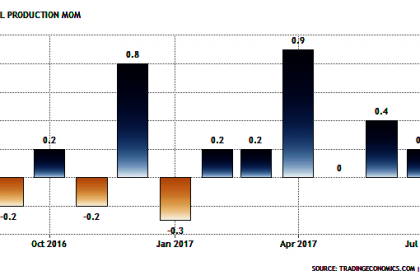

U.S. INDUSTRIAL PRODUCTION UP 0.2%

U.S. - Industrial production rose 0.2 percent in July following an increase of 0.4 percent in June. The index for mining rose 0.5 percent in July for its fourth consecutive monthly increase. Within mining, gains in oil and gas extraction and in metal ore mining were partially offset by declines in nonmetallic mineral mining and in drilling and support activities. The decrease of 0.5 percent in drilling and support services followed 10 consecutive months of increases for that index.

2017, August, 24, 13:50:00

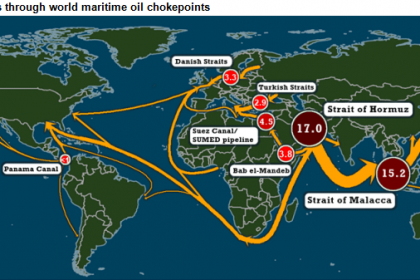

IMPORTANT OIL STRAITS

The Danish Straits and Turkish Straits, together transited by a combined volume of more than 5 million barrels per day (b/d) in 2016, are important chokepoints for Europe’s crude oil and petroleum liquids supply. Nearly 59 million b/d of global petroleum and other liquids production moved on maritime routes in 2015. Although most discussions of maritime chokepoints for oil trade focus on the Strait of Hormuz and the Strait of Malacca, which together were transited by a combined volume of more than 30 million b/d, other chokepoints are significant for specific regions.

2017, August, 24, 13:45:00

NORWAY'S PETROLEUM PRODUCTION UP TO 93 TBD

Preliminary production figures for July 2017 show an average daily production of 2 000 000 barrels of oil, NGL and condensate, which is an increase of 93 000 barrels per day compared to June.

2017, August, 17, 15:25:00

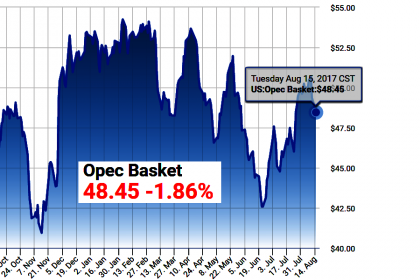

OIL PRICE: NOT ABOVE $51

Brent crude LCOc1 was unchanged at $50.27 a barrel by 0845 GMT. U.S. light crude CLc1 was 5 cents lower at $46.73.

2017, August, 16, 09:45:00

OIL PRICE: NOT ABOVE $52 YET

Brent crude futures LCOc1 were at $51.02 per barrel at 0218 GMT, up 22 cents or 0.4 percent from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $47.70 a barrel, up 15 cents, or 0.3 percent.

2017, August, 16, 09:35:00

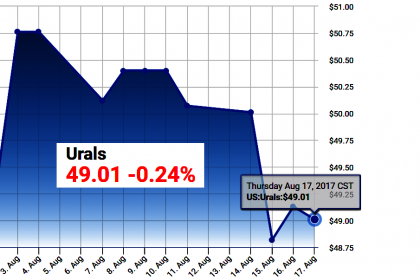

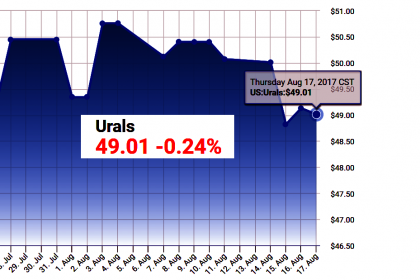

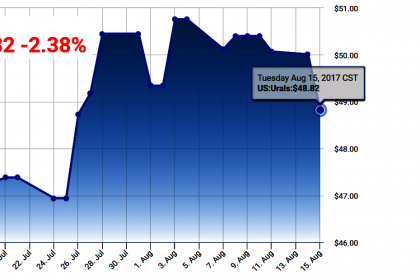

ЦЕНА URALS: $ 49,94

Средняя цена нефти марки Urals по итогам января - июля 2017 года составила $ 49,94 за баррель.

2017, August, 16, 09:25:00

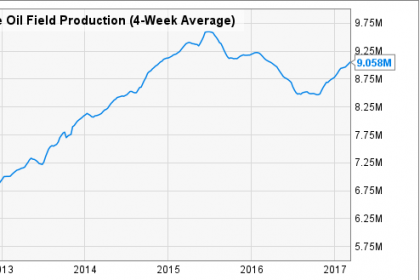

U.S. OIL PRODUCTION: 9.35 - 9.91 MBD

EIA continues to expect US production to rise over the next two years and cross the 10 million b/d threshold in November 2018.

It sees output averaging 9.35 million b/d in 2017, up 20,000 b/d from last month's outlook, and 9.91 million b/d in 2018, up 10,000 b/d from last month.