Analysis

2017, October, 30, 11:45:00

OIL PRICES WILL UP TO $56

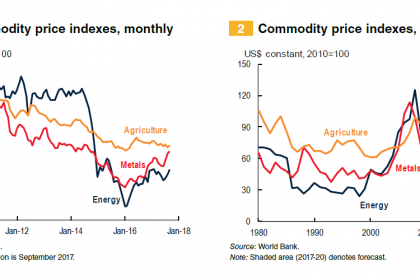

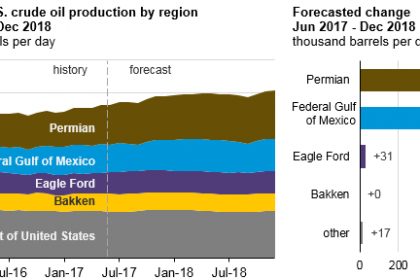

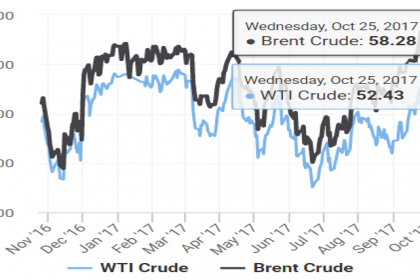

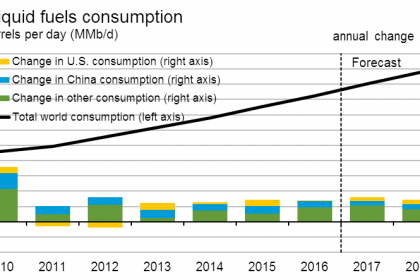

WBG - Oil prices are forecast to rise to $56 a barrel in 2018 from $53 this year as a result of steadily growing demand, agreed production cuts among oil exporters and stabilizing U.S. shale oil production, while the surge in metals prices is expected to level off next year, the World Bank said.

2017, October, 30, 11:35:00

U.S. GDP UP 3%

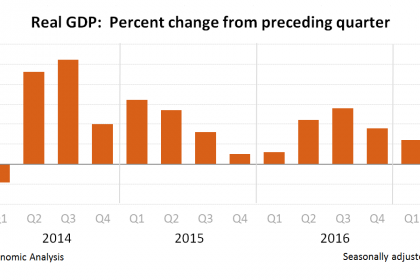

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the third quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.

2017, October, 30, 11:30:00

EXXON EARNINGS $11.3 BLN

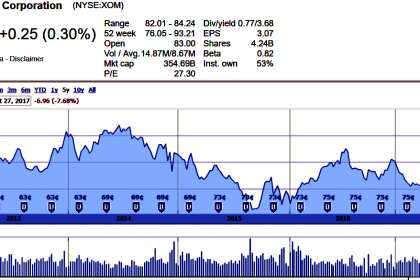

Exxon Mobil Corporation announced estimated third quarter 2017 earnings of $4 billion, or $0.93 per diluted share, compared with $2.7 billion a year earlier as commodity prices improved and performance in the Upstream and Downstream strengthened. Impacts related to Hurricane Harvey reduced earnings by an estimated 4 cents per share.

2017, October, 30, 11:20:00

CHEVRON NET INCOME $6 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $2.0 billion ($1.03 per share – diluted) for third quarter 2017, compared with $1.3 billion ($0.68 per share – diluted) in the third quarter of 2016. Included in the quarter was a gain on an asset sale of $675 million and an asset write-off of $220 million. Foreign currency effects decreased earnings in the 2017 third quarter by $112 million, compared with an increase of $72 million a year earlier.

Sales and other operating revenues in third quarter 2017 were $34 billion, compared to $29 billion in the year-ago period.

2017, October, 30, 11:05:00

U.S. OIL LOSERS

ExxonMobil and Chevron, the two largest US oil and gas groups, are continuing to lose money on oil and gas production in their home country, in spite of the rise in commodity prices since last year.

2017, October, 30, 11:00:00

U.S. RIGS DOWN 4 TO 909

U.S. Rig Count is up 352 rigs from last year's count of 557, with oil rigs up 296, gas rigs up 58, and miscellaneous rigs down 2 to 0.

Canada Rig Count is up 38 rigs from last year's count of 153, with oil rigs up 23 and gas rigs up 15.

2017, October, 27, 19:20:00

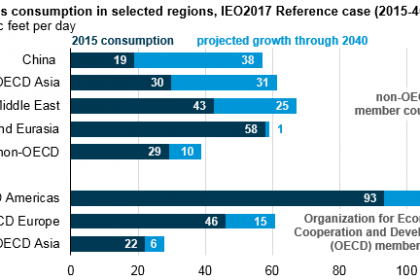

CHINA'S GAS CONSUMPTION UP

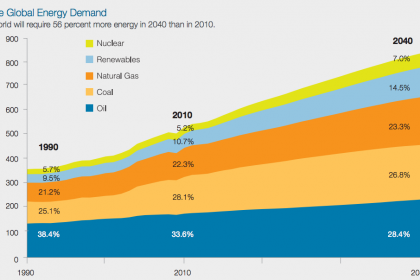

EIA - Global natural gas consumption is expected to grow from 340 billion cubic feet per day (Bcf/d) in 2015 to 485 Bcf/d by 2040, primarily in countries in Asia and in the Middle East. China accounts for more than a quarter of all global natural gas consumption growth between 2015 and 2040.

2017, October, 27, 19:15:00

CONOCO LOSS $2.4 BLN

ConocoPhillips’ nine-month 2017 earnings were a loss of $2.4 billion, or ($1.98) per share, compared with a nine-month 2016 loss of $3.6 billion, or ($2.88) per share. Nine-month 2017 adjusted earnings were $0.2 billion, or $0.16 per share, compared with a nine-month 2016 adjusted loss of $3.0 billion, or ($2.40) per share.

2017, October, 27, 19:10:00

NOV VARCO NET LOSS $221 MLN

National Oilwell Varco, Inc. (NYSE: NOV) reported a third quarter 2017 net loss of $26 million, or $0.07 per share. Revenues for the third quarter of 2017 were $1.84 billion, an increase of four percent compared to the second quarter of 2017 and an increase of eleven percent from the third quarter of 2016. Operating loss for the third quarter was $7 million, or 0.4 percent of sales. Adjusted EBITDA (operating profit excluding other items before depreciation and amortization) for the third quarter was $167 million, or 9.1 percent of sales, an increase of $25 million from the second quarter of 2017. Cash flow from operations for the third quarter was $232 million.

2017, October, 25, 12:35:00

OPTIMISTIC OIL PRICES

Futures edged higher from the settlement in after-market trading in New York, prompted by reports that data from the American Petroleum Institute showed a 5.75 million barrel drop in gasoline last week and 4.95 million fewer barrels of distillate. Meanwhile, OPEC, set to meet next month on prolonging the cuts, are said to be planning how to prevent a new price-killing glut once they end.

2017, October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES

"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said.

"Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added.

2017, October, 25, 12:20:00

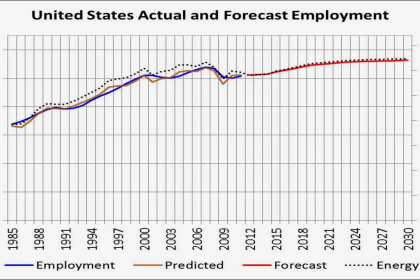

U.S. ECONOMY & EMPLOYMENT 2016 - 2026

Changing demographics in the population will have far-reaching effects on the labor force, the economy, and employment over the 2016–26 decade. The overall labor force participation rate is projected to decline as older workers leave the labor force, constraining economic growth. The aging baby-boomer segment of the population will drive demand for healthcare services and related occupations.

2017, October, 25, 10:53:00

NABORS NET LOSS $430 MLN

Nabors Industries Ltd. ("Nabors" or the "Company") (NYSE: NBR) reported third-quarter 2017 operating revenues of $662 million, compared to operating revenues of $631 million in the second quarter of 2017. The net loss from continuing operations, attributable to Nabors, for the current quarter was $121 million, or $0.42 per diluted share, compared to a loss of $117 million, or $0.41 per diluted share, last quarter.

2017, October, 23, 11:40:00

U.S. PETROLEUM DEMAND UP TO 2.4%

Total petroleum deliveries increased 2.4 percent from September 2016. These September deliveries were the highest September deliveries in a decade. For the third quarter 2017, total petroleum deliveries, a measure of U.S. petroleum demand, increased 2.1 percent from the same period last year to nearly 20.4 million barrels per day. For year to date 2017, total domestic petroleum deliveries increased 1.2 percent compared to the same period last year.

2017, October, 23, 11:30:00

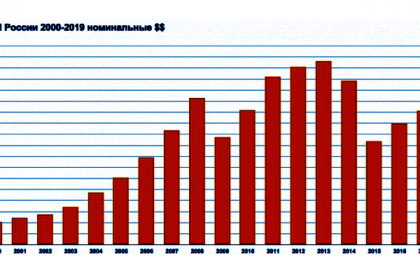

РОССИЯ: РОСТ КОНКУРЕНТОСПОСОБНОСТИ

Мы должны будем увидеть рост конкурентоспособности за счёт снижения себестоимости продукции, технологическое обновление в проблемных секторах, в том числе в жилищно-коммунальном хозяйстве. Достигнем заданных целей по Парижскому соглашению. И, конечно же, высвобождающиеся энергоресурсы будут способствовать дополнительному экономическому росту.