Finance

2020, November, 3, 12:50:00

SAUDI ARAMCO NET INCOME $11.8 BLN

Dhahran, Saudi Arabia, November 3, 2020 – The Saudi Arabian Oil Company (“Aramco” or “the Company”) today announced its financial results for the third quarter of 2020.

2020, November, 3, 12:45:00

RUSSIA'S INVESTMENT TO IRAN €1.3 BLN

In September 2019, Russia awarded a €1.3bn funding to build the project, which will correspond to 85% of the total investment.

2020, October, 30, 13:45:00

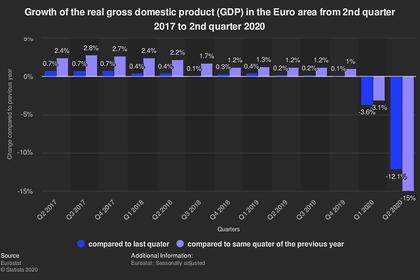

EURO GDP UP 12.7%

Eurostat said gross domestic product in the 19 countries sharing the euro surged 12.7% quarter-on-quarter in the July-September period after a 11.8% contraction in the previous three months.

2020, October, 30, 13:30:00

TOTAL NET INCOME $202 MLN

Total SE's Board of Directors met on October 29, 2020, under the chairmanship of CEO Patrick Pouyanne to approve the Group's third quarter 2020 financial statements.

2020, October, 30, 13:25:00

CONOCOPHILLIPS LOSS $0.5 BLN

ConocoPhillips (NYSE: COP) today reported a third-quarter 2020 loss of $0.5 billion, or ($0.42) per share, compared with third-quarter 2019 earnings of $3.1 billion, or $2.74 per share.

2020, October, 30, 13:20:00

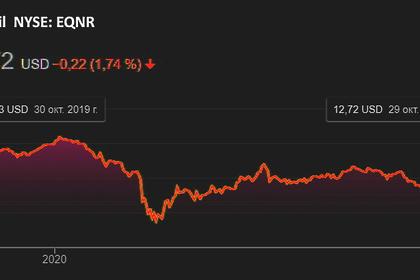

EQUINOR NET LOSS $2 BLN

IFRS net income was negative USD 2.12 billion in the third quarter, down from negative USD 1.11 billion in the third quarter of 2019.

2020, October, 29, 17:05:00

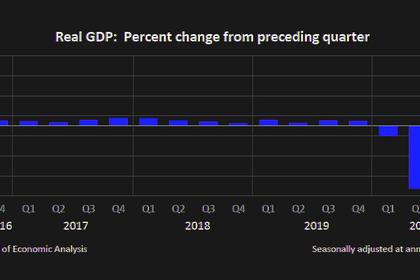

U.S. GDP UP 33%

U.S. Real gross domestic product (GDP) increased at an annual rate of 33.1 percent in the third quarter of 2020

2020, October, 29, 16:50:00

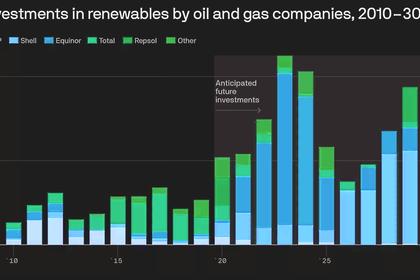

OIL & GAS, RENEWABLES INVESTMENT

Public opinion, governmental regulations, and most importantly, economics, are pushing the O&G industry to diversify its assets into renewables.

2020, October, 29, 16:40:00

S.KOREA'S CARBON NEUTRALITY $7 BLN

In May 2020, South Korea unveiled a long-term energy plan (basic energy policy for the years 2020-2034) shifting from thermal and nuclear power generation to renewable energies

2020, October, 29, 16:35:00

TC ENERGY NET INCOME $904 MLN

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) today announced net income attributable to common shares for third quarter 2020 of $904 million

2020, October, 29, 16:30:00

SHELL INCOME $489 MLN

Income attributable to Royal Dutch Shell plc shareholders was $0.5 billion for the third quarter 2020

2020, October, 29, 16:25:00

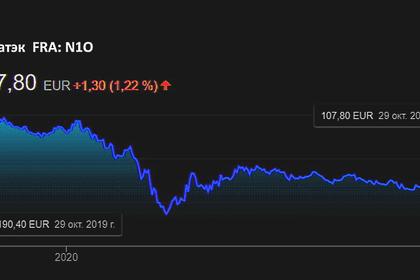

NOVATEK PROFIT RUB13.2 BLN

Profit attributable to shareholders of PAO NOVATEK amounted to RR 13.2 billion

2020, October, 28, 13:50:00

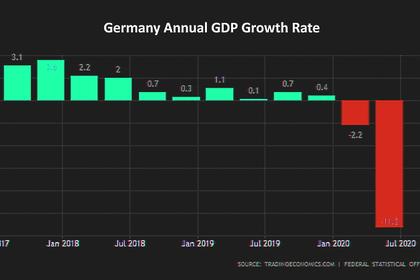

GERMAN ECONOMY UP 6%

The German economy likely grew by around 6% in the third quarter

2020, October, 27, 14:10:00

ISRAEL'S RENEWABLE TARGET $24 BLN

This target follows an ILS80bn (US$24bn) plan unveiled in June 2020 and aimed at increasing the share of solar in the power generation to 30% by 2030,

2020, October, 27, 14:05:00

NOV VARCO NET LOSS $55 MLN

National Oilwell Varco, Inc. (NYSE: NOV) today reported third quarter 2020 revenues of $1.38 billion, a decrease of seven percent compared to the second quarter of 2020 and a decrease of 35 percent compared to the third quarter of 2019.