Finance

2020, August, 10, 11:25:00

OIL, GAS M&A

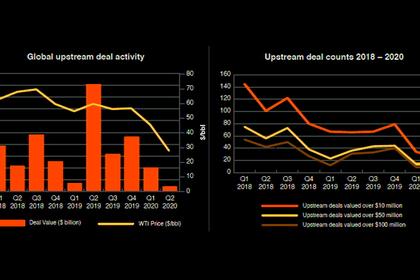

The top country in terms of M&A deals activity in Q2 2020 was the US with 83 deals, followed by China with 33 and Canada with 21.

2020, August, 10, 11:15:00

SAUDI ARAMCO NET INCOME $23.2 BLN

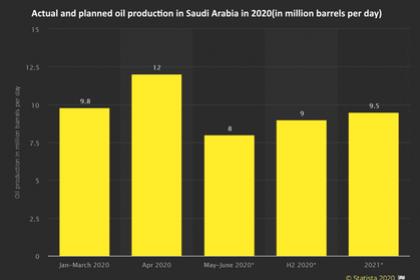

The Saudi Arabian Oil Company (“Aramco” or “the Company”) announced its results for the second quarter and first half of 2020,

2020, August, 10, 11:10:00

SAUDI ARAMCO INVESTMENT $13.6 BLN

Saudi Aramco capital expenditure was $6.2 billion in Q2 and $13.6 billion for the first half of 2020.

2020, August, 7, 13:40:00

ФНБ РОССИИ $176,6 МЛРД.

По состоянию на 1 августа 2020 г. объем ФНБ составил 12 958 678,3 млн. рублей, что эквивалентно 176 637,1 млн. долл. США,

2020, August, 7, 13:20:00

IBERDROLA BOUGHT RENEWABLE INFIGEN

Spanish energy group Iberdrola has taken over Australian renewable producer Infigen Energy

2020, August, 6, 11:45:00

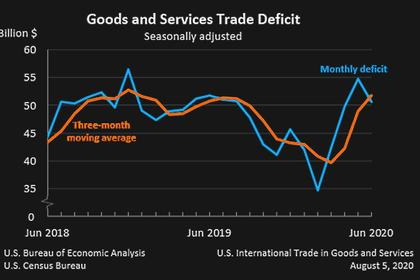

U.S. INTERNATIONAL TRADE DEFICIT $50.7 BLN

The U.S. goods and services deficit was $50.7 billion in June

2020, August, 5, 12:00:00

CHINA'S SHARES UP

The Shanghai Composite index closed up 0.2% at 3,377.56.

2020, August, 4, 14:25:00

ASIA'S STOCKS UP

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 1.05%

2020, August, 4, 14:20:00

FLOATING OFFSHORE WIND FINANCE

Non-recourse finance, which allows lenders to be repaid from the profits of a project and have no claim over the assets of the borrower, will likely be available to upcoming floating wind projects as the market reaches an initial stage of maturity,

2020, August, 4, 14:15:00

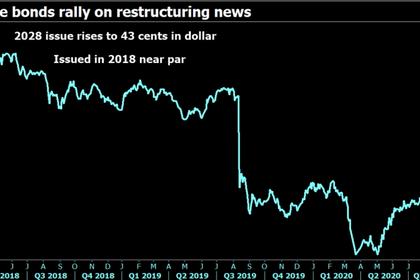

ARGENTINA'S DEFAULT $65 BLN

A major grain producer and once one of the world’s wealthiest countries, Argentina fell into its ninth sovereign default in May

2020, August, 4, 14:10:00

EXXON LOSS $1 BLN

Exxon Mobil Corporation announced an estimated second quarter 2020 loss of $1.1 billion,

2020, August, 4, 14:05:00

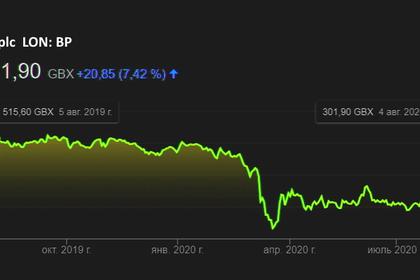

BP LOSS $16.8 BLN

BP Reported loss for the quarter was $16.8 billion, compared with a profit of $1.8 billion for the same period a year earlier,