Oil&Gas

2019, August, 1, 12:05:00

ADNOC, ENI DEAL $3.24 BLN

Eni and ADNOC announced that they have closed their strategic partnership, announced in January, through which Eni acquired a 20% equity interest in ADNOC refining. The final cash price is approximately $3.24bn. The partners, which include Austria’s OMV, also set up a new trading joint venture.

2019, August, 1, 12:00:00

SHELL INCOME $3 BLN

“We have delivered good cash flow performance, despite earnings volatility, in a quarter that has seen challenging macroeconomic conditions in refining and chemicals as well as lower gas prices. This quarter we achieved some key milestones, such as the start-up of Appomattox and the first LNG cargo from Prelude. These add to our competitive portfolio, which is expected to generate additional cash in the coming quarters.

The resilience of our Upstream and customer-facing businesses and their ability to generate cash support the delivery of our 2020 outlook, which remains unchanged.”

2019, August, 1, 11:55:00

SHELL BUYBACK PROGRAMME $2.75 BLN

Royal Dutch Shell plc (the ‘company’) today announces the commencement of trading in the next tranche of its share buyback programme previously announced on July 26, 2018. In the next tranche, the company has entered into an irrevocable, non-discretionary arrangement with a broker to enable the purchase of A ordinary shares and/or B ordinary shares for a period up to and including October 28, 2019. The aggregate maximum consideration for the purchase of A ordinary shares and/or B ordinary shares under the next tranche is $2.75 billion. The company’s intention is to buy back at least $25 billion of its shares by the end of 2020, subject to further progress with debt reduction and oil price conditions.

2019, August, 1, 11:50:00

SHELL SELLS $1.9 BLN

Royal Dutch Shell plc (Shell), through its affiliate Shell Overseas Holdings Limited, has completed the sale of its shares in Shell Olie-og Gasudvinding Danmark B.V. (SOGU), holding a 36.8% non-operating interest in the Danish Underground Consortium (DUC), to Norwegian Energy Company ASA (Noreco) for a consideration amount of $1.9 billion.

2019, August, 1, 11:45:00

SHELL SELLS $0.965 BLN

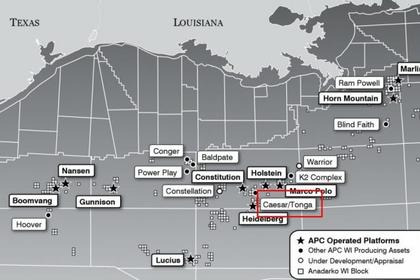

Shell Offshore Inc. (Shell), a subsidiary of Royal Dutch Shell plc, has completed the sale of 22.45% non-operated interest in the Caesar-Tonga asset in the US Gulf of Mexico to Equinor Gulf of Mexico LLC (Equinor), a subsidiary of Equinor ASA, subject to approval of the lease assignments by the regulator. The total cash consideration was $965 million.

2019, August, 1, 11:40:00

BAKER HUGHES A GE NET LOSS $9 MLN

BAKER HUGHES, A GE COMPANY ANNOUNCES SECOND QUARTER 2019 RESULTS

2019, July, 31, 13:25:00

TC ENERGY SELLS $2.87 BLN

TC Energy Corporation (TSX:TRP) (NYSE:TRP) (TC Energy) announced that it has entered into an agreement through its wholly-owned subsidiary, TransCanada Energy Ltd., to sell interests in three Ontario natural gas-fired power plants to a subsidiary of Ontario Power Generation Inc., for approximately $2.87 billion.

2019, July, 31, 13:20:00

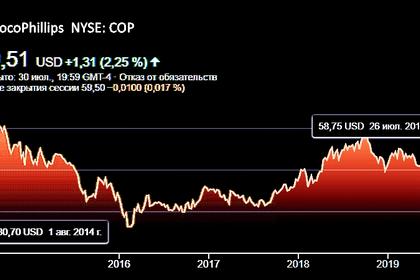

CONOCO EARNINGS $1.6 BLN

ConocoPhillips (NYSE: COP) reported second-quarter 2019 earnings of $1.6 billion, or $1.40 per share, compared with second-quarter 2018 earnings of $1.6 billion, or $1.39 per share.

2019, July, 30, 11:40:00

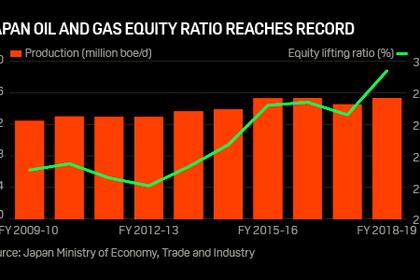

JAPAN'S OIL, GAS 29%

Japan's oil and gas equity ratio rose to a record 29.4% of total imports and domestic output in fiscal 2018-2019 (April-March)

2019, July, 30, 11:10:00

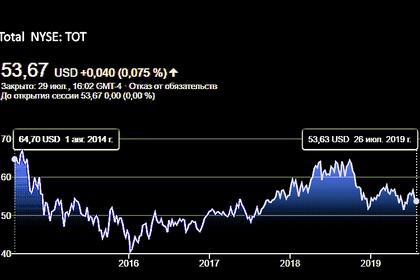

TOTAL NET INCOME $2.8 BLN

Total net income (Group share) of 2.8 B$ in 2Q19, a 26% decrease compared to 2Q18

Net-debt-to-capital ratio of 20.6% at June 30, 2019

Hydrocarbon production of 2,957 kboe/d in 2Q19, an increase of 9% compared to 2Q18

2019, July, 30, 11:05:00

BP PROFIT $2.8 BLN

Strong financial results

– Underlying replacement cost profit for the second quarter of 2019 was $2.8 billion, similar to a year earlier. The quarter’s result largely reflected continued good operating performance, offset by oil prices lower than in the second quarter of 2018.

– Non-operating items in the second quarter of $0.9 billion, post-tax, related mainly to impairment charges.

– Operating cash flow, excluding Gulf of Mexico oil spill payments, was $8.2 billion for the second quarter, including a $1.5-billion working capital release (after adjusting for net inventory holding gains), and $14.2 billion for the first half, including a $0.5-billion working capital release.

– Gulf of Mexico oil spill payments of $1.4 billion on a post-tax basis in the second quarter were primarily the scheduled annual payments.

– A dividend of 10.25 cents a share was announced for the quarter.

2019, July, 30, 11:00:00

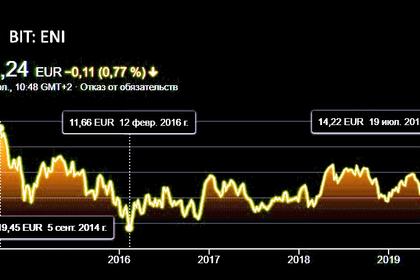

ENI NET PROFIT DOWN BY 27%

Eni adjusted net profit: €0.56 billion for the quarter, down by 27% q-o-q (down by 24% excluding IFRS 16 accounting effects). €1.55 billion in the first half, down by 11% (down by 8% excluding IFRS 16 accounting effects).

2019, July, 30, 10:55:00

EQUINOR NET INCOME UP 27%

Equinor reports adjusted earnings of USD 3.15 billion and USD 1.13 billion after tax in the second quarter of 2019. IFRS net operating income was USD 3.52 billion and the IFRS net income was USD 1.48 billion.

2019, July, 30, 10:50:00

MUBADALA PETROLEUM, PREMIER OIL 20%

Mubadala Petroleum has signed an agreement with Premier Oil to farmout a 20% participating interest in each of the Andaman I and South Andaman Gross Split Production Sharing Contracts (PSCs), in which Mubadala Petroleum is the operator.

2019, July, 30, 10:45:00

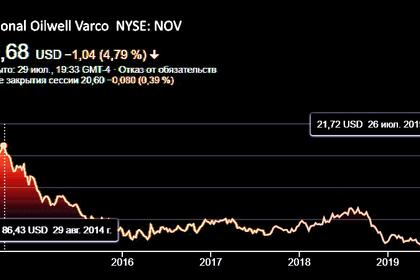

NOV VARCO NET LOSS $5.4 BLN

National Oilwell Varco, Inc. (NYSE: NOV) today reported second quarter 2019 revenues of $2.13 billion, an increase of 10 percent compared to the first quarter of 2019 and an increase of one percent from the second quarter of 2018.