Oil&Gas

2017, November, 20, 09:10:00

U.S. PETROLEUM DEMAND UP TO 19.9 MBD

API - Total petroleum deliveries in October moved up by 1.1 percent from October 2016 to average 19.9 million barrels per day. These were the highest October deliveries in 10 years, since 2007. Compared with September, total domestic petroleum deliveries, a measure of U.S. petroleum demand, decreased 1.8 percent. For year-to-date, total domestic petroleum deliveries moved up 1.2 percent compared to the same period last year.

2017, November, 20, 08:50:00

U.S. RIGS UP 8 TO 915

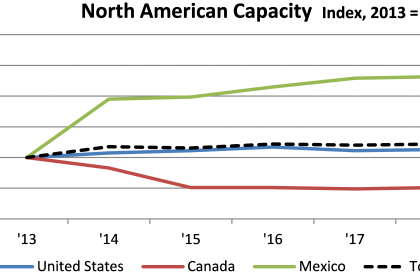

U.S. Rig Count is up 327 rigs from last year's count of 588, with oil rigs up 267, gas rigs up 61, and miscellaneous rigs down 1 to 1.

Canada Rig Count is up 24 rigs from last year's count of 184, with oil rigs up 9 and gas rigs up 15.

2017, November, 17, 19:30:00

U.S. INDUSTRIAL PRODUCTION UP 0.9%

FRB - Industrial production rose 0.9 percent in October, and manufacturing increased 1.3 percent. The index for utilities rose 2.0 percent, but mining output fell 1.3 percent, as Hurricane Nate caused a sharp but short-lived decline in oil and gas drilling and extraction. Even so, industrial activity was boosted in October by a return to normal operations after Hurricanes Harvey and Irma suppressed production in August and September. Excluding the effects of the hurricanes, the index for total output advanced about 0.3 percent in October, and the index for manufacturing advanced about 0.2 percent.

2017, November, 13, 10:10:00

TRANSCANADA NET INCOME $2.136 BLN

TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for third quarter 2017 of $612 million or $0.70 per share compared to a net loss of $135 million or $0.17 per share for the same period in 2016. Comparable earnings for third quarter 2017 were $614 million or $0.70 per share compared to $622 million or $0.78 per share for the same period in 2016. TransCanada's Board of Directors also declared a quarterly dividend of $0.625 per common share for the quarter ending December 31, 2017, equivalent to $2.50 per common share on an annualized basis.

2017, November, 9, 14:00:00

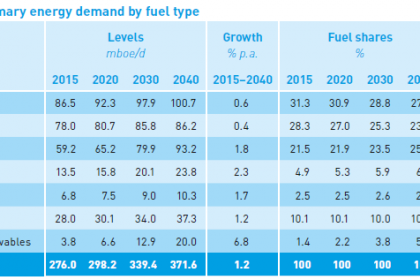

OPEC: 2040 GLOBAL ENERGY CHANGES

Within the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d.

2017, November, 7, 12:05:00

U.S. RIGS DOWN 11 TO 898

U.S. Rig Count is up 329 rigs from last year's count of 569, with oil rigs up 279, gas rigs up 52, and miscellaneous rigs down 2 to 2.

Canada Rig Count is up 38 rigs from last year's count of 154, with oil rigs up 24 and gas rigs up 14.

2017, October, 30, 11:40:00

SAUDIS PROGRESS

IMF - Saudi Arabia had made good progress in initiating its ambitious reform agenda. Fiscal consolidation efforts are beginning to bear fruit. Progress with reforms to improve the business environment are gaining momentum, and a framework to increase the transparency and accountability of government is in place. Effective prioritization, sequencing, and coordination of the reforms is essential, and they need to be well-communicated and equitable to gain social buy-in to ensure their success.

2017, October, 30, 11:25:00

TOTAL NET INCOME $7.6 BLN

"Total reported adjusted net income of $2.7 billion this quarter, a 29% increase compared to a year ago while the Brent price increased by 14%. This solid performance was also reflected in a return on equity of close to 10% and strong cash flow generation: excluding acquisitions-divestments, the Group generated $2.1 billion of cash flow after investments in the third quarter 2017 and $5.2 billion in the first nine months. The Group took full advantage of the favorable environment thanks to the performance of its integrated model and its strategy to reduce its breakeven point.

2017, October, 30, 11:00:00

U.S. RIGS DOWN 4 TO 909

U.S. Rig Count is up 352 rigs from last year's count of 557, with oil rigs up 296, gas rigs up 58, and miscellaneous rigs down 2 to 0.

Canada Rig Count is up 38 rigs from last year's count of 153, with oil rigs up 23 and gas rigs up 15.

2017, October, 27, 19:00:00

TRANSCANADA SELLS SOLAR $540 MLN

TransCanada Corporation has entered into an agreement to sell its Ontario solar portfolio comprised of eight facilities with a total generating capacity of 76 megawatts to Axium Infinity Solar LP, a subsidiary of Axium Infrastructure Canada II Limited Partnership, for approximately $540 million.

2017, October, 16, 11:30:00

U.S. RIGS DOWN 8 TO 928

U.S. Rig Count is up 389 rigs from last year's count of 539, with oil rigs up 311, gas rigs up 80, and miscellaneous rigs down 2 to 2.

Canada Rig Count is up 47 rigs from last year's count of 165, with oil rigs up 22 and gas rigs up 25.

2017, September, 18, 12:30:00

RUSSIA - CHINA - VENEZUELA OIL

“The principal risk regarding Russian and Chinese activities in Venezuela in the near term is that they will exploit the unfolding crisis, including the effect of US sanctions, to deepen their control over Venezuela’s resources, and their [financial] leverage over the country as an anti-US political and military partner,” observed R. Evan Ellis, a senior associate in the Center for Strategic and International Studies’ Americas Program.

2017, September, 15, 08:50:00

NIGERIA NEEDS TIME

Emmanuel Kachikwu, Nigeria’s minister of state for petroleum resources, told the Financial Times that the west African nation’s energy sector was still suffering from years of violent disruptions and needed more “recovery time” before joining a supply deal agreed last year between some of the world’s biggest oil producers.

2017, August, 28, 19:45:00

IMF: BAHRAIN'S VULNERABILITY UP

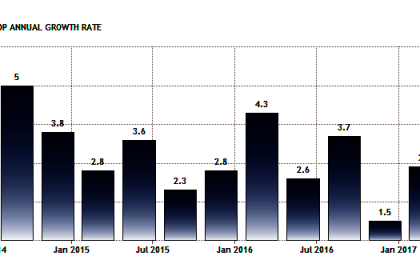

Bahrain’s fiscal and external vulnerabilities have increased in the wake of the oil price decline. Overall GDP grew 3 percent in 2016, supported by strong growth of 3.7 percent in the non-oil sector aided by the implementation of GCC-funded projects. Average inflation remained moderate at 2.8 percent. Bank deposit and private sector credit growth slowed. The banking sector remains well capitalized and liquid. Despite the implementation of significant fiscal adjustment, lower oil prices meant that the overall fiscal deficit reached nearly 18 percent of GDP and government debt rose to 82 percent of GDP. The current account deficit widened to 4.7 percent. International reserves have declined.

2017, August, 3, 12:05:00

BP PROFIT $553 MLN

“We continue to position BP for the new oil price environment, with a continued tight focus on costs, efficiency and discipline in capital spending. We delivered strong operational performance in the first half of 2017 and have considerable strategic momentum coming into the rest of the year and 2018, with rising production from our new Upstream projects and marketing growth in the Downstream.”